The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Way’s Weekly Radio Talk Show – Connecting Talents「匯賢天下」

This week’s Connecting Talents 匯賢天下 has Stephen interviewing Principal & Senior Financial Planner of Wealthpedia, Sophia Li, on how high level efficiency can enhance your whole business and make more money. Tune in according to the schedule below to hear what Sophia’s way of success is.

AM1320 – 10:15am every Wednesday

AM1470 – 11:16am every Thursday

NEW Way & iA Financial Group Sales Contest

How to get additional $300, $600 or even more cash rewards from your business application submissions? From the Sales Contest held by Way & iA, Way will top up your reward by 50% once you hit 5 apps and DOUBLE it once you hit 10 apps! All business must be submitted by April 30, 2021 and placed by June 30, 2021. See the details below and attached pdf (iA_Dash for Cash Sales Contest).

Rishu Bains and Jackqueline Singzon will be coming this Friday for virtual training. Please feel free to interact with them at that time.

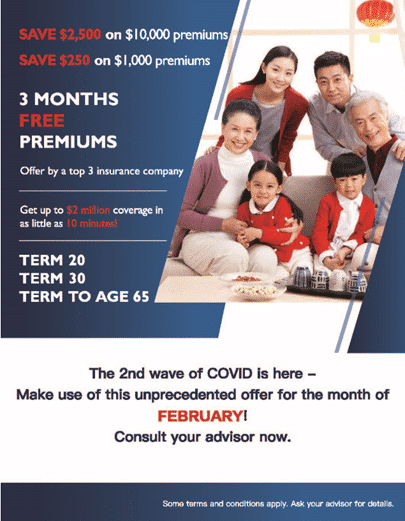

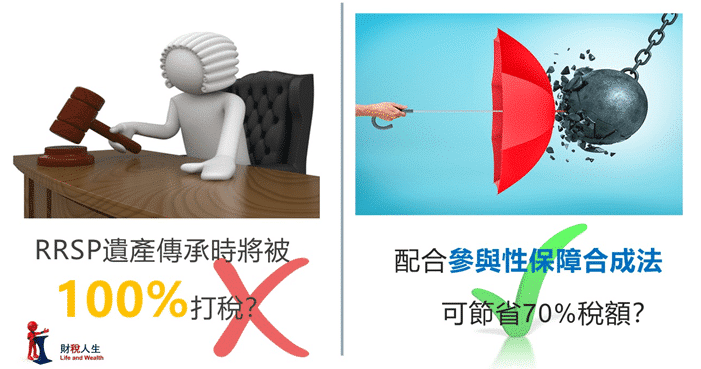

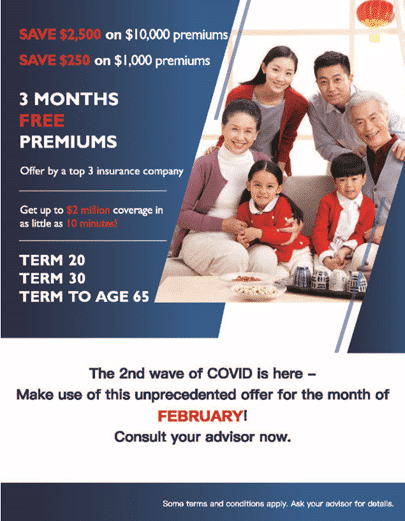

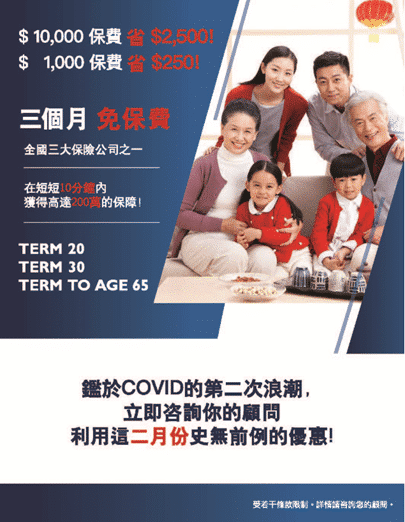

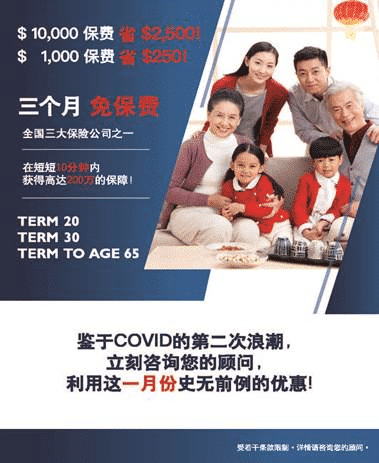

Canada Life 3-Months Free Premium Promotion extended to Mar 19

Canada Life has announced to extend the promotion. The last eligible date for application submission is March 19, 2021. As previously mentioned, Canada Life is offering free three months premium on qualifying, new term 20, term 30 and term-to-age-65 policies, in BC. Business from other provinces will enjoy four months premium free. This is an unprecedented offer and there are also updates on SimpleProtect to make your application process smoother. A client can get $2 million in coverage in just 10 minutes! Watch this video if you do not know how to use SimpleProtect. Details as below.

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203 or Aldous Lam at Aldous.Lam@canadalife.com or (604)443-8215 if you have any questions.

Carriers’ Updates

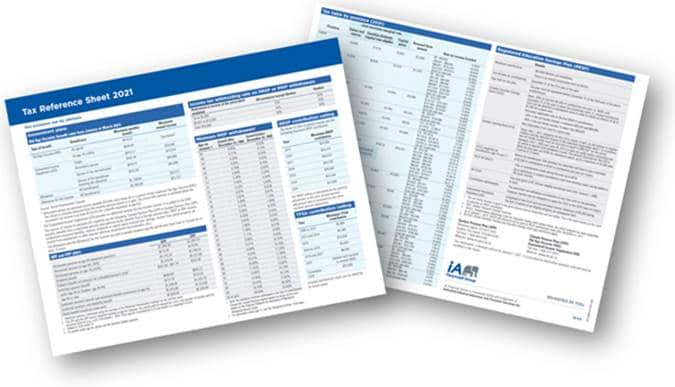

iA

Investment

Check iA weekly economic publication by Mr. Clément Gignac, Chief Economist here.

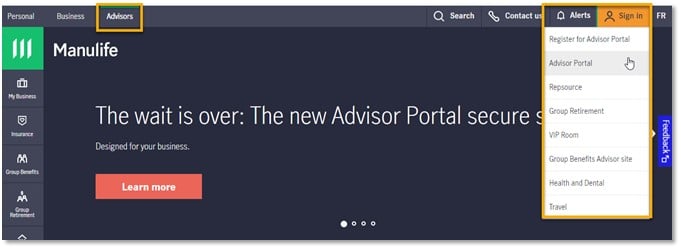

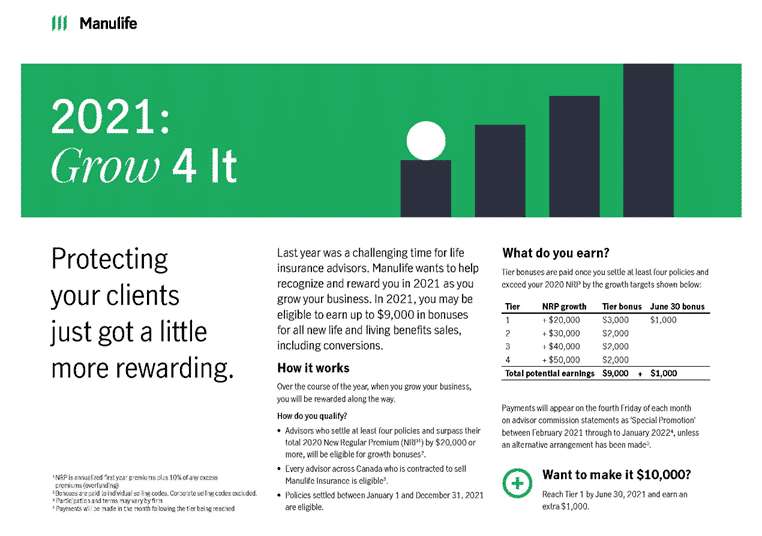

Manulife

Insurance

Manulife is launching a Grow 4 It rewards program this year that gives advisors up to $10,000 in additional bonus for settling insurance cases. Take a look at the attachment (ML 2021_Grow 4 It One-Pager_EN) for details or ask Chris Chang at chris_chang@manulife.com or at (604)355-4879 for more information.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

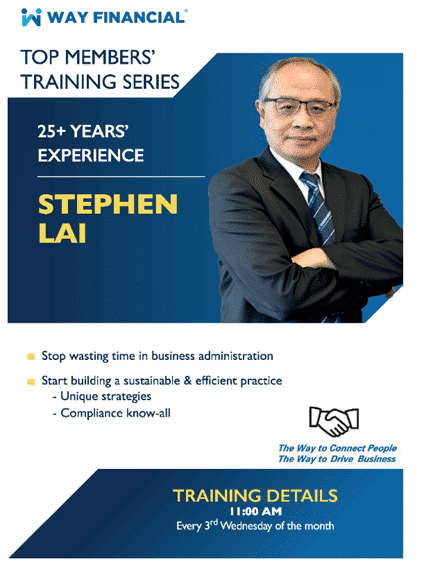

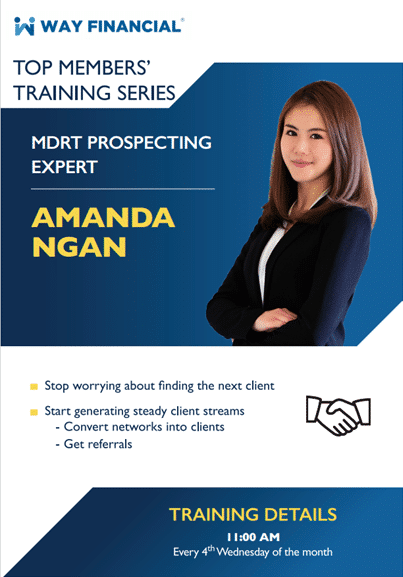

New Top Members’ Training Series by Certified Public Accountant Joanne Ma – every 4th Wednesday

Director of Fortunepath Financial and Certified Public Accountant Joanne Ma, who will be teaching members how to address clients’ tax problems and sharing tips on how insurance makes taxation sense. Joanne’s training is at 11am on every 4th Wednesday.

With over 15 years of accounting experience and having worked at the Public Guardian and Trustee of BC, Joanne is familiar with Estate and Personal Trust Services, Child and Youth Trust Services and Private Committees. She has worked with small businesses, government organizations and publicly trade corporations, which have given her unique perspectives to the financial services field.

In addition, Joanne is both a Certified Group Fitness Professional and Certified Personal Trainer, having been teaching since 2012. Her success in the fitness world is proven by the loyalty of her students, many of whom have followed her throughout the years. Joanne is widely seen as a trustworthy financial professional, reliable friend and a life coach.

Income Tax Filing Part 1: How to fill T1 General -Joanne Ma, CPA

Time & Date: 11am PST, Wednesday, Feb 24

iA Financial Kick off – A reintroduction to iA Life & Living Benefits with special CPB Feature -iA Rishu Bains & Jacqueline Singzon

Rishu and Jacqueline will refresh your memory on iA Life & Living Benefits with special CPB feature. It’s a kick start to enter the New Sales Contest and win the cash rewards.

Time & Date: 11am PST, Friday, Feb 26

Meeting ID: 881 2750 7632

Reminder of CE Credit Requirements for License Renewal

All life insurance licensees are required to renew their licenses before June 1st. It is time to check if you have enough CE credits for the renewal.

- All licensees must meet the continuing education requirements of their class of licence, for each licence year (June 1 to May 31, annually).

- Licensees must maintain valid records of continuing education course attendance and completion, for Council audits.

- If you have an approved designation, e.g. CFP, CLU, RHU, you must have 5 technical hours of continuing education.

- If you have been licensed for at least 5 of the last 7 years, and you do not have an approved designation, you must have 10 technical hours of continuing education.

- If you have NOT been licensed for at least 5 of the last 7 years, and you do not have an approved designation, you must have 15 technical hours of continuing education.

- If you were licensed after March 1, 2019 and you haven’t completed the Council Rules Course, you have to take the course ASAP.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.