Hi Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

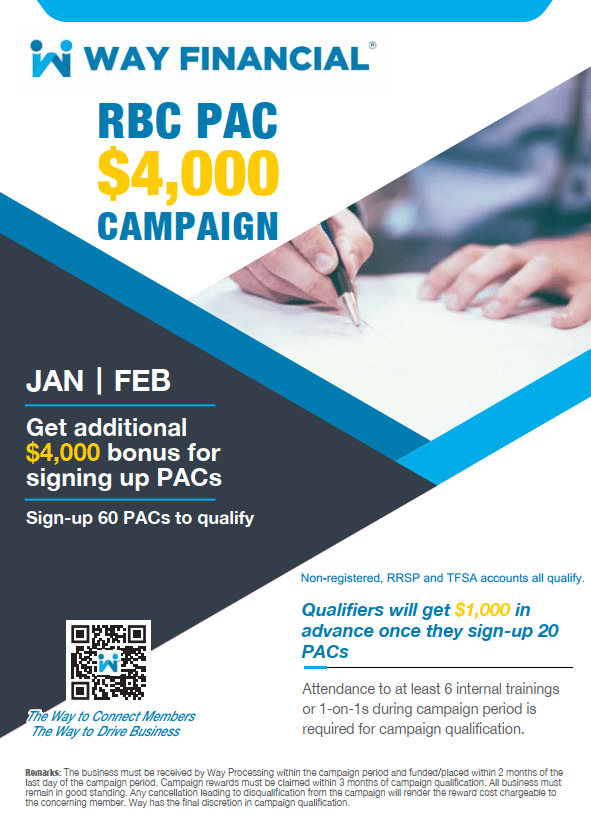

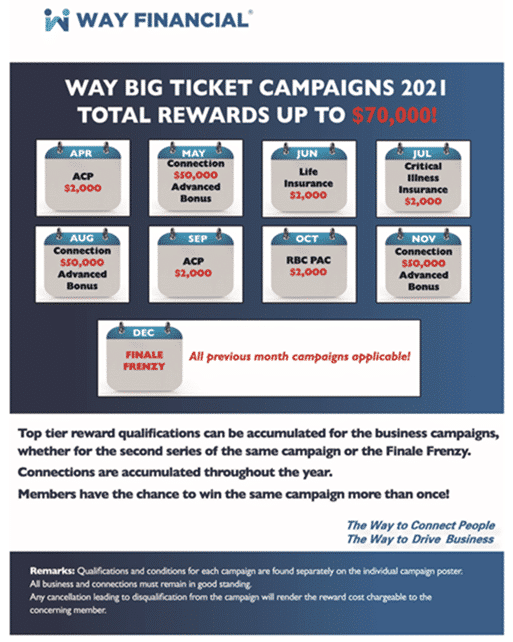

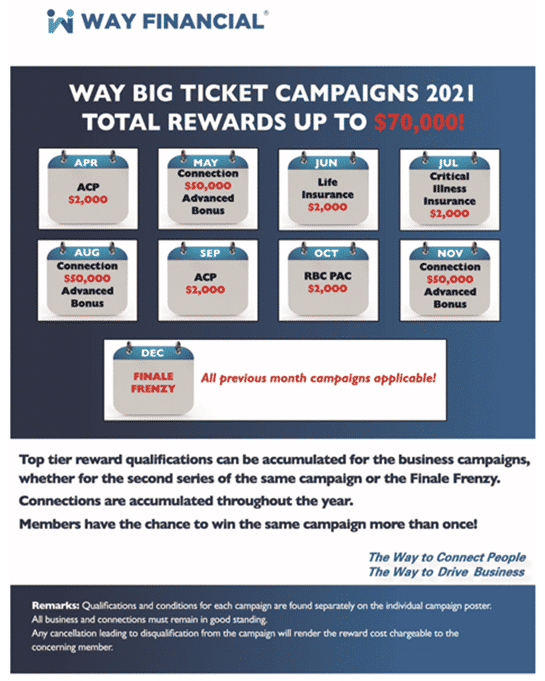

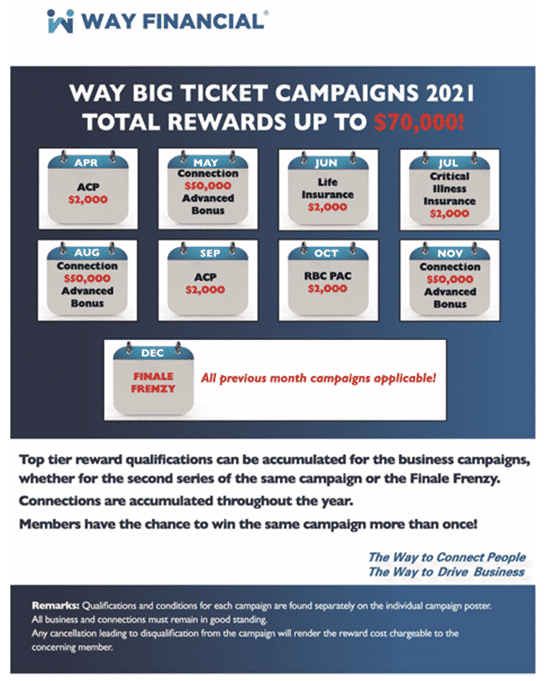

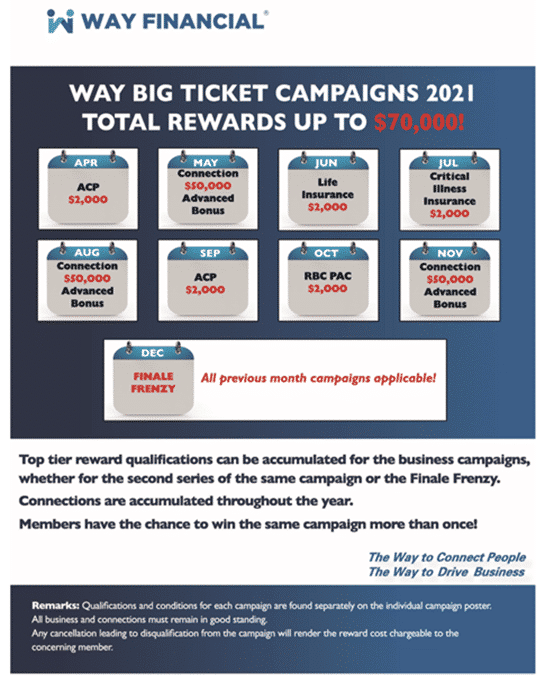

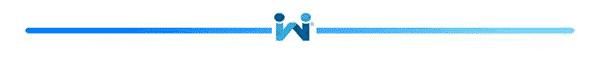

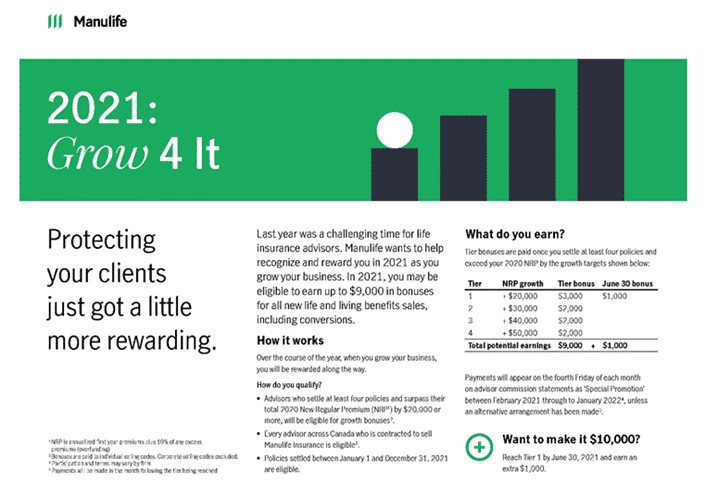

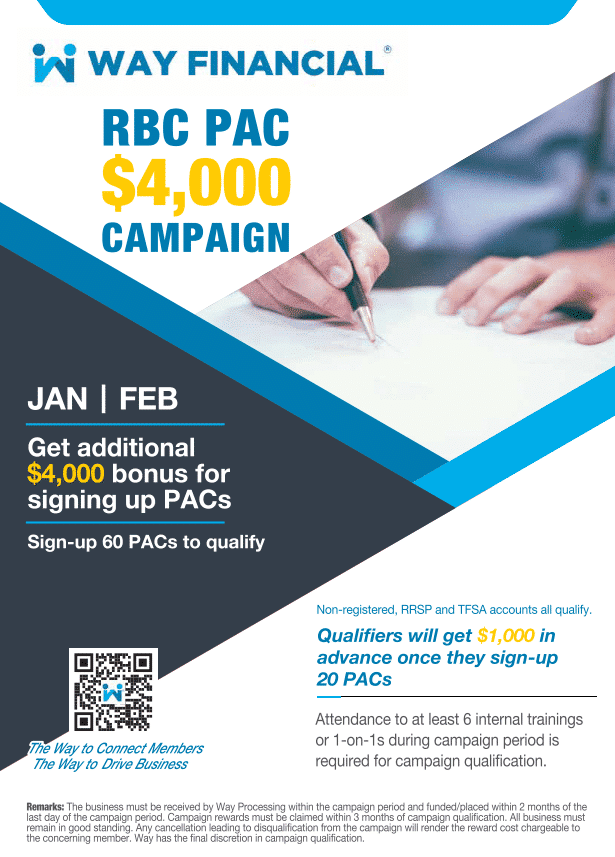

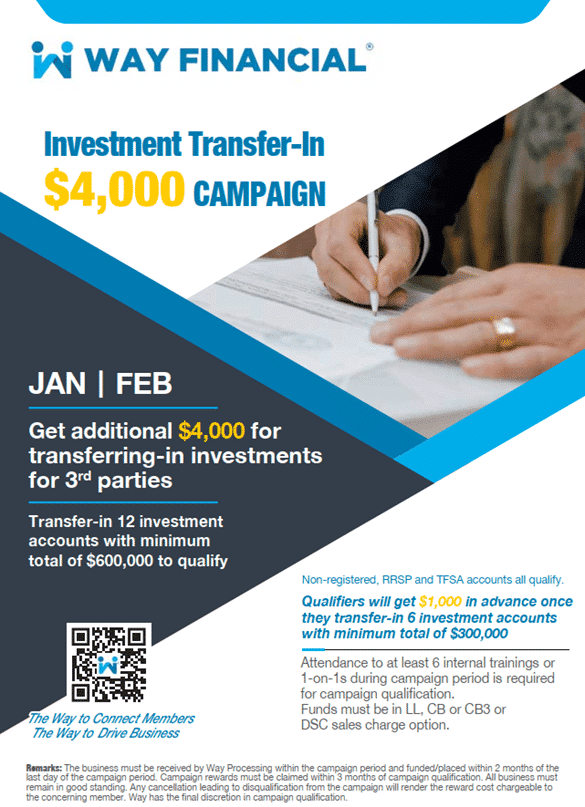

January & February Campaigns $4,000 X 2 = $8,000

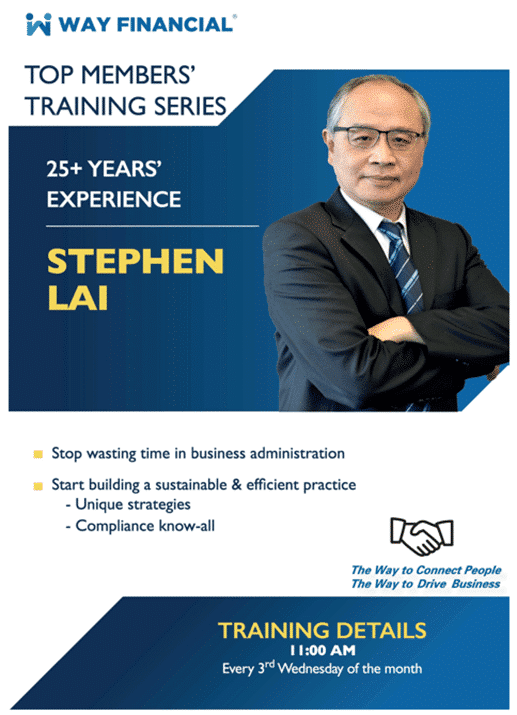

The Investment Transfer-In and RBC PAC Campaigns are on! Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for each campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at stephen.lai@www.wayfinancial.ca or 604-279-0866 ext. 114.

Upcoming Trainings

Please remember to sign in using your full name to have your Way Membership confirmed and your training session uninterrupted. Unconfirmed names may be removed from the session.

Also note that the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

Leave the online meeting room only when the presenter confirmed that the training is over.

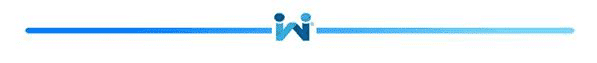

Time & Date: 11:00am PST, Wednesday, January 12

Investment Strategies by RBCI Mike Jackson & B2B Bank Danya Wang

This session count as one of the sessions for campaign qualification.

Click here to join the meeting

Time & Date: 11:00am PST, Friday, January 14

Disability Insurance, the Basics and Beyond – CL Carol Ng

Click here to join the meeting

Upcoming 1-on-1 Case Studies (30 mins or 1 hour sessions available) – all sessions count towards campaign qualification

Bring a case to get your desired results. All you need to bring is the client’s name and enquiry area. Examples include:

- How to present the case (illustrations & presentations help)

- How to respond to clients’ objections

- How to get repeated or referral business

- How to start the conversation

Check out the 1-on-1 case studies schedule in January below and book your session online via the Way Platform Events Calendar or contact admin@www.wayfinancial.ca or 604-279-0866 for assistance.

| Time & Date: 1:00 – 3:00pm PST, Wednesday, January 12

1-on-1 Case Studies with SL Renee Ho

Time & Date: 1:00 – 3:00pm PST, Friday, January 14 1-on-1 Case Studies with CL Carol Ng

Schedule of 1-on-1 Case Studies in January 2022 |

||||

| Monday | Tuesday | Wednesday | Thursday | Friday |

| 3 | 4 | 5 | 6 | 7 |

| 1-on-1 Case Studies with EQ Monica Zhang (1:30 – 4:00pm) | ||||

| 10 | 11 | 12 | 13 | 14 |

| 1-on-1 Case Studies with SL Renee Ho (1:00-3:00pm) | 1-on-1 Case Studies with CL Carol Ng (1:00-3:00pm) | |||

| 17 | 18 | 19 | 20 | 21 |

| 1-on-1 Case Studies by ML Chris Chang (1:00-3:00pm) | ||||

| 24 | 25 | 26 | 27 | 28 |

| 1-on-1 Case Studies with RBCI Mike Jackson (1:00-3:00pm) | 1-on-1 Case Studies with CL Richard Chen (1:00-3:00pm) | |||

| 31 | ||||

Carriers’ Updates

B2B Bank

Help your clients reach their retirement goals faster

Click to read the B2B Bank RSP Load, which has 5- and 10-year competitive rate, and help wider range of clients to catch up their RRSP contribution and invest in the retirement of their dreams.

- No Proof of Income (POI)/ Proof of Assets (POA) required for loans up to $50,000.

- Send applications prior to February 14, 2022 to avoid delays and ensure your clients’ applications can be approved and funded before the contribution deadline of March 1, 2022.

Contact Danya Wang at 236-688-6201 or danya.wang@b2bbank.com if you have any question.

Canada Life

Insurance

Go paperless with My Canada Life

Canada Life has piloted a new client site, My Canada Life. It will give clients 24/7 access to information about their Canada Life products and the ability to switch to paperless eStatements, which will be more convenient and easier for advisors and clients. Please refer to attached file (CL – We’re inviting clients to go paperless with My Canada Life) for more details.

Contact Carol Ng at 604-377-7203 or Carol.Ng@CanadaLife.com or Amber Wang at 226-272-1297 or AmberHanYi.Wang@canadalife.com or Wenjia Li at 6046125105 or wenjia.li@canadalife.com if you have any questions.

Equitable

Insurance

In the training of last Friday, EQ wholesaler Monica gave a new insight of the benefit in choosing Equitable Life and gave strategies on using EQ products to better serve your clients’ needs. Read attached presentation file for more details.

Contact Monica Zhang at 604-366-4314 or mzhang@equitable.ca if you have any question.

iA Financial

Investment

Tools provided by iA can be used to help you optimize your service as advisor.

Help your clients be more independent and increase the amount of their RRSP or TFSA contributions or set up regular contributions.

This tool will illustrate the different financial scenarios for your clients, including investments, tax savings, or retirement budget, etc. It allows you to better understand your clients’ reality.

It helps your clident find out how much they’d need to contribute to their RRSPs based on their individual situation and retirement goals.

Contact Hilda Ng at 778-873-1254 or hilda.ng@ia.ca or Barbra Vuan at 604-737-9245 or barbra.vuan@ia.ca if you have any questions.

Sun Life

Helping advisors better serve Mandarin-speaking Clients

Sun Life’s advisor site is now available in English and Simplified Chinese. Click the Chinese Marketing Centre, where it includes the Simplified Chinese marketing materials and sales strategies in one easy-to-find location. Advisors can feel free to use those tools to better support the Mandarin-speaking clients.

Bust the myths about insurance for your wealthy Clients

In advisor site, new tools are currently provided to help advisors better serve your wealthy clients and add value to preserve their affluent lifestyle. It includes many marketing videos, analytical articles, as well as the excel strategy tools. Click here to read more and get the tools!

Contact Renee Ho at 604-657-9251 or renee.ho@sunlife.com or June Wang at 604-895-5413 or june.wang@sunlife.com if you have any questions.

Best Regards,

Administration Department

“The WAY to connect members. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

Reply

Forward

Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for the campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at

Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for the campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at