Hi Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Marketing Posters for Term Insurance Promotion (January)

To help members generate more interest from clients and to leverage the discount on term insurance from Canada Life, a generic poster template has been designed for your use so you would not see any logos, including Way’s, on it – personalize it by adding your own logo and contact information. All business must be received by January 31, 2022.

To read more details about this promotion, please click here.

Check out and utilize the attached and below posters, as well as, leverage the text templates to generate immediate client interest:

XXX, are you already paying for your mortgage or term life insurance? If yes, are you interested in finding out whether you can qualify for 15% less cost?

XXX, 你已經為你的房屋貸款保險作好準備了嗎? 你有興趣知道你怎樣可以節省15%的費用嗎?

XXX,你已经为你的房屋贷款保险作好准备了吗? 你有兴趣知道你怎样可以节省15%的费用吗?

Reminder on Office Guidelines in Managing COVID-19

In face of the new Omicron variant and current wave of COVID cases, the office remains prudent in managing the pandemic risk and safe-guarding the health and safety of our members while using innovative ways to help everyone generate more business and revenue. Please be reminded of the safety protocols currently undertaken.

In visiting the office, everyone including those who have been vaccinated should continue to maintain a high level of personal hygiene and be mindful of the following when you enter the premise:

- Sanitize your hands and put on a face mask;

- Keep social distance when communicating with each other in person; and

- Ask your visitors to do the same above.

Persons who are not feeling well, have travelled outside Canada within the last 14 days, have been in contact with a person confirmed to have COVID-19 or have the following symptoms are asked not to come to the office:

- Fever

- Chills

- Cough

- Shortness of breath

- Loss of sense of smell or taste

- Diarrhea

- Nausea and vomiting

Let’s place our attention on growing business in 2022 while continuing our efforts to keep this virus at bay.

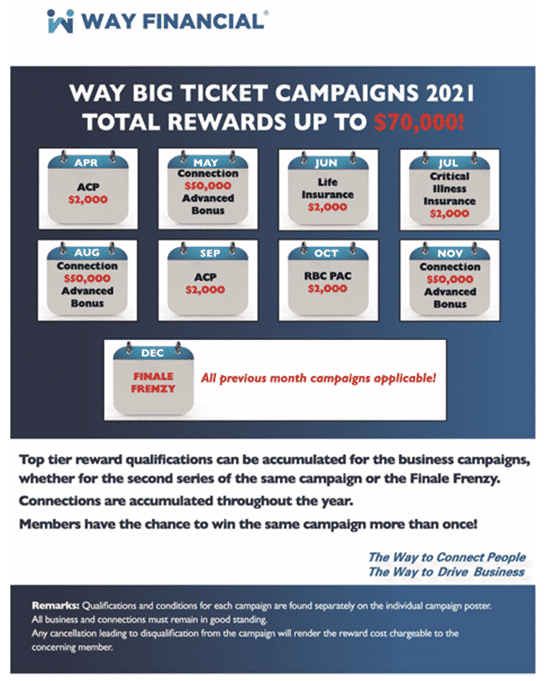

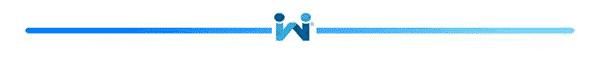

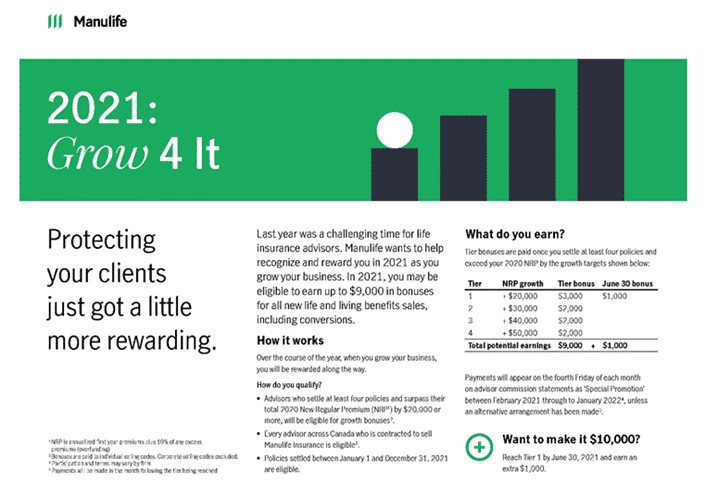

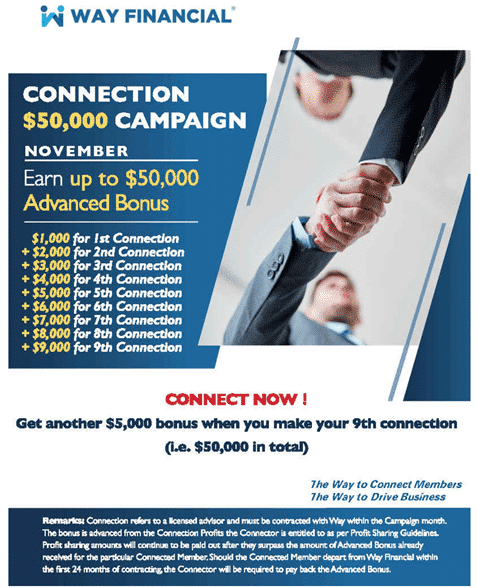

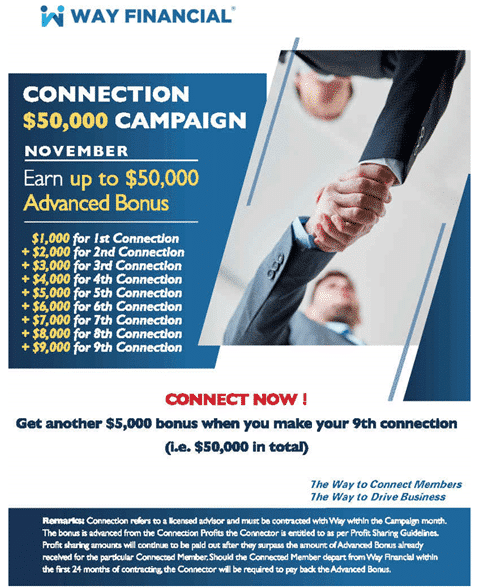

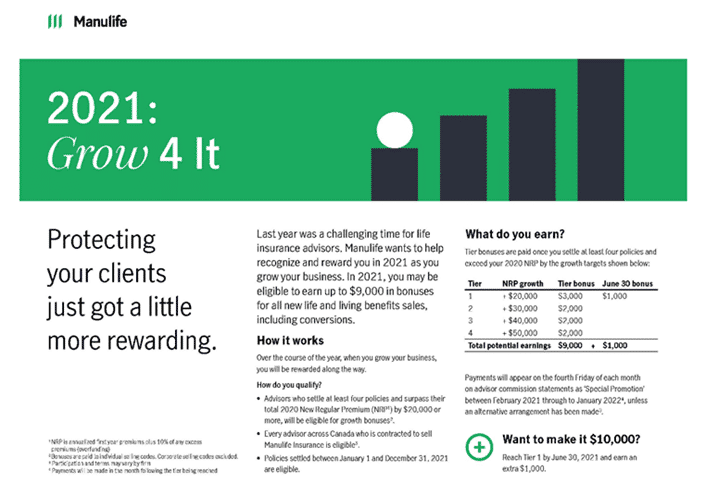

Business Campaigns 2022 – doubling the rewards to $4,000+/campaign

Next year will see another set of Big Ticket business campaigns to help members grow their business and income. In reviewing members’ request, each campaign will double in duration, target and reward amounts! That means you would have two months each campaign to win up to $4,000, with two concurrent campaigns, making the maximum reward amount each member can win to $8,000!

Get ready to win up to $4,000 rewards from the Investment Transfer-In and RBC PAC Campaigns in January. The campaign posters will be available shortly so be prepared for your business submissions right at the turn of the new year!

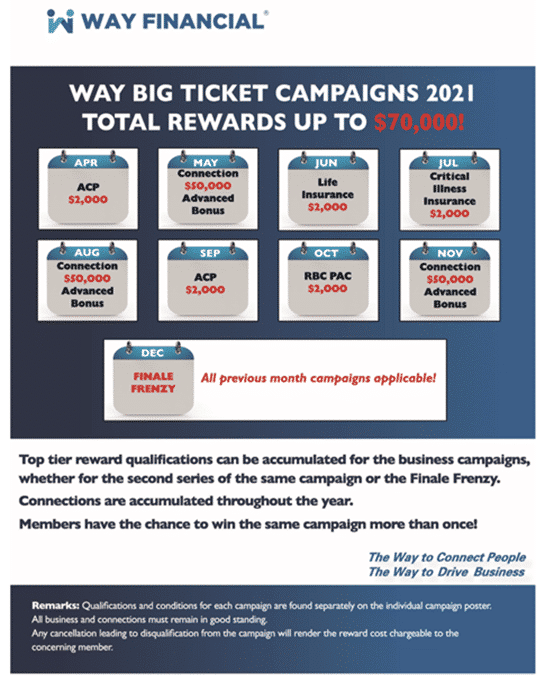

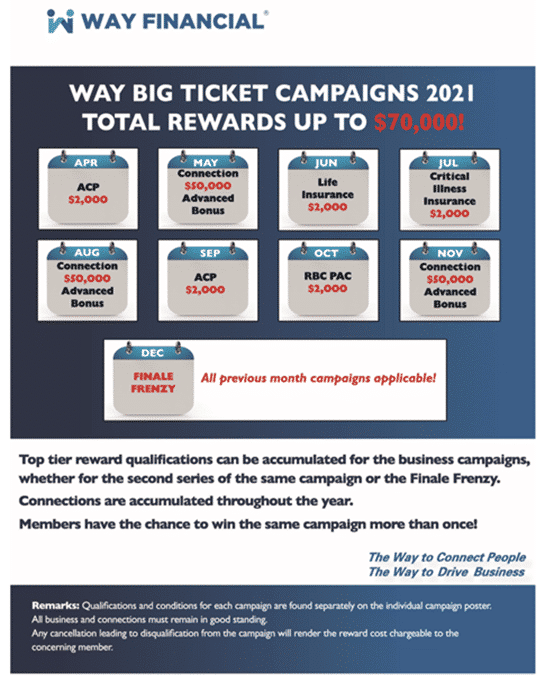

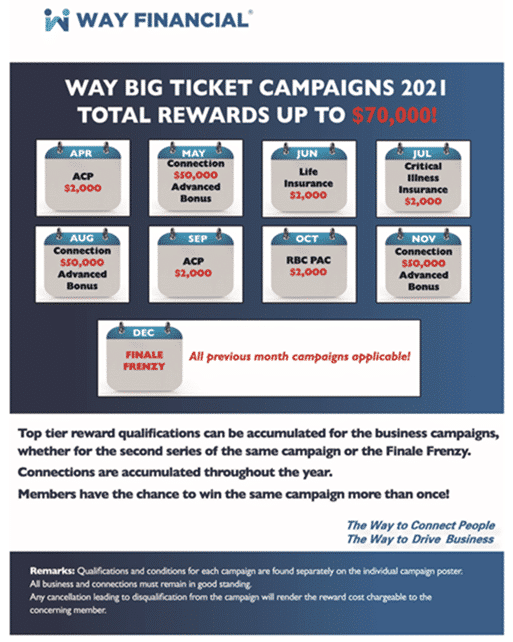

Finale Frenzy Campaign – December

Last week to go for the Finale Frenzy campaign to win total rewards up to $70,000! It reopens the campaign qualification for all 2021 Big Ticket Campaigns. Good luck! See details in the poster below.

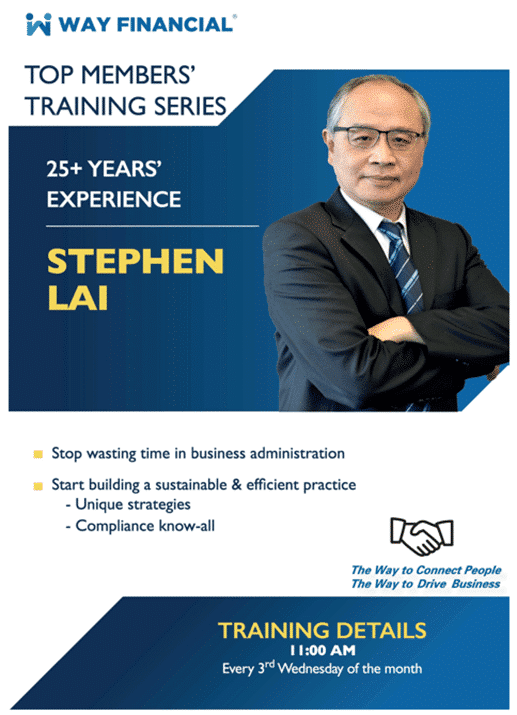

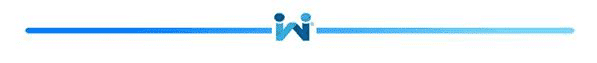

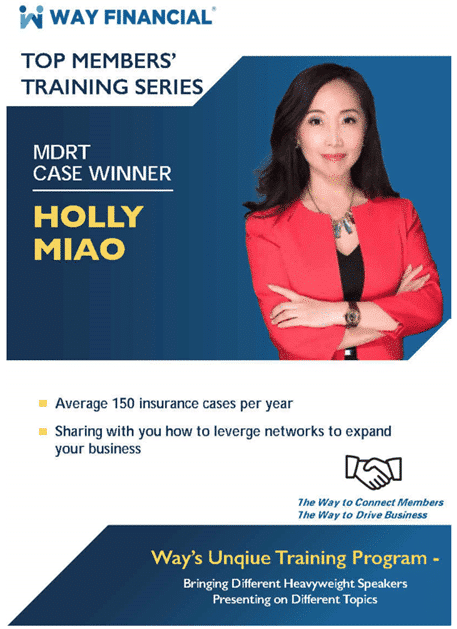

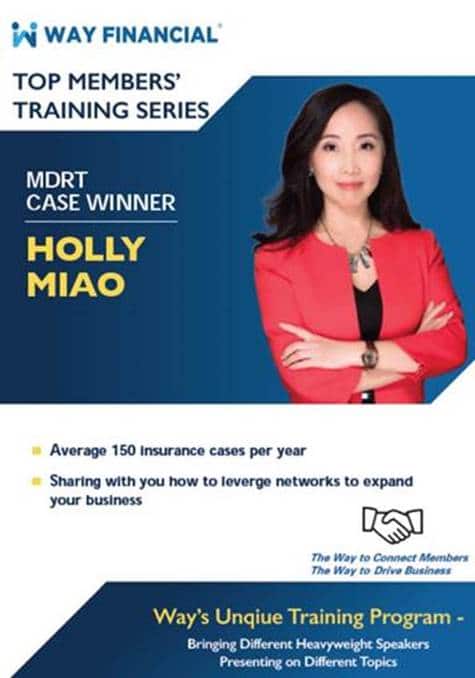

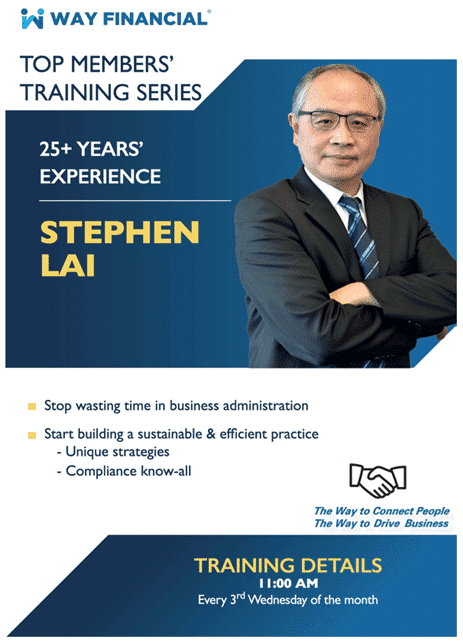

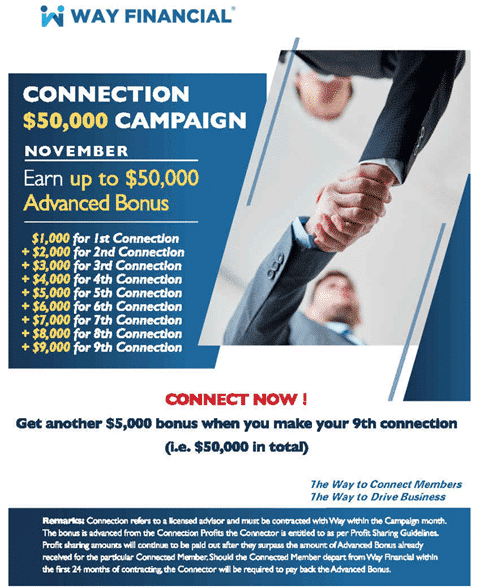

Upcoming Trainings

Please remember to sign in using your full name to have your Way Membership confirmed and your training session uninterrupted. Unconfirmed names may be removed from the session.

Also note that the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

In view of renewed concerns of COVID-19, in-person training arrangements will be postponed, including Tim Lau’s special training originally scheduled for January 5. The first training of 2022 will take place on January 7, with details below.

Time & Date: 11:00am PST, Friday, January 7

Choosing Equitable Life – Equitable Life Monica Zhang

Come and learn from EQ wholesaler Monica Zhang, who will share you the reason of choosing Equitable life and make better plan for your clients.

Click here to join the meeting

Upcoming 1-on-1 Case Studies (30 mins or 1 hour sessions available)

Bring a case to get your desired results. All you need to bring is the client’s name and enquiry area. Examples include:

- How to present the case (illustrations & presentations help)

- How to respond to clients’ objections

- How to get repeated or referral business

- How to start the conversation

Check out the 1-on-1 case studies schedule in January below and book your session online via the Way Platform Events Calendar or contact admin@www.wayfinancial.ca or 604-279-0866 for assistance.

| Schedule of 1-on-1 Case Studies in January 2022 | ||||

| Monday | Tuesday | Wednesday | Thursday | Friday |

| 3 | 4 | 5 | 6 | 7 |

| 1-on-1 Case Studies with EQ Monica Zhang (1:30 – 4:00pm) | ||||

| 10 | 11 | 12 | 13 | 14 |

| 1-on-1 Case Studies with SL Renee So (1:00-3:00pm) | 1-on-1 Case Studies with CL Carol Ng (1:00-3:00pm) | |||

| 17 | 18 | 19 | 20 | 21 |

| 1-on-1 Case Studies with ML Chris Chang (1:00-3:00pm) | ||||

| 24 | 25 | 26 | 27 | 28 |

| 1-on-1 Case Studies with RBC Mike Jackson (1:00-3:00pm) | 1-on-1 Case Studies with CL Richard Chen (1:00-3:00pm) | |||

| 31 | ||||

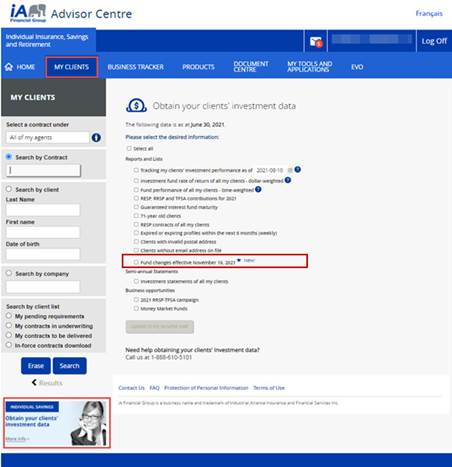

Carriers’ Updates

Equitable

Insurance

Accept eSignature on All Documents

Effective immediately, EQ will accept eSignature from the approved vendors, including DocuSign, eSignLive (OneSpan/Silanis), HelloSign, AdobeSign, and iGeny, on all documents of individual insurance, savings, and retirement. When submitting a form, please remember to include esign@equitable.ca, which will be a reviewer of the eSignature to ensure a smooth and timely process.

Contact Monica Zhang at 604-366-4314 or mzhang@equitable.ca if you have any question.

Tugo

15 minute Live Information Sessions in January

There will have a 15 minute short live webinars throughout the month of January, designed to help you better understand Tugo’s coverages, find correct information, and ask questions. Check out the calendar below and register.

| January 2022 | ||||||

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

| 1 | ||||||

| HAPPY NEW YEAR! | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| HOLIDAY ⛄️ | Everything Covid19 | Quarantine | Trip Cancellation & Interruption + CFAR | |||

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| Medical Questionnaire | Pre-existing Conditions | Partner Express Orientation | Everything Covid19 | Quarantine | ||

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| Trip Cancellation & Interruption + CFAR | Everything Covid19 | Quarantine | Real Claim Stories + Prov. Healthcare | Submitting a claim | ||

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| Visitors to Canada | Marketing Travel Insurance | Trip Cancellation & Interruption + CFAR | Medical Questionnaire | Pre-existing Conditions | ||

| 30 | 31 | |||||

| Partner Express Orientation | ||||||

Contact Helene Desjardins at 905-267-1724 or hdes@tugo.com if you have any question.

Happy New Year

Wish Members a joyful new year, staying safe and happy together with family and friends.

Our office will be closed from 1:30pm Friday, December 31 (Friday), to January 3 (Monday). Normal business hours will resume on Tuesday, January 4, 2022.

Best Regards,

Administration Department

“The WAY to connect members. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.