Hi members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

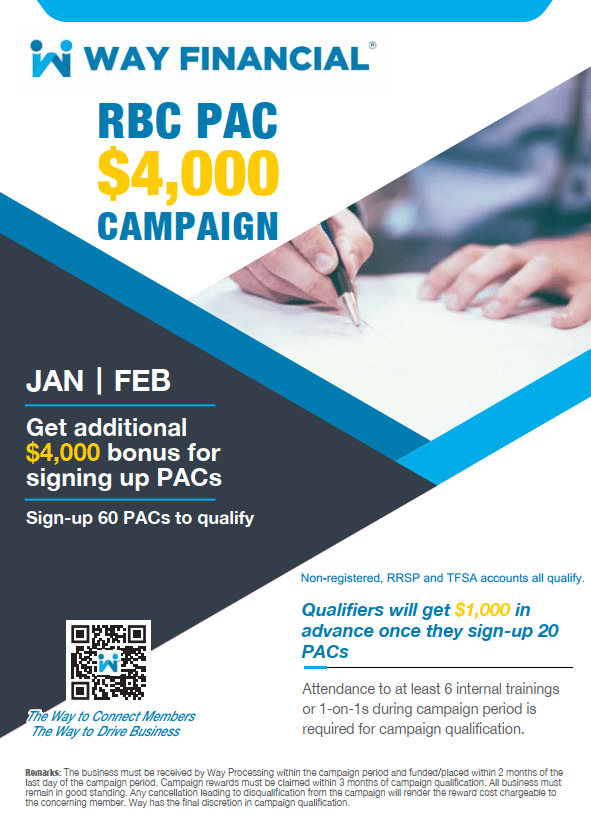

Equitable Life $10,000 Campaign – Step Up Campaign

Win an extra $10,000 with your Equitable business this year!

Place at least FYC20,000 more than your business amount in 2021 and four insurance cases to win.

Read attached PDF file (EQ Step Up Your Sales 2022) for more details.

Read attached PDF file (EQ Step Up Your Sales 2022) for more details.

Contact Monica Zhang at 604-366-4314 or mzhang@equitable.ca if you have any question.

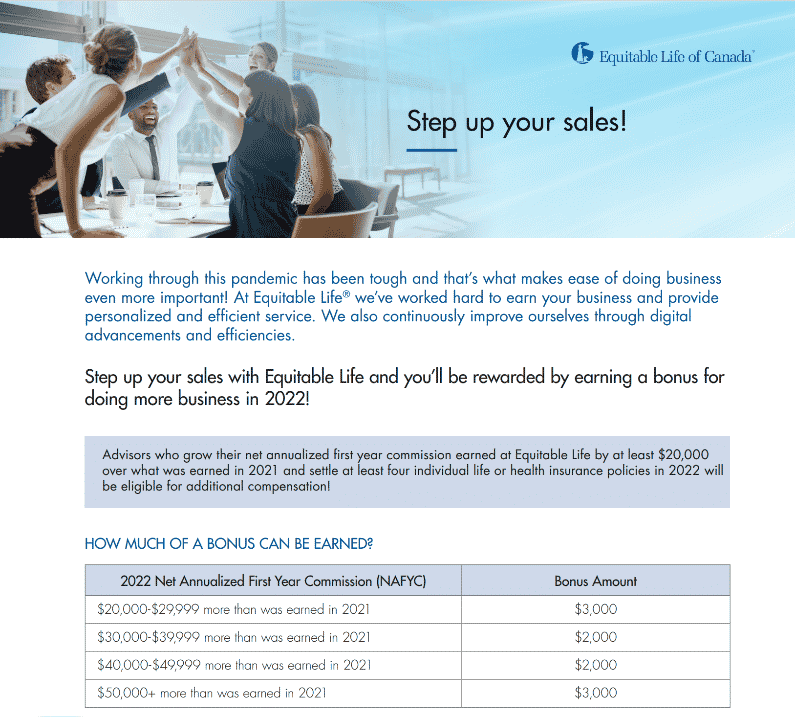

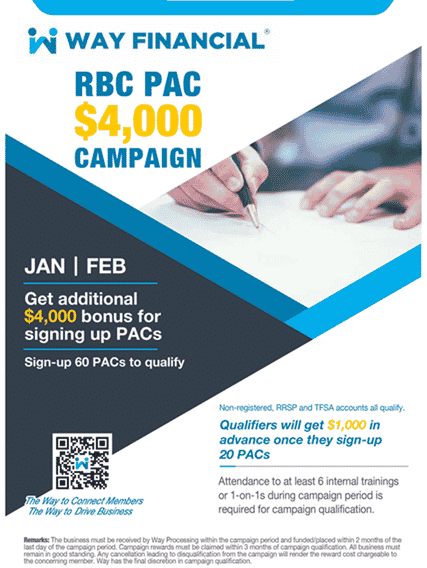

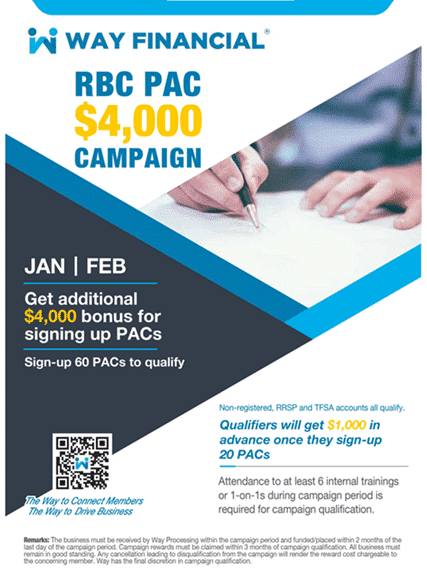

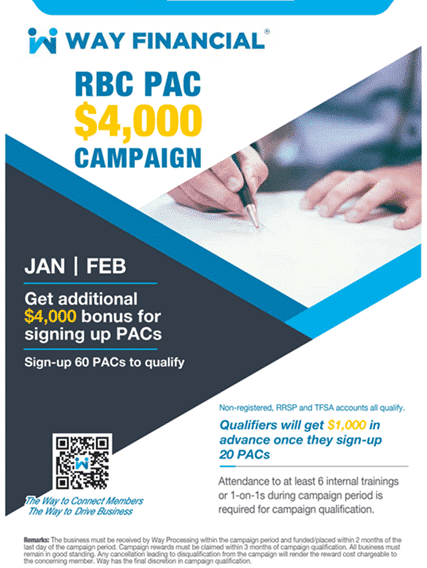

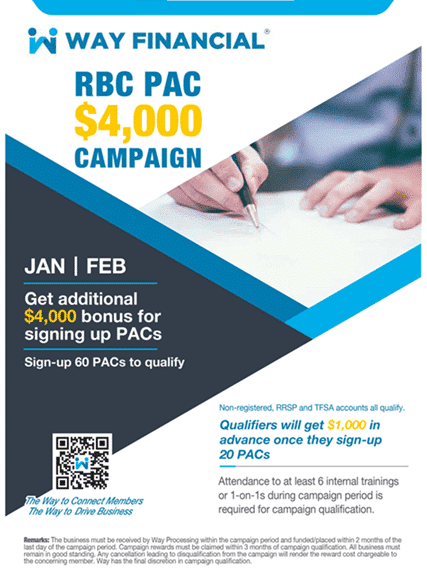

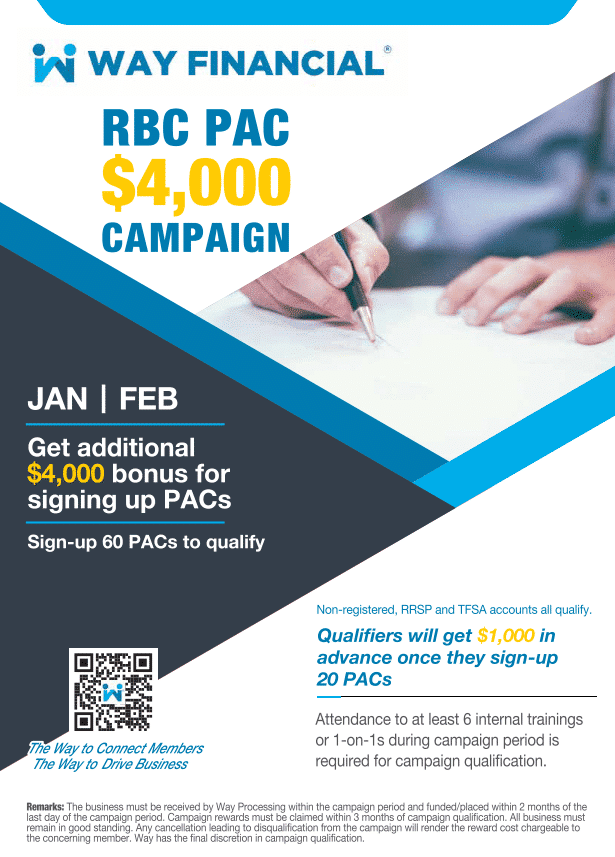

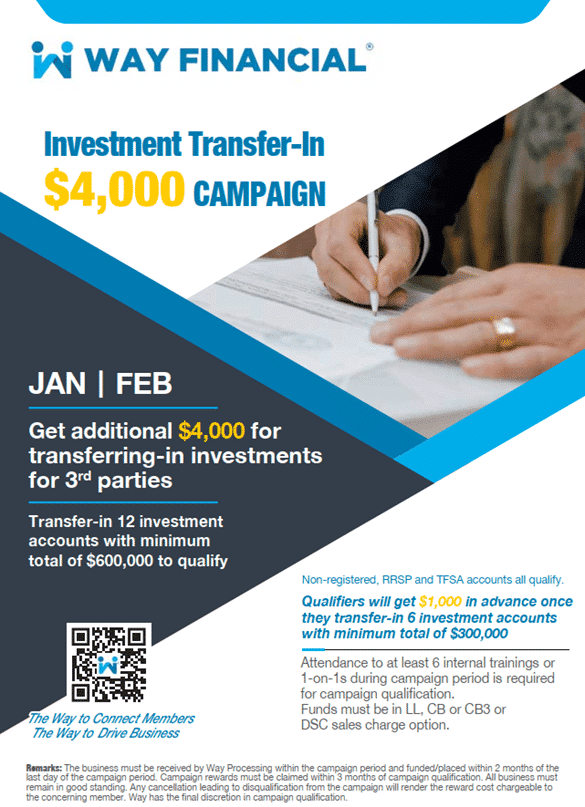

January & February Campaigns $4,000 X 2 = $8,000

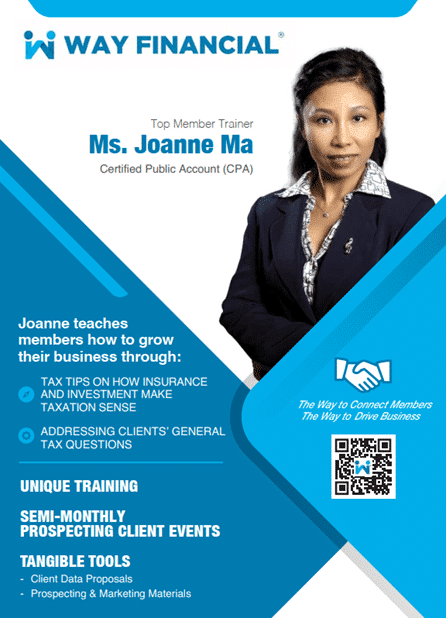

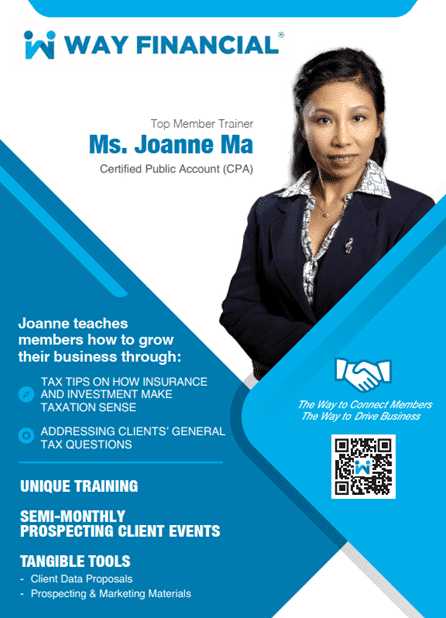

Two weeks left for the Investment Transfer-In and RBC PAC Campaigns! Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for each campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at stephen.lai@www.wayfinancial.ca or 604-279-0866 ext. 114.

Two weeks left for the Investment Transfer-In and RBC PAC Campaigns! Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for each campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at stephen.lai@www.wayfinancial.ca or 604-279-0866 ext. 114.

Upcoming Client Events

9 RRSP Tax Efficient Withdrawal Solutions: PAR Synthesis + Withdrawn Timing

Date: February 19, Saturday.

Language: Mandarin

Time: 10:55 am PST

YouTube link: https://youtu.be/ClcJsTA8NG4

Language: Cantonese

Time: 1:55 pm PST

YouTube link: https://youtu.be/yYgHzdALLGs

Check out the posters below for broadcasting to your clients.

And here is the registration link: http://sv.mikecrm.com/p1gAV0s

Ask admin@www.wayfinancial.ca if you have any question.

Upcoming Trainings

Please remember to sign in using your full name to have your Way Membership confirmed and your training session uninterrupted. Unconfirmed names may be removed from the session.

Also note that the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Time & Date: 11:00am PST, Wednesday, February 16

iA RRSP and RRSP loan program by iA Investment Hilda Ng

Click here to join the meeting

Time & Date: 11:00am PST, Friday, February 18

Estate & Income Planning – How to open the conversation with your clients by Sunlife Justin Ezekiel

Click here to join the meeting

Upcoming 1-on-1 Case Studies (30 mins or 1 hour sessions available) – all sessions count towards campaign qualification

Bring a case to get your desired results. All you need to bring is the client’s name and enquiry area. Examples include:

- How to present the case (illustrations & presentations help)

- How to respond to clients’ objections

- How to get repeated or referral business

- How to start the conversation

Check out the 1-on-1 case studies schedule in January below and book your session online via the Way Platform Events Calendar or contact admin@www.wayfinancial.ca or 604-279-0866 for assistance.

| Time & Date: 2:00 – 6:00pm PST, Wednesday, February 16

1-on-1 Case Studies with iA Hilda Ng

Time & Date: 1:00 – 3:00pm PST, Friday, February 18 1-on-1 Case Studies with B2B Danya Wang Schedule of 1-on-1 Case Studies in February 2022 |

| Monday | Tuesday | Wednesday | Thursday | Friday |

| 31 | 01 | 02 | 03 | 04 |

| 1-on-1 case studies with EQ Monica Zhang (1:00-3:00pm) | ||||

| 07 | 08 | 09 | 10 | 11 |

| 1-on-1 case studies with COT Amanda Ngan (2:00-6:00pm) | 1-on-1 case studies with CL Insurance Carol Ng (1:00-3:00pm) | |||

| 14 | 15 | 16 | 17 | 18 |

| 1-on-1 case studies with iA Investment Hilda Ng (1:00-3:00pm) | 1-on-1 case studies with B2B Danya Wang (1:00-3:00pm) | |||

| 21 | 22 | 23 | 24 | 25 |

| 1-on-1 case studies with iA Insurance Rishu Bains (1:00-3:00pm) |

Carriers’ Updates

Canada Life

Investment

Canada Life Win with Wealth in 2022 – Get an Extra 1 Bps of your AUM

By generating net sales of 5% of your January 1, 2022 assets under management (AUM), minimum $500,000, you could receive an extra 1 bps of your December 31, 2022 AUM.

Check out the attached PDF (CL Win with Wealth in 2022) and the Q&A for more information on qualifications & rules.

Contact Richard Chen at (604)338-6416 or richard.chen@canadalife.com or Floria Song at (604)331-2420 or floria.song@canadalife.com if you have any question.

Insurance

Delete function is now available on SimpleProtect. Watch clip here to know more about the process.

Canada Life Jeff Nason shared how Canada Life’s PAR stacks up to face the competition last Friday. See Jeff’s training presentation from the attached PDF (CL PAR Landscape Way 220211) for details.

Contact Carol Ng at 604-377-7203 or carol.ng@canadaLife.com or Amber Wang at 226-272-1297 or amberhanyi.wang@canadalife.com or Wenjia Li at (604)612-5105 or wenjia.li@canadalife.com if you have any question.

Equitable Life

New Product Launch – Equitable updates including 20 Pay CI and Par 10 Pay.

Speaker: Kelly Ganter and the Equitable Life team

Time & Date: 9:00am PST, Tuesday, February 15

Click the link https://equitable-ca.zoom.us/webinar/register/WN_oDUr_9zmSTqvDDh_iVE7lQ for registration.

After registering, you will receive a confirmation email containing information about joining the webinar.

You can also see all the topics and speakers for Q1 2022, click on the link below and register for all the sessions that you would like to attend.

https://lu.ma/u/usr-HkcAPtJyeNfv7fZ

New EquiMax 10 Pay premium option and a new EquiLiving CI plan – Effective February 12, 2022

The new illustration is available for download here: https://advisor.equitable.ca/advisor/en/forms/sales-illustrations

Contact Monica Zhang at 604-366-4314 or mzhang@equitable.ca if you have any question.

iA Financial

Insurance

STRATEGY SESSIONS – Shared Ownership CI Strategy

Speaker: Ross Cook, Sales Director – Large Cases & National Accounts

Time & Date: 9:30 am PST, Thursday, February 24

This session will cover the below topics

– Business Owners needs for Critical Illness

– Shared Ownership Strategy

– Tools available to help with this strategy at iA Financial

– Overview of the CI Product options at iA Financial by Jessica Johanson, Director of Living Benefits for MB/SK

Click here to register for the session.

Contact Rishu Bains at (604)354-2711 or rishu.bains@ia.ca , or Vanora McLay at 604-737-9170 or vanora.mclay@ia.ca , or Michelle Kwan at (778)886-8492 or Michelle.Kwan@ia.ca, or Alfredson Tolentino at 844-744-4282 ext. 403206 or fredson.tolentino@ia.ca if you have any question.

Manulife

Insurance

New Grow For It Campaign by Manulife – Win up to two iPad Airs this year

You will get an iPad Air when you:

• Settle 10 or more life or living benefits policies in 2022

or

• Sell 5 or more health and dental policies with an effective date in 2022

If you achieve both policy count requirements, you will receive two iPads!

Read attached PDF file (ML Grow For It 2022 Poster) and refer to the poster below for more details.

Contact Chris Chang at (604)355-4879 or chris_chang@manulife.com or Cherry Xiang at (604)678-1558 or Cherry_Xiang@manulife.ca

if you have any question.

Best Regards,

Administration Department

“The WAY to connect members. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

The Investment Transfer-In and RBC PAC Campaigns are on! Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for each campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at

The Investment Transfer-In and RBC PAC Campaigns are on! Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for each campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at

Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for the campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at

Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for the campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at