Home » 新聞資源

您好會員,

在巴拉克·奧巴馬的鼓勵下,祝您在三月和四月有大生意。

「如果你走在正確的道路上,並且願意繼續走下去,最終你會取得進步。」

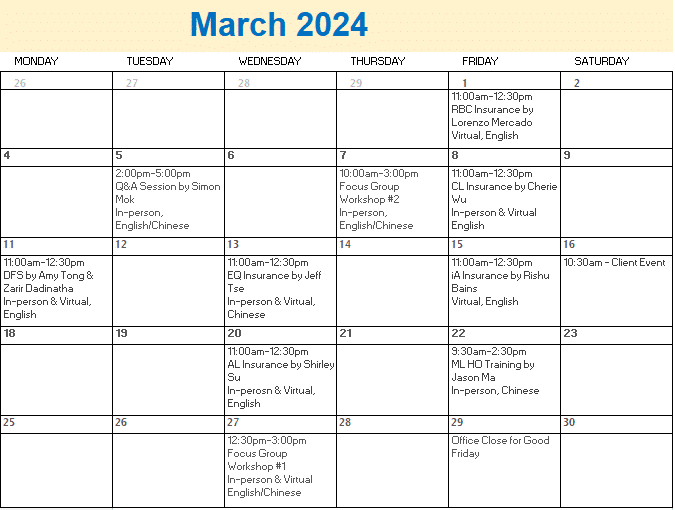

1. 2024 年 4 月 25日午餐會客戶活動註冊 – 剩餘 40 張門票

在 Way,我們很高興地宣佈即將於 2024 年 4 月 25 日舉行第 2 屆第 2季度 120 人午餐會,致力於説明您促進新業務和回頭客以及推薦。這個獨特的活動將為您提供一個機會來推廣您的服務,同時向您的網路提供關於「高凈值客戶遺產規劃和公司稅收節省」的高級策略。

我們的午餐會議以創造有意義的網路的有利環境而聞名,確保您能夠與同行和客戶建立有價值的聯繫。除了豐富的討論外,我們還為您和您的客人策劃了愉快的體驗,包括香檳和美味的自助午餐。

由於之前的 1 月 18日 午餐會客戶活動產生了數百萬的保費和投資,其他會員已經為 4 月 25 日的活動預訂了 80張 門票,只剩下 40 張門票供您在 4 月 3 日星期三之前從連結 http://financialplatform.sv.mikecrm.com/Ubi4NYZ 預訂,並聯繫辦公室經理 Susana Yu 安排付款以確保您的門票。

這次午餐會是您的絕佳機會,不僅可以增強您的專業網路,還可以展示您的專業知識。不要錯過這個提升您的業務並建立持久聯繫的機會。

P.S. 現金獎勵是為了鼓勵客人填寫幸運抽獎表與會員預約,因此如果會員的客人獲得現金獎勵,則由會員負責。

平臺更新

2. 共用資料夾

已為 Way Members 創建了一個新的在線資料夾,用於訪問培訓演示檔、文本範本等材料。按兩下此處 ![]() 獲取 訪問許可權。

獲取 訪問許可權。

3. Sea & Sky會議室可供預訂

一些會員已經在使用Sea & Sky會議室了。雖然優先考慮辦公室使用者,但所有會員都可以在這裡進行預訂: Sea,& Sky

行業動態

4. 不列顛哥倫比亞省保險委員會

年度許可證更新

中的 CE 和 E&O 要求所有保險委員會持牌人的年度許可證更新將於 2024 年 4 月 3 日開始。被許可方完成繼續教育 (CE) 要求的年度截止日期為 2024 年 5 月 31 日,許可期限為 2024 年 6 月 1 日至 2025 年 5 月 31 日。在截止日期後更新執照且在 5 月 31 日之前未達到 CE 要求的被許可人可能會受到進一步調查,我的結果將受到紀律處分。

可在此處找到按許可證類別和CE信用標準劃分的CE指南。

其他 2024 年度許可證續訂要求網路研討會

由於需求量大,我們將於 4 月 11 日(太平洋時間上午 9:30-10:30)舉辦第三場 2024 年度許可證更新要求網路研討會。此網路研討會是免費的,但需要註冊。 在這裡註冊

運營商更新

5. 加拿大人壽

保險

Canada Life 插圖

的新功能3 月 25 日,Canada Life 插圖將推出,您將發現更容易存取非整合銷售策略、添加顧問資料的新選項以及用於恢復正在進行的插圖的自動保存功能。

詳細了解 這些即將推出的增強功能。

更新您的 Concourse 軟體(版本 5.1)

通過此更新,桌面 Concourse 插圖軟體將不再提供 UL。

更新后,過去保存的案例將不再可用。

了解我們如何通過插圖資訊、行銷材料和其他學習資源來增強UL。 瞭解更多資訊

擁抱基於網路的 Canada Life Illustrations

時代在我們準備移除桌面保險插圖軟體時搶佔先機。立即通過 Workspace 訪問 Canada Life 插圖,以熟悉增強的體驗和功能。 瞭解更多資訊

Canada Life Elevate 支援您的大型病例需求

我們有兩個新資源可以説明您流覽承保大型案件的世界。這包括一份新指南,詳細介紹了從頭到尾的大宗承保流程,以及AVP Advanced Underwriting的 Sylvie Schmaus 和副總裁兼首席承保商 Brigitte Loos 的新文章,以揭開再保險一詞的神秘面紗。

立即查看這些 資源 。

保險業務更新

– 表格更新 – 退保申請表 (322 CAN) 閱讀更多

我們正在提高 DocuSign

的安全性從 2024 年 2 月 14 日開始,您接收 DocuSign 結業證書的方式將發生變化。DocuSign 現在將向您發送一個安全連結,而不是附加的 PDF,以便您登錄並下載證書。閱讀有關此更改的更多資訊,並擁有您可以保存的證書。

投資

利用我們屢獲殊榮的基金

與您的客戶開始對話我們的 30 多隻投資基金在 2 月 1 日舉行的 2023 年 Fundata FundGrade A+ ® 獎項中獲得認可。FundGrade A+ ® 獎是加拿大投資基金行業備受推崇的成就。它每年頒發給全年表現出一致、出色、風險調整后業績的投資基金。

查看完整的獲獎者 名單 ,並考慮他們如何融入您的客戶投資計劃。

財富管理業務最新情況

– 表單更新 閱讀更多

6. 紅細胞

投資

11 月,我們就 收入分配以及 RBC GIF 稅收的運作方式進行了溝通。

RBC GIF T3 計劃於 3 月中旬郵寄。

要為客戶諮詢做好準備,請查看 銷售資源中心(Sales Resource Centre )的「財富管理師銷售工具」(Wealth Manager > Sales Tools)下的RBC GIF 2024年最終收入分配報告。

請致電 604-363-7583 或 mike.jackson@rbc.com 聯繫 Mike Jaskson,或致電 236-333-1621 聯繫 Jeffery Ng,如果您有任何問題 ,請 Jeffery.ng@rbc.com 。

7. 圖戈

旅行

學生醫療保險更新 – 4 月 11

日生效2024 年 4 月 11 日,我們將更新學生計劃。優勢和產品功能將保持不變。以下是這些變化的快速細分:

介紹

– myTuGo – 重點介紹用於修改和擴展策略的新自助服務功能。

– TuGo 錢包應用程式 – 包括從 App Store 或 Google Play 下載應用程式的新連結。

聯繫資訊

– 闡明瞭有關如何聯繫 TuGo 的說明,以及對國際存取代碼的更新。

資格條件

– 作為新的資格要求,學生或學生的家庭成員不得接受或被建議接受姑息治療。這與策略中的現有排除項一致。

一般排除

– 包括新的牛仔競技/馬術運動排除條款。

定義

– 運動與活動 – 對機動運動、攀岩和登山的定義進行了更新。

有關這些變化的更詳細摘要,請參閱合作夥伴平臺的新聞和文章部分。TuGo 的下載中心也提供了針對加拿大和國際學生的更新政策措辭。

請致電 905-267-1724 聯繫 Helene Desjardins,如果您有任何問題,請致電 hdes@tugo.com 。

Way & Carriers’ 活動

8.

9. 圖戈

旅行

為 60 場比賽乾杯!

從 2024 年 1 月 1 日至 3 月 31 日,對於售出或續保的每份保單,您將有機會贏取…

欲瞭解更多資訊,請點擊 這裏 瞭解更多資訊

請致電 905-267-1724 聯繫 Helene Desjardins,如果您有任何問題,請致電 hdes@tugo.com 。

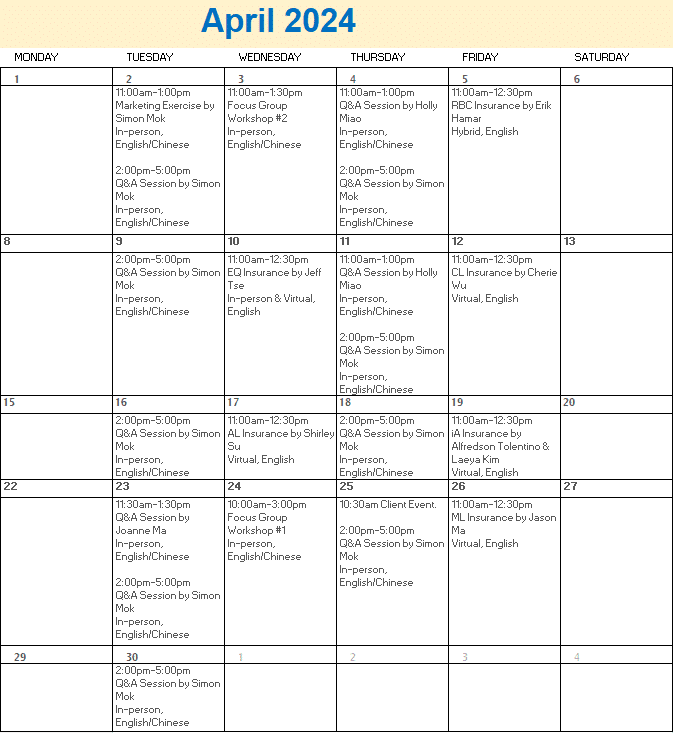

來自 Way Platform 和營運商的培訓

10.

11. 問答環節

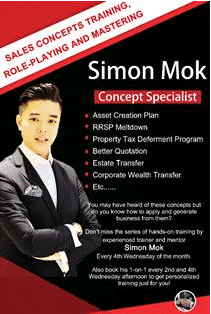

直接與Simon Mok預約您的問答環節 每週二和週四下午2:00 – 5:00pm – 保險產品、插圖、案例應用、銷售技巧和聯繫

歡迎您參加面對面的問答環節,討論您對 Carriers 產品、插圖、案例應用、銷售技巧和莫先生的聯繫的任何一般查詢。

Simon 的聯繫資訊:

電子郵件: simon.mok@seedpacific.ca

電話: 604-338-2928

直接與Holly Miao預約您的問答環節 每月第一和第三個週四從上午11:00至下午1:00 – 共用擁有權紅利(SOD)

歡迎您參加面對面的問答環節,討論股份擁有權股息 SOD,這是一種幫助企業擁有者獲得重大疾病保險保護以及 Holly Miao 女士的潛在節稅股息提取福利的策略。

Holly 的聯繫資訊:

電子郵件: sunnylife1618financial@gmail.com

電話:778-869-5008

直接與喬安妮馬預約問答環節 每月第四個星期二上午 11:30 至下午 1:30 – 報稅、審查稅務報表和公司保險的 CPA POV

歡迎您參加面對面的問答環節,討論個人和公司稅務申報,審查稅務聲明和註冊會計師關於做公司保險的觀點,由Joanne 馬女士主持。

Joanne 的聯繫資訊:

電子郵件: joanne622@gmail.com

電話:778-8952236

12. 巨集利

不要錯過通過我們的 Critical Illness School 學習的機會!

加入國家生活福利顧問 Vanessa Scott 的 5 部分重大疾病系列。選擇以下超連結 (時間) 進行註冊。

第 #1 部分:設置舞臺 – 回歸基礎

部分#2:創建解決方案並解決異議

部分 #3: 商業解決方案和稅務

部分 #4:承保和索賠

第 #5 部分:處理異議

13. RBCI

RBCI 春季殘疾保險學校

RBCI 春季殘疾保險學校是一門全面的七節課課程,涵蓋從 A 到 Z 的殘疾保險。報名參加所有課程,以逐步利用學習 DI,每周積累您的知識。如果您的時間有限,並且您已經熟練掌握了我們的其中一項產品,我們建議您參加我們的其他會議。 在這裡註冊

放假通知

請注意,我們的辦公室將於以下時間關閉:

3 月 29 日星期五(家庭日)

正常運營將在以下時間恢復:

2024 年 4 月 1 日星期一

此致敬意

大溫哥華地區 (GVA) 400 – 6388 No. 3 Road,Richmond BC V6Y 0L4 大多倫多地區 (GTA) Suite N500, 675 Cochrane Drive, North Tower,Markham , ON L3R 0B8

|

俞

淑嫻 運營經理

|

|

| 604 279 0866 (分機號 122) | ||

|

為投資PACs / Lumpsum活動在一月和二月 獲得額外的3,000美元 連接會員的方式。 推動業務的方式。” |

||

| 此電子郵件(包括任何附件)是機密的,可能包含 Way Financial Inc. 的專有資訊。它可能享有特權或以其他方式受到保護,不會洩露。如果您不是預期的收件者,請立即通過回覆電子郵件通知寄件者,並從您的系統中刪除該電子郵件。嚴禁披露、傳播、分發或複製此電子郵件。 | ||

专业联盟

利润分享

合规支持

培训和辅导资源

工商管理和运营

概念和技术

相关支持

营销支持

销售策略

Dear Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

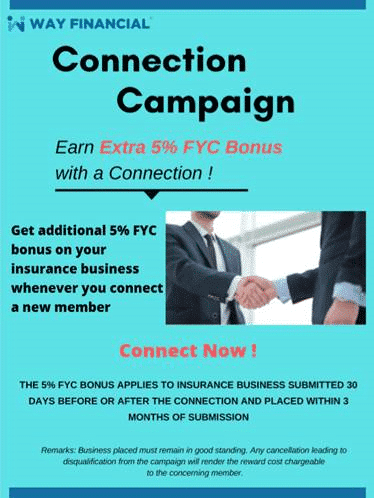

Connection Campaign 2020 – Earn Extra 5% FYC Bonus on Your Business with Every New Connection

In addition to generating residual income from Profit Sharing on your connections, you will be rewarded with an extra 5% FYC bonus on your insurance business submitted 30 days before or after you connect a new member. So do more business and connect more members to get more reward amounts this year!

RBC PAC Campaign – $2,000 Lump-Sum Bonus (January to March 2020)

Get first dips in this campaign by submitting your business by the final training session on February 21st:

Additional 20% FYC Bonus Campaign for IA Business

Also stay tuned for IA’s revamped Critical Illness Insurance, to be announced at the Lunch & Learn on February 28th to see how to make use of new features like 10-pay, new pricing to increase your business volume. Wholesaler, Rishu Bains, will also be available for 1-on-1 sessions from 1 to 3pm following the morning group training that day.

RRSP Deadline Reminder – March 2nd, 2020

Please be reminded that all RRSP business must be signed and dated by March 2nd, 2020, and received by the office by 9:30am on March 3rd, 2020, to count towards the contribution for 2019. Feel free to ask your specific coordinator or e-mail process@www.wayfinancial.ca if you have any question.

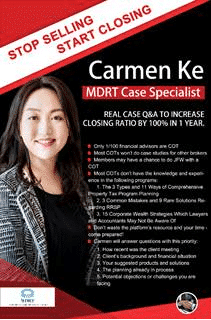

Upcoming Featured Trainings

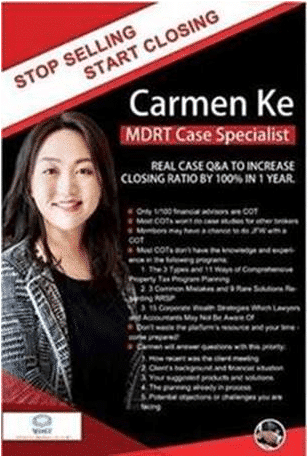

Case Studies: Closing Your Wealth Transfer Cases Using Cascading Insurance – MDRT Carmen Ke

11am, Wednesday, February 12th

Role Play: 1st Mistakes and Fact Find – 3 RRSP mistakes and 9 solutions (#8 Interest Deduction) – Simon Mok

11am, Wednesday, February 19th

Dear Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Important Health Information: Coronavirus

As you are aware, the Wuhan Coronavirus has already made an impact in both our professional and personal lives. As of January 31, 2020, 4 cases have been confirmed in Canada: 3 in Ontario and 1 in BC. In our industry and profession, we all work with a diverse clientele who may travel or be in close proximity of those that have recently travelled to the affected areas. We encourage our cherished members to be cautious with hygiene and considerate of those around them. Here is some resource that may help you:

Preventing coronavirus infection/spreading

Infection Prevention and control Canada (IPAC)

https://ipac-canada.org/coronavirus-resources.php

Government of Canada

Coronavirus Infection: Symptoms and treatment

https://www.canada.ca/en/public-health/services/diseases/coronavirus.html

Novel Coronavirus infection: Frequently Asked Questions (FAQ)

https://www.canada.ca/en/public-health/services/diseases/2019-novel-coronavirus-infection/frequently-asked-questions.html

Coronavirus Infection: Prevention and risks

https://www.canada.ca/en/public-health/services/diseases/coronavirus/prevention-risks.html

2019 Novel Coronavirus infection (Wuhan, China): Outbreak update

https://www.canada.ca/en/public-health/services/diseases/2019-novel-coronavirus-infection.html

The Wuhan Virus: How to Stay Safe

https://foreignpolicy.com/2020/01/25/wuhan-coronavirus-safety-china/

Upcoming Featured Trainings

Way Insiders’ News: Working with Professional Clients – MDRT Sophia Li

11am, Wednesday, February 5th

Come hear how MDRT member Sophia Li works with professional clients and close cases on Shared Ownership for Corporate CII.

Case Studies: Closing Your Wealth Transfer Cases Using Cascading Insurance – MDRT Carmen Ke

11am, Wednesday, February 12th

RBC PAC Campaign – $2,000 Lump-Sum Bonus (January to March 2020)

Get first dips in this campaign by submitting your business by the final training session on February 21st:

Additional 20% FYC Bonus Campaign for IA Business

Qualification is simple: for the 15 or more members who qualify for the Continuous Production Bonus (“CPB”) in 2020, all who qualify will get an additional 20% commission bonus on their IA FYC in 2020, jointly paid out by Way and IA.

Become a CPB qualifier by placing FYC10,000 or more IA insurance business in 2020! So the bonus will give you at least $2,000 more in compensation!

Also stay tuned for IA’s revamped Critical Illness Insurance, to be announced at the Lunch & Learn on February 28th to see how to make use of new features like 10-pay, new pricing to increase your business volume. Wholesaler, Rishu Bains, will also be available for 1-on-1 sessions from 1 to 3pm following the morning group training that day.

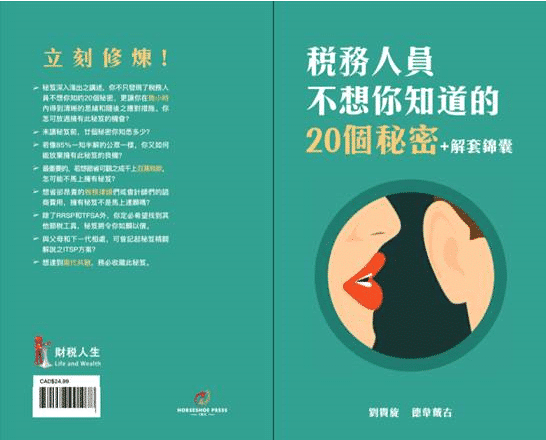

20 Secrets that the Taxman Doesn’t Want You to Know

The highly anticipated Chinese version of 20 Secrets that the Taxman Doesn’t Want You to Know is now available to order. It will be priced at $24.99 on Amazon and local bookstores, and sold for the same price at the Client Events.

For Way Members only, if you order 2 copies, you can bring your receipt to Accounting Department to claim a $20 sponsorship. That means you can get 2 copies for only $29.99 – one for yourself, one for your client.

If you want to order more, you can still get the $20 sponsorship for every 2 copies.

This is to encourage you to do more business and build a closer relation with your clients as the book will help you close cases after your clients read it. As you may already know, the English version is a National Best Seller.

The books are scheduled to arrive this month. First come first served.

Events Schedule – February (updated)

The updated Events Schedule for February is attached for your reference.

Holiday Notice

Please note that our office will be closed on:

Monday, February 17th, 2020 (Family Day)

Normal operations will resume on:

Tuesday, February 18th, 2020

Dear Members,

Happy Chinese New Year! May the Year of the Rat bring you and your family good health, fortune and greater business!

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Partner Events

In addition to client events, the Platform will organize events for partners of yours who either refer you clients or can help you close a case. One for Accountants is coming up next week with details below:

Charity Lecture on Tax Planning Strategies for High Net Worth and Corporate Clients

Follow the Social Media & Event Development group in WeChat for registration and updated news.

20 Secrets that the Taxman Doesn’t Want You to Know

The highly anticipated Chinese version of 20 Secrets that the Taxman Doesn’t Want You to Know is now available to order. It will be priced at $24.99 on Amazon and local bookstores, and sold for the same price at the Client Events.

For Way Members only, if you order 2 copies, you can bring your receipt to Accounting Department to claim a $20 sponsorship. That means you can get 2 copies for only $29.99 – one for yourself, one for your client.

If you want to order more, you can still get the $20 sponsorship for every 2 copies.

This is to encourage you to do more business and build a closer relation with your clients as the book will help you close cases after your clients read it. As you may already know, the English version is a National Best Seller.

The books are scheduled to arrive next month. First come first served.

Upcoming Featured Trainings

How to do PACs efficiently using WealthLink and opportunities from RRSP – RBC Mike Jackson

This is the second in the training series for the PAC Concept. Find out how to efficiently open 30 PACs over a 3-months period.

Attendance to this training session is mandatory for the extra $2,000 bonus!

Members who have submitted 5 PACs by this date will be able to get an advanced bonus of $100.

Way Insiders’ News: Working with Professional Clients, Doctors, Dentists and more – MDRT Sophia Li

11am, Wednesday, February 5th

Way’s special in-house training will continue to feature Insiders’ News presented by members experienced in a specific field. We will start this year with the presentation by MDRT member Sophia Li, who will teach you how to work with professional clients and close cases on Shared Ownership for Corporate CII. Don’t miss out!

RBC PAC Campaign – $2,000 Lump-Sum Bonus (January to March 2020)

Some members are already getting first dips of this campaign and receiving an advanced $100 for submitting 5 RBC PACs by the training session this Friday, January 31st.

News from ICBC

Have You Completed Your Continuing Education for Annual Filing?

Annual filing may be months away, but it’s not too early to complete your continuing education (CE) credits. All licensees regardless of status are required to complete the CE requirements for their class of licence annually by May 31 as part of their annual filing.

If you are not sure how many CE credits you are required to complete, or what qualifies as technical content, see the Licensee Resources section of Council’s website for more information.

Disciplinary Decisions

Azadeh Hosseini was disciplined for contravening Council’s Rules requiring licensees to complete continuing education (CE) credit requirements. The licensee was found to have failed to complete the minimum CE credits required. The licensee was fined $3,000 and was required to make up the missing CE credits and complete the Council Rules Course.

Events Schedule – February

The Events Schedule for February is attached for your reference.

Dear Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Canada Life Par is now on Simple Protect

Less waiting. Less uncertainty. Instant decisions. Complete a participating life insurance (par) application in minutes. If you’re new to SimpleProtectTM, these resources will help you get started. If you’re already familiar with SimpleProtect, try completing an application now.

Click here for more information: https://gwl.campaign.adobe.com/nl/jsp/m.jsp?c=%40bCBOh6ZSqozqb0gGRsvd2uN8aEoI5GF8FVUobDi3Ih0%3D

Or ask wholesaler, Carol Ng, for more details at Carol.Ng@productsolutionscentre.ca or (604) 377-7203.

Assumption Life Support – New Wholesaler’s Contact

Mohammed Saiepour is now our Business Development Manager for Assumption Life business and he is the go-to person for any questions on getting coverage for your non-resident or hard-to-insure clients, as well as the newly designed portal for advisors to launch their insurance business online!

Ask Mo for more details at mohammed.saiepour@assomption.ca or (403) 542-5209.

RBC PAC Campaign – $2,000 Lump-Sum Bonus (January to March 2020)

Join the 24 members who are on track to getting an extra $2,000 Lump-Sum Bonus on their RBC PAC business. They have attended the first training in this concept and will be rewarded an advanced $100 for submitting 5 RBC PACs by the next training session on January 31st.

In view of poor weather conditions last week, for those of you who missed the first training, you can still qualify for the $2,000 if you attend the remaining second and third training sessions. Don’t miss out again as this is your last chance.

Connection Profits

It was a robust year in 2019 with many members trying the Platform resources to build their connections and are rewarded with new streams of residual income.

The Connection Profits are being calculated and will be distributed by the Annual Compliance Training on February 19th.

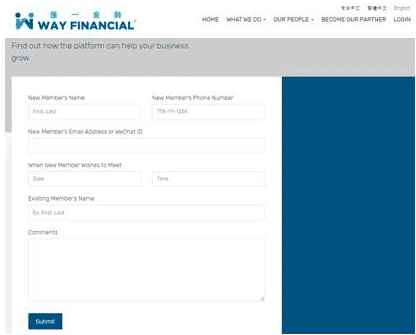

For those looking to connect to more members, simply input their names and information on the bottom part of Way’s homepage to get started: https://www.wayfinancial.ca/

Feel free to ask Stephen for more details at stephen.lai@www.wayfinancial.ca or 604-279-0866 (ext. 114).

Upcoming Featured Trainings

Role Play: Level-Up Closing Appointment of RRSP Meltdown – Simon Mok

11am, Wednesday, January 22nd

Continue the good practice from last year in polishing your client meetings’ skills and enhancing your closing rate! Learn from top sales, Simon Mok, in the topic of RRSP and close more business this RRSP season.

How to do PACs efficiently using WealthLink and opportunities from RRSP Season – RBC Mike Jackson

11am, Friday, January 31st

Take part in this second session to beef up your PAC concept knowledge and to qualify for the $2,000 Lump-Sum Bonus Campaign. Also come to learn how to get another advance on the bonus payment!

Dear Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

B2B RSP Loans Promotion

Submit your clients’ RSP Loan applications to save 0.25% off the posted rate. RSP Loan applications must be:

For more information, visit B2B’s website here: RSP Resource Centre

How to Start the Conversation on Long Term Care Insurance with Clients?

Start by showing them how much long term care cost is in British Columbia:

Here is also a guide to how to get clients’ applications efficiently processed and approved:

https://www.sunlife.ca/files/advisor/english/PDF/LTCI_External_Field_UW_Guide.pdf

Ask wholesaler Viola Lam for more details at Viola.Lam@sunlife.com or 604-417-0791.

Upcoming Featured Trainings

The PAC Concept, Benefits to Clients & Advisors – RBC Mike Jackson

11am, Friday, January 17th

This is the start of the RBC PAC Campaign Training Series – you must attend if you wish to qualify for the $2,000 Lump-Sum Bonus! Mike will explain how to use this strategy to enlarge your clientele and increase your repeated business and residual income.

Role Play: Level-Up Closing Appointment of RRSP Meltdown – Simon Mok

11am, Wednesday, January 22nd

Continue the good practice from last year in polishing your client meetings’ skills and enhancing your closing rate! Learn from top sales, Simon Mok, in the topic of RRSP and close more business this RRSP season.

RBC PAC Campaign – $2,000 Lump-Sum Bonus (January to March 2020)

Sign up 30 RBC PACs from January to March 2020 to receive an additional $2,000 bonus. Any PAC amount works! And it’s per account, be it RRSP, TFSA, non-reg, etc.

Those who sign up over 15 but less than 30 RBC PACs will also be rewarded with a lump-sum $750 bonus.

You can learn the details of this concept and how to efficiently apply it at the three upcoming RBC training sessions. To be eligible for the bonus, you must attend all three sessions:

Jan 17th – The PAC concept, benefits to clients and advisors (clientele, repeated business, residual income)

Jan 31st – How to do PACs efficiently using WealthLink and opportunities from RRSP loans

Feb 21st – Answering clients’ objections: Seg Funds vs Mutual Funds, Comparing to the Bank’s service, etc

Start your PAC business now!

Client Events

The 3 types and 11 ways of Comprehensive Property Tax Program Planning

Time & Date: 1:45pm, Saturday, January 18th – Open for registration

Language: Mandarin

3 common mistakes and 9 rare solutions of RRSP

Time & Date: 1:45pm, Thursday, 23rd – Open for registration

Language: Cantonese

Follow the Social Media & Event Development group in WeChat for registration and updated news.