Home » 新闻资料

企业家与连接器 – 2023 年 3 月

GT 财富

WF 财富第一金融集团公司

Sunnylife 1618 Financial Inc.

Yanjiang Chen Wealth Management Inc.

Dear Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

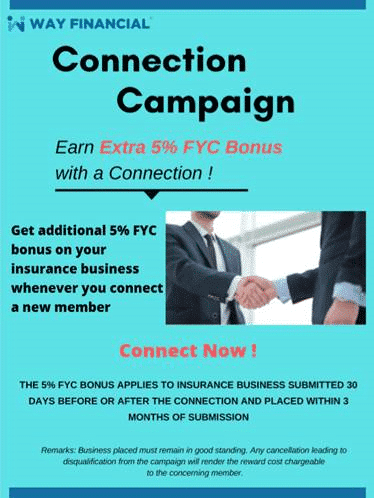

Connection Campaign 2020 – Earn Extra 5% FYC Bonus on Your Business with Every New Connection

In addition to generating residual income from Profit Sharing on your connections, you will be rewarded with an extra 5% FYC bonus on your insurance business submitted 30 days before or after you connect a new member. So do more business and connect more members to get more reward amounts this year!

RBC PAC Campaign – $2,000 Lump-Sum Bonus (January to March 2020)

Get first dips in this campaign by submitting your business by the final training session on February 21st:

Additional 20% FYC Bonus Campaign for IA Business

Also stay tuned for IA’s revamped Critical Illness Insurance, to be announced at the Lunch & Learn on February 28th to see how to make use of new features like 10-pay, new pricing to increase your business volume. Wholesaler, Rishu Bains, will also be available for 1-on-1 sessions from 1 to 3pm following the morning group training that day.

RRSP Deadline Reminder – March 2nd, 2020

Please be reminded that all RRSP business must be signed and dated by March 2nd, 2020, and received by the office by 9:30am on March 3rd, 2020, to count towards the contribution for 2019. Feel free to ask your specific coordinator or e-mail process@www.wayfinancial.ca if you have any question.

Upcoming Featured Trainings

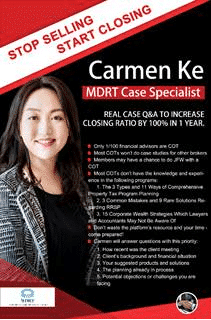

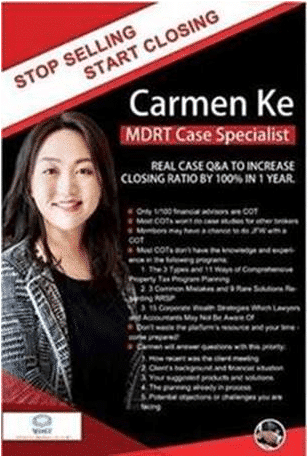

Case Studies: Closing Your Wealth Transfer Cases Using Cascading Insurance – MDRT Carmen Ke

11am, Wednesday, February 12th

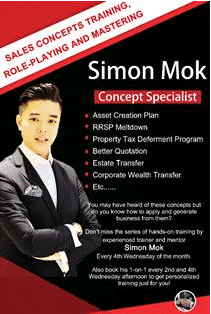

Role Play: 1st Mistakes and Fact Find – 3 RRSP mistakes and 9 solutions (#8 Interest Deduction) – Simon Mok

11am, Wednesday, February 19th

Dear Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Important Health Information: Coronavirus

As you are aware, the Wuhan Coronavirus has already made an impact in both our professional and personal lives. As of January 31, 2020, 4 cases have been confirmed in Canada: 3 in Ontario and 1 in BC. In our industry and profession, we all work with a diverse clientele who may travel or be in close proximity of those that have recently travelled to the affected areas. We encourage our cherished members to be cautious with hygiene and considerate of those around them. Here is some resource that may help you:

Preventing coronavirus infection/spreading

Infection Prevention and control Canada (IPAC)

https://ipac-canada.org/coronavirus-resources.php

Government of Canada

Coronavirus Infection: Symptoms and treatment

https://www.canada.ca/en/public-health/services/diseases/coronavirus.html

Novel Coronavirus infection: Frequently Asked Questions (FAQ)

https://www.canada.ca/en/public-health/services/diseases/2019-novel-coronavirus-infection/frequently-asked-questions.html

Coronavirus Infection: Prevention and risks

https://www.canada.ca/en/public-health/services/diseases/coronavirus/prevention-risks.html

2019 Novel Coronavirus infection (Wuhan, China): Outbreak update

https://www.canada.ca/en/public-health/services/diseases/2019-novel-coronavirus-infection.html

The Wuhan Virus: How to Stay Safe

https://foreignpolicy.com/2020/01/25/wuhan-coronavirus-safety-china/

Upcoming Featured Trainings

Way Insiders’ News: Working with Professional Clients – MDRT Sophia Li

11am, Wednesday, February 5th

Come hear how MDRT member Sophia Li works with professional clients and close cases on Shared Ownership for Corporate CII.

Case Studies: Closing Your Wealth Transfer Cases Using Cascading Insurance – MDRT Carmen Ke

11am, Wednesday, February 12th

RBC PAC Campaign – $2,000 Lump-Sum Bonus (January to March 2020)

Get first dips in this campaign by submitting your business by the final training session on February 21st:

Additional 20% FYC Bonus Campaign for IA Business

Qualification is simple: for the 15 or more members who qualify for the Continuous Production Bonus (“CPB”) in 2020, all who qualify will get an additional 20% commission bonus on their IA FYC in 2020, jointly paid out by Way and IA.

Become a CPB qualifier by placing FYC10,000 or more IA insurance business in 2020! So the bonus will give you at least $2,000 more in compensation!

Also stay tuned for IA’s revamped Critical Illness Insurance, to be announced at the Lunch & Learn on February 28th to see how to make use of new features like 10-pay, new pricing to increase your business volume. Wholesaler, Rishu Bains, will also be available for 1-on-1 sessions from 1 to 3pm following the morning group training that day.

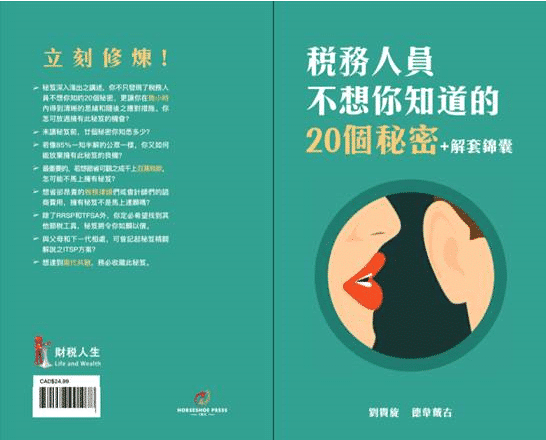

20 Secrets that the Taxman Doesn’t Want You to Know

The highly anticipated Chinese version of 20 Secrets that the Taxman Doesn’t Want You to Know is now available to order. It will be priced at $24.99 on Amazon and local bookstores, and sold for the same price at the Client Events.

For Way Members only, if you order 2 copies, you can bring your receipt to Accounting Department to claim a $20 sponsorship. That means you can get 2 copies for only $29.99 – one for yourself, one for your client.

If you want to order more, you can still get the $20 sponsorship for every 2 copies.

This is to encourage you to do more business and build a closer relation with your clients as the book will help you close cases after your clients read it. As you may already know, the English version is a National Best Seller.

The books are scheduled to arrive this month. First come first served.

Events Schedule – February (updated)

The updated Events Schedule for February is attached for your reference.

Holiday Notice

Please note that our office will be closed on:

Monday, February 17th, 2020 (Family Day)

Normal operations will resume on:

Tuesday, February 18th, 2020

Dear Members,

Happy Chinese New Year! May the Year of the Rat bring you and your family good health, fortune and greater business!

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Partner Events

In addition to client events, the Platform will organize events for partners of yours who either refer you clients or can help you close a case. One for Accountants is coming up next week with details below:

Charity Lecture on Tax Planning Strategies for High Net Worth and Corporate Clients

Follow the Social Media & Event Development group in WeChat for registration and updated news.

20 Secrets that the Taxman Doesn’t Want You to Know

The highly anticipated Chinese version of 20 Secrets that the Taxman Doesn’t Want You to Know is now available to order. It will be priced at $24.99 on Amazon and local bookstores, and sold for the same price at the Client Events.

For Way Members only, if you order 2 copies, you can bring your receipt to Accounting Department to claim a $20 sponsorship. That means you can get 2 copies for only $29.99 – one for yourself, one for your client.

If you want to order more, you can still get the $20 sponsorship for every 2 copies.

This is to encourage you to do more business and build a closer relation with your clients as the book will help you close cases after your clients read it. As you may already know, the English version is a National Best Seller.

The books are scheduled to arrive next month. First come first served.

Upcoming Featured Trainings

How to do PACs efficiently using WealthLink and opportunities from RRSP – RBC Mike Jackson

This is the second in the training series for the PAC Concept. Find out how to efficiently open 30 PACs over a 3-months period.

Attendance to this training session is mandatory for the extra $2,000 bonus!

Members who have submitted 5 PACs by this date will be able to get an advanced bonus of $100.

Way Insiders’ News: Working with Professional Clients, Doctors, Dentists and more – MDRT Sophia Li

11am, Wednesday, February 5th

Way’s special in-house training will continue to feature Insiders’ News presented by members experienced in a specific field. We will start this year with the presentation by MDRT member Sophia Li, who will teach you how to work with professional clients and close cases on Shared Ownership for Corporate CII. Don’t miss out!

RBC PAC Campaign – $2,000 Lump-Sum Bonus (January to March 2020)

Some members are already getting first dips of this campaign and receiving an advanced $100 for submitting 5 RBC PACs by the training session this Friday, January 31st.

News from ICBC

Have You Completed Your Continuing Education for Annual Filing?

Annual filing may be months away, but it’s not too early to complete your continuing education (CE) credits. All licensees regardless of status are required to complete the CE requirements for their class of licence annually by May 31 as part of their annual filing.

If you are not sure how many CE credits you are required to complete, or what qualifies as technical content, see the Licensee Resources section of Council’s website for more information.

Disciplinary Decisions

Azadeh Hosseini was disciplined for contravening Council’s Rules requiring licensees to complete continuing education (CE) credit requirements. The licensee was found to have failed to complete the minimum CE credits required. The licensee was fined $3,000 and was required to make up the missing CE credits and complete the Council Rules Course.

Events Schedule – February

The Events Schedule for February is attached for your reference.

Dear Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Canada Life Par is now on Simple Protect

Less waiting. Less uncertainty. Instant decisions. Complete a participating life insurance (par) application in minutes. If you’re new to SimpleProtectTM, these resources will help you get started. If you’re already familiar with SimpleProtect, try completing an application now.

Click here for more information: https://gwl.campaign.adobe.com/nl/jsp/m.jsp?c=%40bCBOh6ZSqozqb0gGRsvd2uN8aEoI5GF8FVUobDi3Ih0%3D

Or ask wholesaler, Carol Ng, for more details at Carol.Ng@productsolutionscentre.ca or (604) 377-7203.

Assumption Life Support – New Wholesaler’s Contact

Mohammed Saiepour is now our Business Development Manager for Assumption Life business and he is the go-to person for any questions on getting coverage for your non-resident or hard-to-insure clients, as well as the newly designed portal for advisors to launch their insurance business online!

Ask Mo for more details at mohammed.saiepour@assomption.ca or (403) 542-5209.

RBC PAC Campaign – $2,000 Lump-Sum Bonus (January to March 2020)

Join the 24 members who are on track to getting an extra $2,000 Lump-Sum Bonus on their RBC PAC business. They have attended the first training in this concept and will be rewarded an advanced $100 for submitting 5 RBC PACs by the next training session on January 31st.

In view of poor weather conditions last week, for those of you who missed the first training, you can still qualify for the $2,000 if you attend the remaining second and third training sessions. Don’t miss out again as this is your last chance.

Connection Profits

It was a robust year in 2019 with many members trying the Platform resources to build their connections and are rewarded with new streams of residual income.

The Connection Profits are being calculated and will be distributed by the Annual Compliance Training on February 19th.

For those looking to connect to more members, simply input their names and information on the bottom part of Way’s homepage to get started: https://www.wayfinancial.ca/

Feel free to ask Stephen for more details at stephen.lai@www.wayfinancial.ca or 604-279-0866 (ext. 114).

Upcoming Featured Trainings

Role Play: Level-Up Closing Appointment of RRSP Meltdown – Simon Mok

11am, Wednesday, January 22nd

Continue the good practice from last year in polishing your client meetings’ skills and enhancing your closing rate! Learn from top sales, Simon Mok, in the topic of RRSP and close more business this RRSP season.

How to do PACs efficiently using WealthLink and opportunities from RRSP Season – RBC Mike Jackson

11am, Friday, January 31st

Take part in this second session to beef up your PAC concept knowledge and to qualify for the $2,000 Lump-Sum Bonus Campaign. Also come to learn how to get another advance on the bonus payment!

Dear Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

B2B RSP Loans Promotion

Submit your clients’ RSP Loan applications to save 0.25% off the posted rate. RSP Loan applications must be:

For more information, visit B2B’s website here: RSP Resource Centre

How to Start the Conversation on Long Term Care Insurance with Clients?

Start by showing them how much long term care cost is in British Columbia:

Here is also a guide to how to get clients’ applications efficiently processed and approved:

https://www.sunlife.ca/files/advisor/english/PDF/LTCI_External_Field_UW_Guide.pdf

Ask wholesaler Viola Lam for more details at Viola.Lam@sunlife.com or 604-417-0791.

Upcoming Featured Trainings

The PAC Concept, Benefits to Clients & Advisors – RBC Mike Jackson

11am, Friday, January 17th

This is the start of the RBC PAC Campaign Training Series – you must attend if you wish to qualify for the $2,000 Lump-Sum Bonus! Mike will explain how to use this strategy to enlarge your clientele and increase your repeated business and residual income.

Role Play: Level-Up Closing Appointment of RRSP Meltdown – Simon Mok

11am, Wednesday, January 22nd

Continue the good practice from last year in polishing your client meetings’ skills and enhancing your closing rate! Learn from top sales, Simon Mok, in the topic of RRSP and close more business this RRSP season.

RBC PAC Campaign – $2,000 Lump-Sum Bonus (January to March 2020)

Sign up 30 RBC PACs from January to March 2020 to receive an additional $2,000 bonus. Any PAC amount works! And it’s per account, be it RRSP, TFSA, non-reg, etc.

Those who sign up over 15 but less than 30 RBC PACs will also be rewarded with a lump-sum $750 bonus.

You can learn the details of this concept and how to efficiently apply it at the three upcoming RBC training sessions. To be eligible for the bonus, you must attend all three sessions:

Jan 17th – The PAC concept, benefits to clients and advisors (clientele, repeated business, residual income)

Jan 31st – How to do PACs efficiently using WealthLink and opportunities from RRSP loans

Feb 21st – Answering clients’ objections: Seg Funds vs Mutual Funds, Comparing to the Bank’s service, etc

Start your PAC business now!

Client Events

The 3 types and 11 ways of Comprehensive Property Tax Program Planning

Time & Date: 1:45pm, Saturday, January 18th – Open for registration

Language: Mandarin

3 common mistakes and 9 rare solutions of RRSP

Time & Date: 1:45pm, Thursday, 23rd – Open for registration

Language: Cantonese

Follow the Social Media & Event Development group in WeChat for registration and updated news.