Dear Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

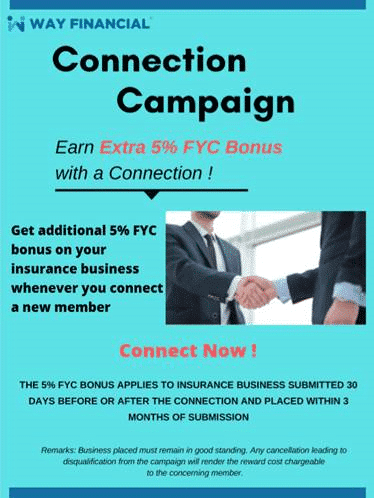

Connection Campaign 2020 – Earn Extra 5% FYC Bonus on Your Business with Every New Connection

In addition to generating residual income from Profit Sharing on your connections, you will be rewarded with an extra 5% FYC bonus on your insurance business submitted 30 days before or after you connect a new member. So do more business and connect more members to get more reward amounts this year!

RBC PAC Campaign – $2,000 Lump-Sum Bonus (January to March 2020)

Get first dips in this campaign by submitting your business by the final training session on February 21st:

- Submit 5 PACs & get $100 advanced bonus!

- Submit 10 PACS & get $200 advanced bonus!

Additional 20% FYC Bonus Campaign for IA Business

Also stay tuned for IA’s revamped Critical Illness Insurance, to be announced at the Lunch & Learn on February 28th to see how to make use of new features like 10-pay, new pricing to increase your business volume. Wholesaler, Rishu Bains, will also be available for 1-on-1 sessions from 1 to 3pm following the morning group training that day.

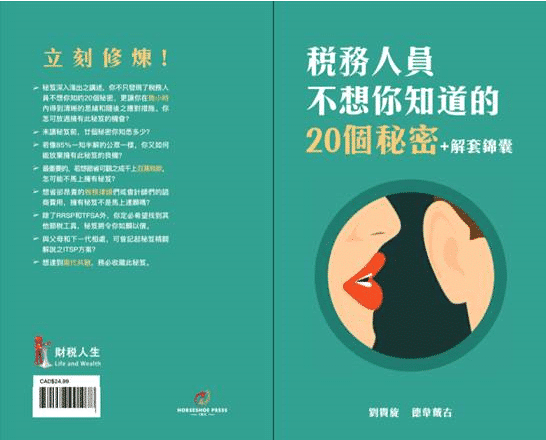

RRSP Deadline Reminder – March 2nd, 2020

Please be reminded that all RRSP business must be signed and dated by March 2nd, 2020, and received by the office by 9:30am on March 3rd, 2020, to count towards the contribution for 2019. Feel free to ask your specific coordinator or e-mail process@www.wayfinancial.ca if you have any question.

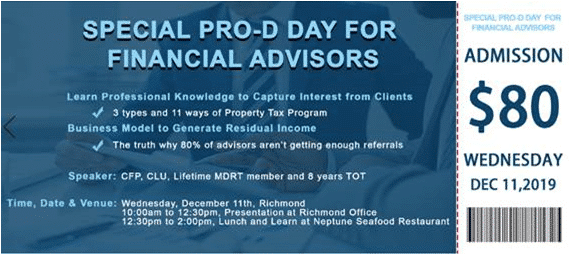

Upcoming Featured Trainings

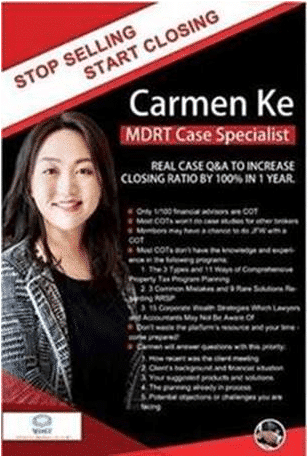

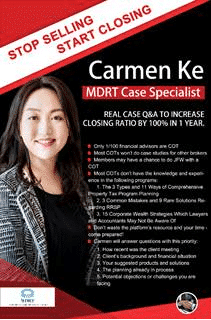

Case Studies: Closing Your Wealth Transfer Cases Using Cascading Insurance – MDRT Carmen Ke

11am, Wednesday, February 12th

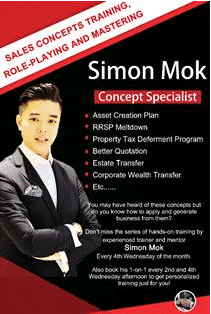

Role Play: 1st Mistakes and Fact Find – 3 RRSP mistakes and 9 solutions (#8 Interest Deduction) – Simon Mok

11am, Wednesday, February 19th