Hi members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

In-person Internal Trainings Restarting – beginning with the Property Tax Program Strategy Focus Groups in May

As previously mentioned, the office has restarted some in-person events and starting in May, some of Wednesday’s internal trainings will be open for in-person participation. RSVP will be needed for those sessions as spots are limited, and each month will focus on a particular strategy to ensure Members can close relevant cases immediately.

The Property Tax Season is coming and the first training in May will give you an introduction on how to expand your clientele with this strategy as well as polishing your existing closing skills. We will announce how to get a spot for the subsequent in-person focus groups during the training on May 4. Be sure you attend to not miss out.

In-person attendees are reminded to continue to adhere to office protocols of managing COVID-19 risks, including to not visit the office when unwell. Feel free to ask Administration should you have any question.

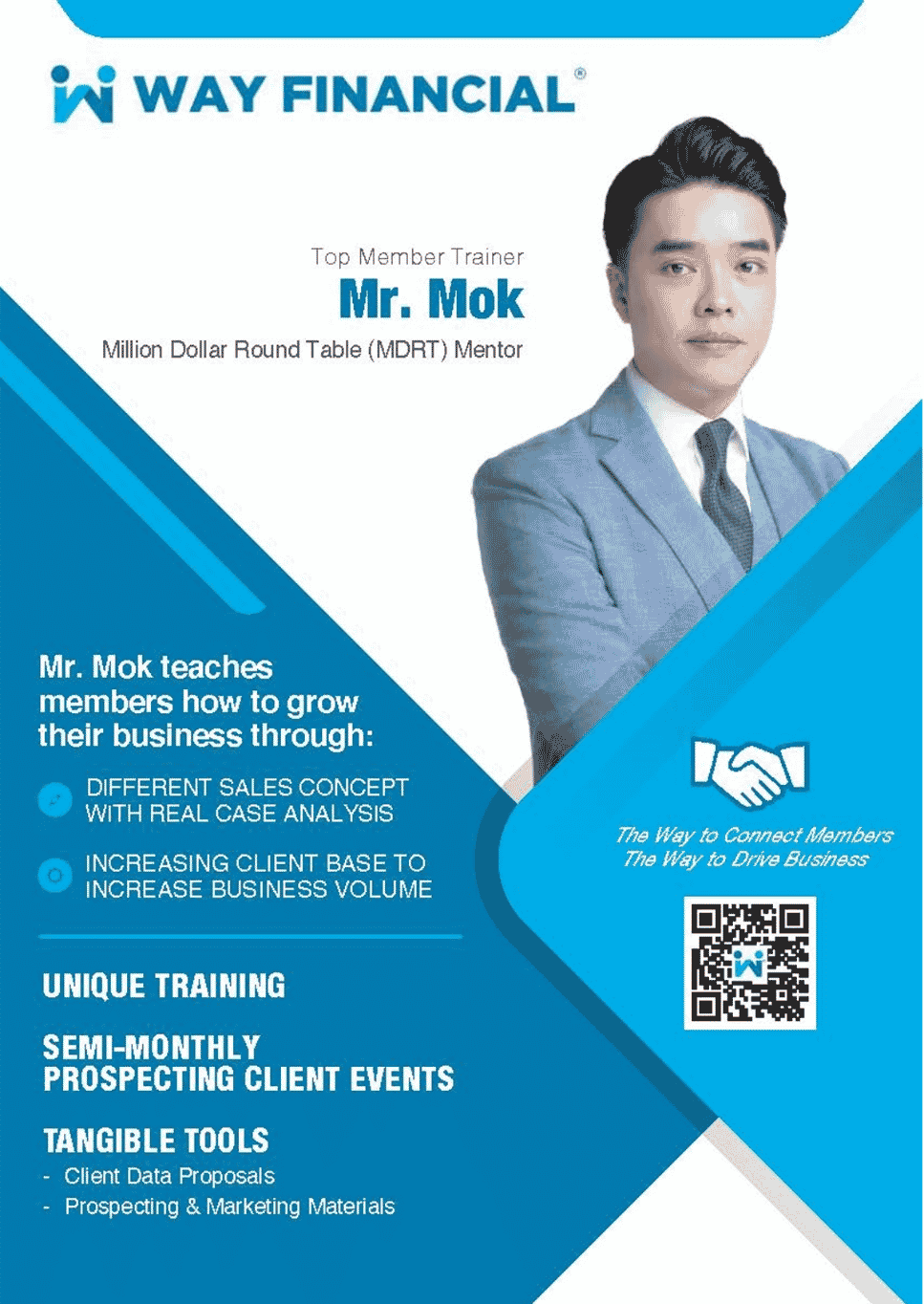

New / Experienced Members Boot Camp – double your income and/or achieve MDRT

Last chance to RSVP by tomorrow, April 26, 2022 for in-person sessions for the next series of New Members Boot Camp, starting on May 2, 2022. New members, as well as those who have made requests, have received a calendar invitation to attend the whole camp, while experienced members are welcome to join individual classes by sending a request to admin@www.wayfinancial.ca. It’s a good time to beef up your knowledge again in person!

Live sessions will be hosted for attendance of 10 members or more. Otherwise, a hybrid set-up with live and playback elements will be arranged. See the curriculum attached and schedule below.

| Date | Time | Topic | Audience |

| May 2 | 10am – 1pm | Class 1: Basic insurance product suitability for various types of clients | Green members |

| May 3 | 10am – 1pm | Class 2: Various financial carriers’ strengths by software/illustrations comparison | Green members |

| May 5 | 10am – 1pm | Class 3: Investment – Untapped market especially amongst Asian clientele | Green members |

| May 9 | 10am – 1pm | Class 4: Business cycle – marketing, prospecting, advising, servicing, referring, repeating

(with Special Guest Trainer) |

Green & Experienced members |

| May 10 | 10am – 1pm | Class 5: Way’s uniqueness – helping various types of members achieve their goals | Green & Experienced members |

| May 12 | 10am – 1pm | Class 6: Applying Way’s Tools

(with Special Guest Trainer) |

Green & Experienced members |

| May 16 | 10am – 1pm | Class 7: Compliance to help your ship sail smoothly in the ocean | Green & Experienced members |

| May 17 | 10am – 1pm | Class 8: Unique financial concepts and calculation tools

(with Special Guest Trainer) |

Experienced members |

Contact Stephen Lai at stephen.lai@www.wayfinancial.ca or 604-279-0866 ext. 114 if you have any question.

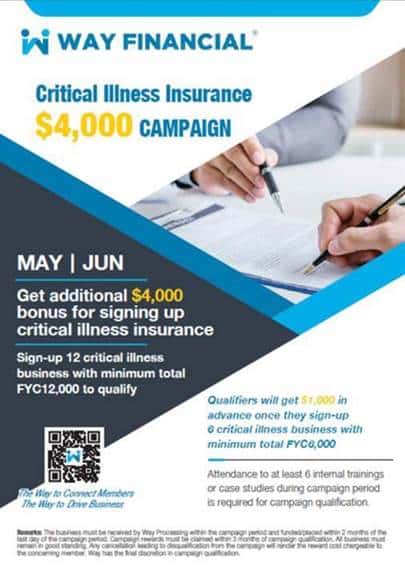

May & June Campaigns – Additional $8,000 bonus!

Get ready for these big-ticket new business campaigns to promote life and critical illness business in May and June.

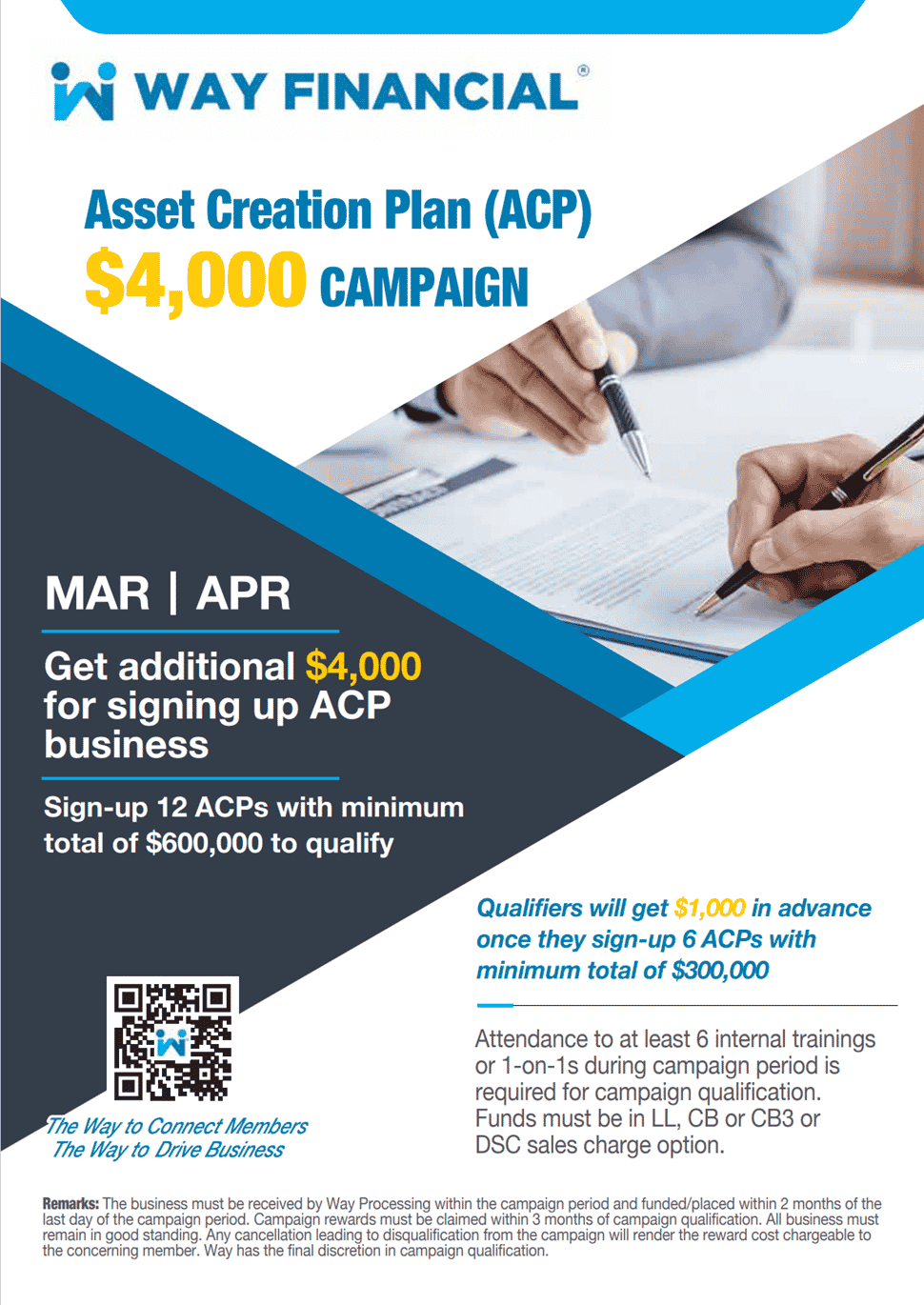

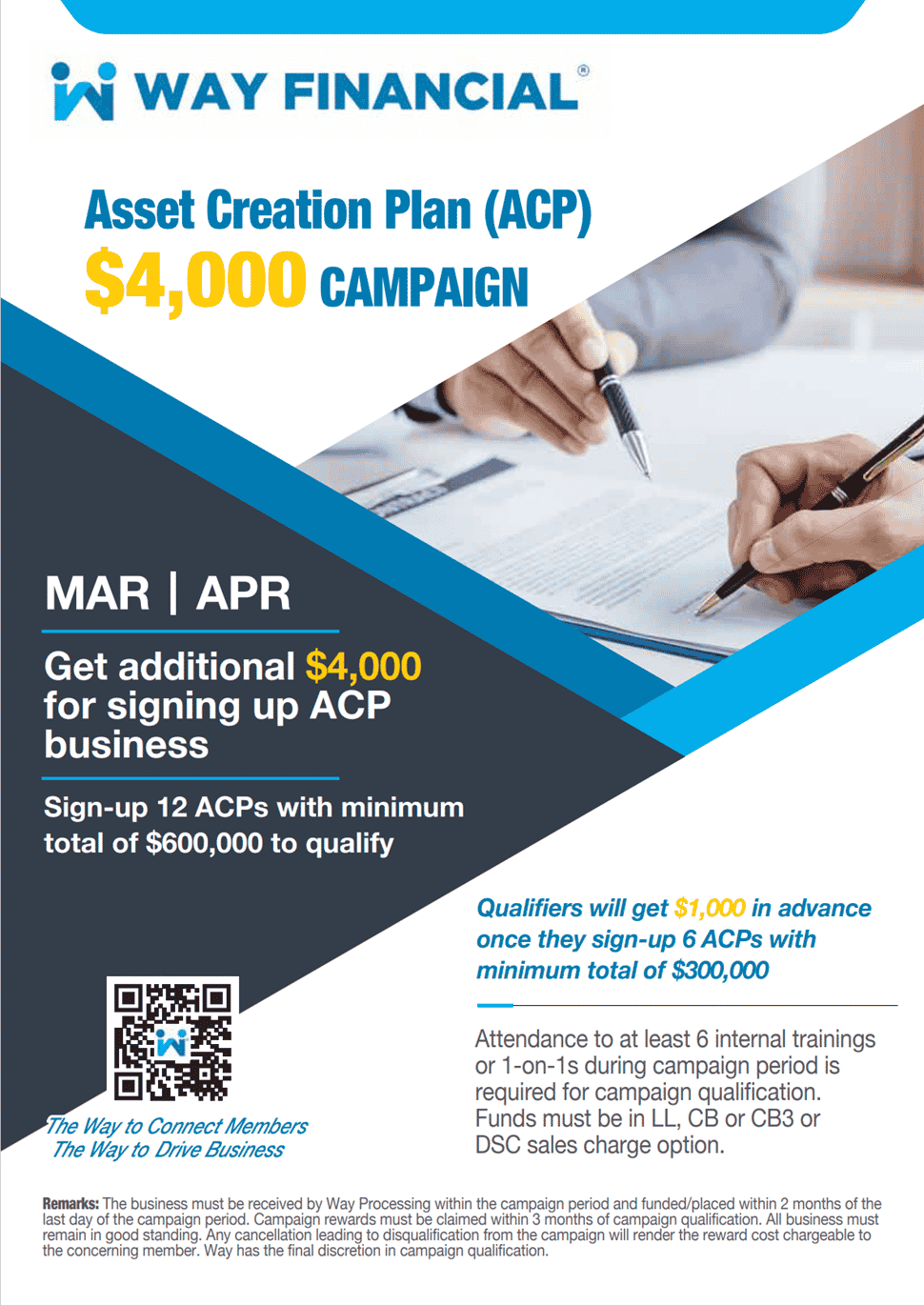

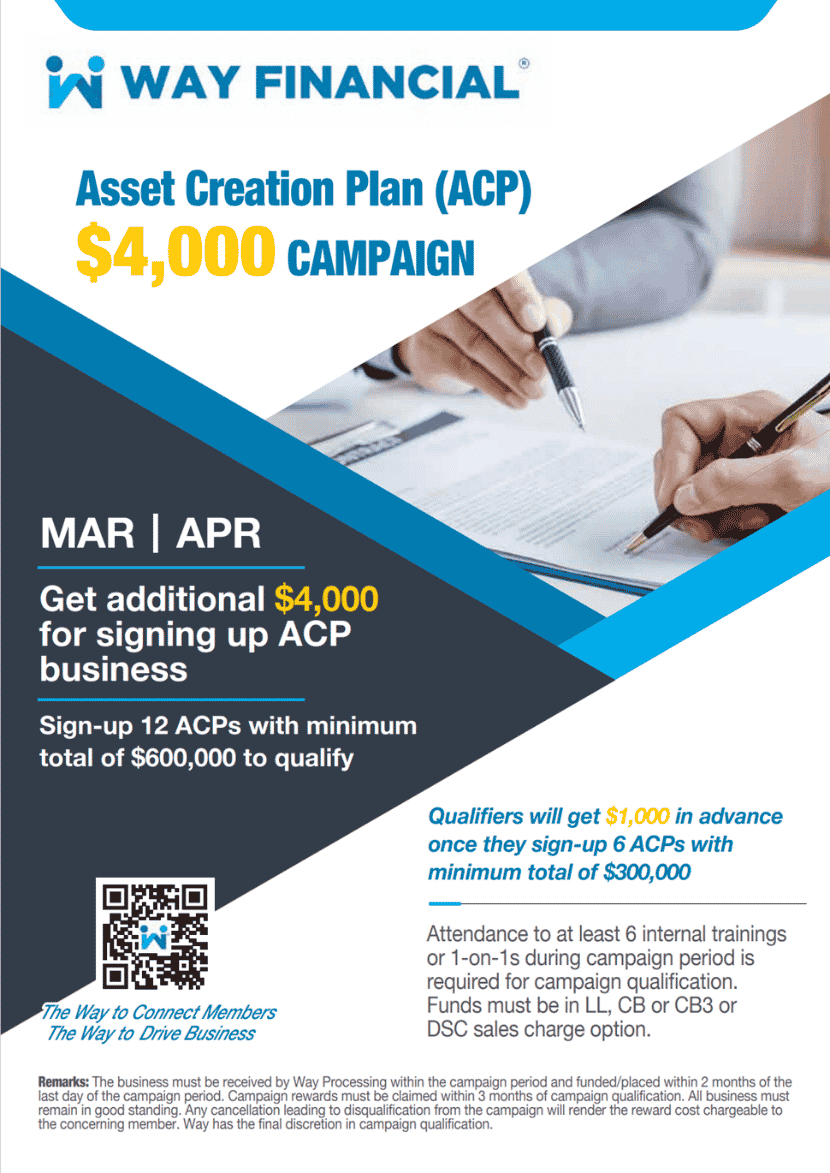

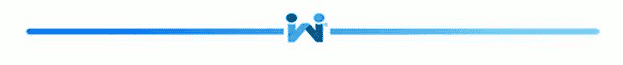

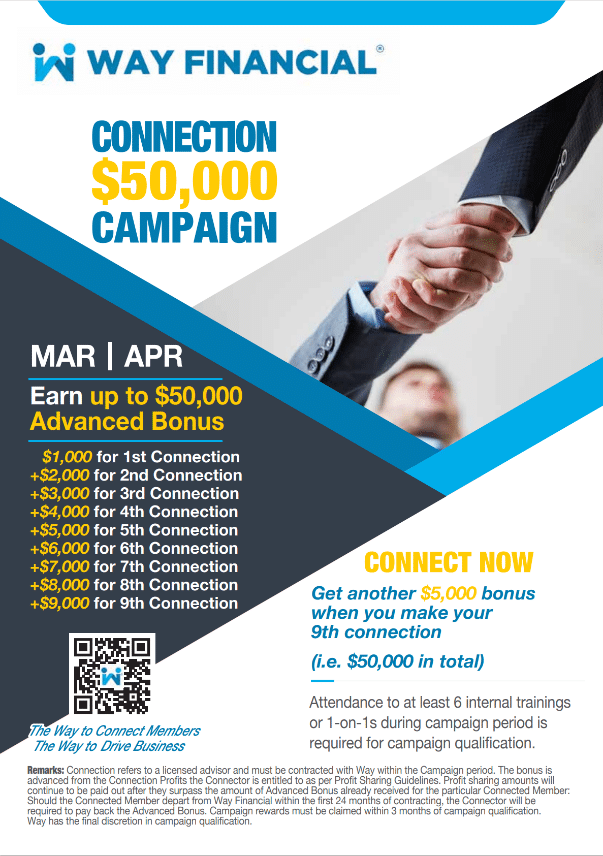

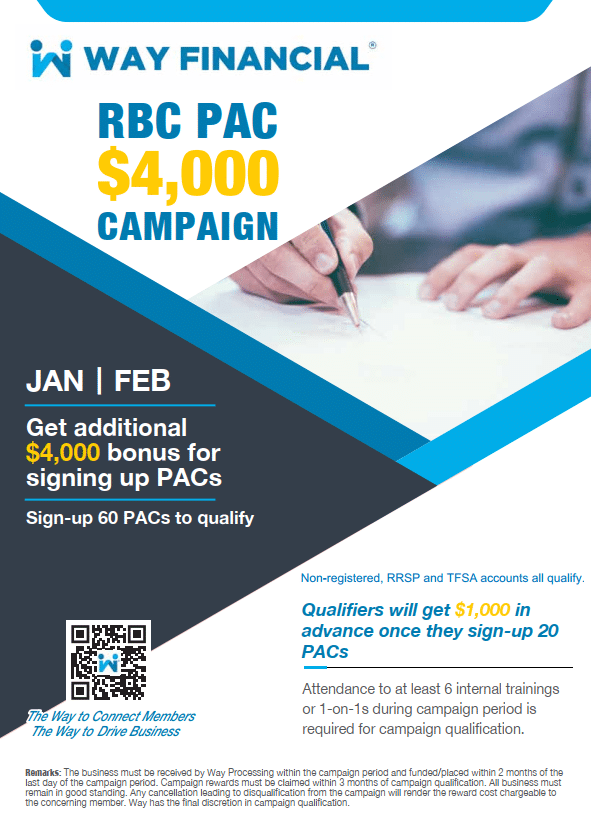

March & April Campaigns – $54,000 up for grabs!

Last week to go for the ACP and Connection Advanced Bonus campaigns! Attend at least 6 internal trainings or case studies during campaign period as part of the prerequisites to winning.

Feel free to ask Stephen Lai if you have any question on the business submissions at stephen.lai@www.wayfinancial.ca or 604-279-0866 ext. 114. Members’ Relations Manager, Samuel Xu, is also available to help you with your connections. Reach out to him at relations@www.wayfinancial.ca or 604-279-0866 ext. 120.

Upcoming Training – internal training sessions count towards campaign qualification

Please remember to sign in using your full name to have your Way Membership confirmed and your training session uninterrupted. Unconfirmed names may be removed from the session.

Feel free to share the training posters with your external broker connections to showcase the type of topics and strategies taught on the Way Platform. A free training trial can be arranged for qualified connections. Ask Stephen Lai at stephen.lai@www.wayfinancial.ca or 604-279-0866 ext. 114 or Samuel Xu at relations@www.wayfinancial.ca or 604-279-0866 ext. 120 for more details.

Time & Date: 11:00am PST, Wednesday, April 27

Risk Management / Health Insuring and Legacy Building – MDRT Holly Miao (Mandarin)

Learn from Holly how to gain clients’ trust, fact find, conduct needs analysis and present solutions.

Click here to join the meeting

Time & Date: 11:00am PST, Friday, April 29

Sun RHA Product Overview and CII – Sun Life Renee Ho

As you build and review retirement income plans for your clients, it’s important to help them recognize and consider their future health care needs and the impact their choices and expectations will have on their plans. Sun RHA is a LTCI solution focused on planning for the health risk associated with later retirement.

Click here to join the meeting

Upcoming Case Studies (30 mins sessions available) – all sessions count towards campaign qualification

Bring a case to get your desired results. All you need to bring is the client’s name and enquiry area. Examples include:

- How to present the case (illustrations & presentations help)

- How to respond to clients’ objections

- How to get repeated or referral business

- How to start the conversation

Check out the case studies schedule in April below and book your session online via the Way Platform Events Calendar or contact admin@www.wayfinancial.ca or 604-279-0866 for assistance.

|

Time & Date: 12:30 – 1:30pm PST, Wednesday, April 27 Case studies with MDRT Holly Miao Schedule of Case Studies in April 2022

|

Carriers’ Updates

Desjardins

Insurance

Further to Amy Tong’s training last Wednesday on corporate shared ownership on CII, attached is the brochure of the Executive Health Plan.

Contact Bailey Bews-Luykx at 604-346-5600 or bailey.bews-luykx@dfs.ca if you have any question.

Equitable Life

Insurance

Weekly Business Builder Series – Join this webinar to learn more about the difference between CI and life underwriting with Jennifer Engman, the Regional Life Sales Manager who used to work as an underwriter.

Topic: Critical Illness Insurance – Understanding CI Underwriting

When: 9:00am PST on April 26, 2022

Register in advance for this webinar: Webinar Registration – Zoom

Contact Monica Zhang at 604-366-4314 or mzhang@equitable.ca if you have any question.

iA

Insurance

iA offers more flexibility to advisors with the immediate lifting of the face amount limit on remote sales of Term Life, Whole Life, Universal Life and Par. Click here to see more details.

Contact Rishu Bains at 604-354-2711 or Rishu.Bains@ia.ca or Vanora McLay at 604-737-9170 or vanora.mclay@ia.ca if you have any question.

Investment

Watch a market review on the recent inflation increase by iA Chief Strategist, Sébastien McMahon, click here to see how it may affect you and your clients.

Contact Hilda Ng at 778-873-1254 or hilda.ng@ia.ca if you have any question.

Manulife

Insurance

Manulife has just enhanced their Par features by guaranteeing the cost to buy paid-up and deposit option insurance. Click here for more details on how this can attract more clients for you.

Contact Chris Chang at 604-355 4879 or Chris_Chang@Manulife.ca or Cherry Xiang at 604-678-1558 or Cherry_Xiang@manulife.ca if you have any question.

Best regards,

Administration Department

“The WAY to connect members. The WAY to drive business.”

Way Financial

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

Feel free to ask Stephen Lai if you have any question on the business submissions at

Feel free to ask Stephen Lai if you have any question on the business submissions at

Meeting ID:870 1281 3204

Meeting ID:870 1281 3204

Feel free to ask Stephen Lai if you have any question on the business submissions at

Feel free to ask Stephen Lai if you have any question on the business submissions at

279-0866 ext. 114.

279-0866 ext. 114.