Hi Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

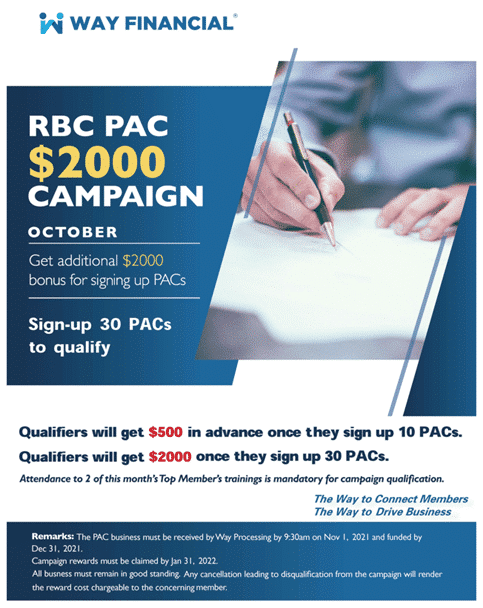

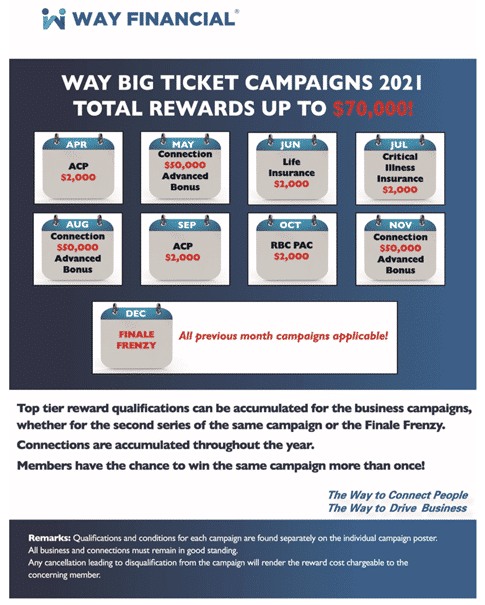

Finale Frenzy Campaign – December

Next month, the Finale Frenzy will start, which reopens the campaign qualification for all 2021 Big Ticket Campaigns. Get ready to win total rewards up to $70,000! See details in the poster below.

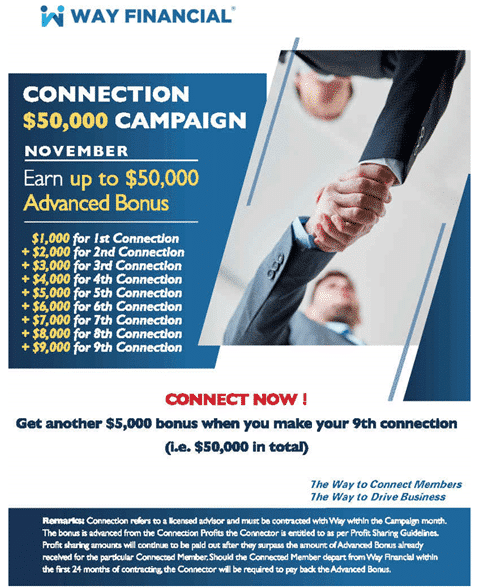

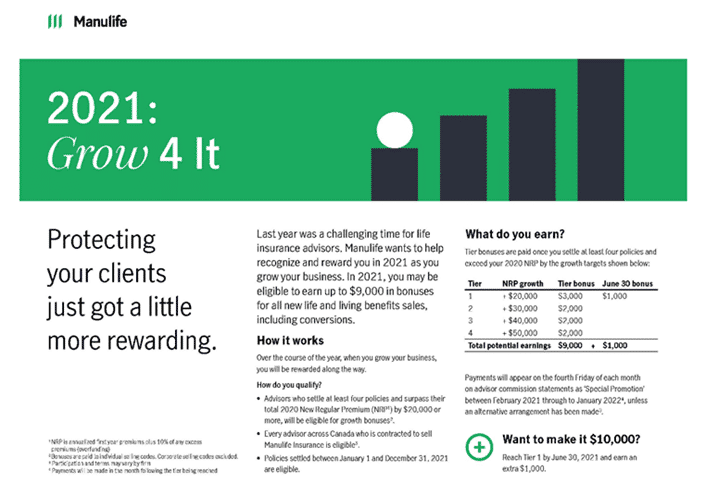

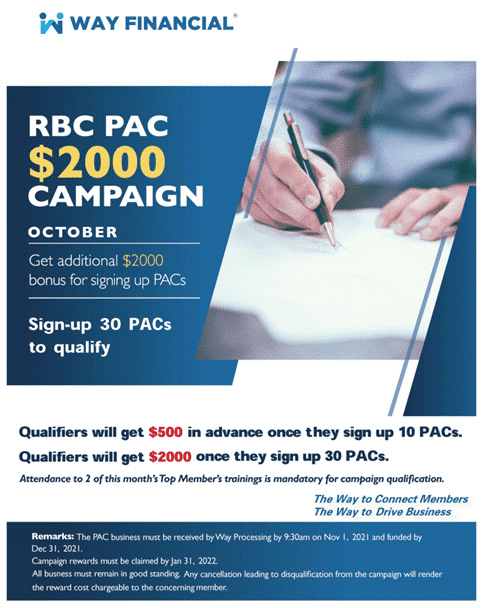

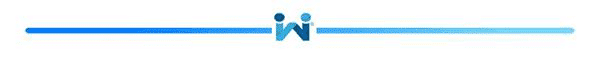

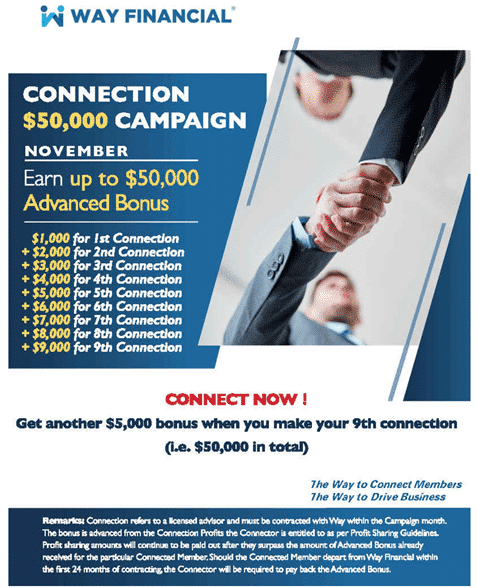

Connection Profits Campaign – November

Reach out to your potential connections now to win up to $50,000 advanced bonus this month. Those who have connected members in earlier campaign months this year – your results accumulate! For example, if you had connected someone during the previous campaign months, you will receive $2000 already for connecting a new member this month, or receive $3000 if you have previously connected 2 new members, etc. See more details below and ask Stephen Lai at stephen.lai@www.wayfinancial.ca or 604-279-0866 ext 114 if you have any question or want to set-up a connection meeting.

Upcoming Client Events

Tax and Execution Tactics: Tax Investigation Department (series 2) + RRSP Hedging

Please refer to upcoming WeChat announcements on the next client event posters and details.

Ask admin@www.wayfinancial.ca if you have any question.

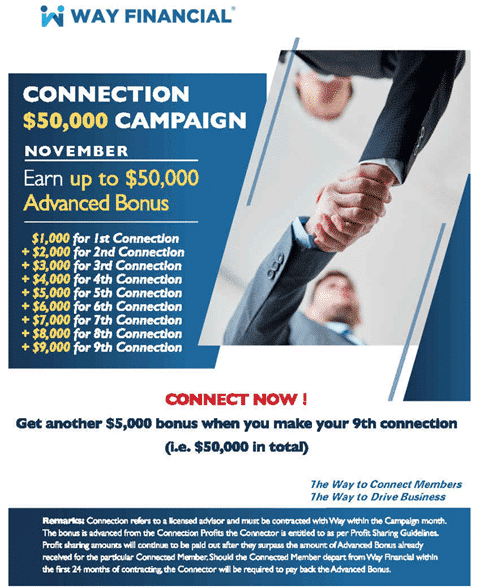

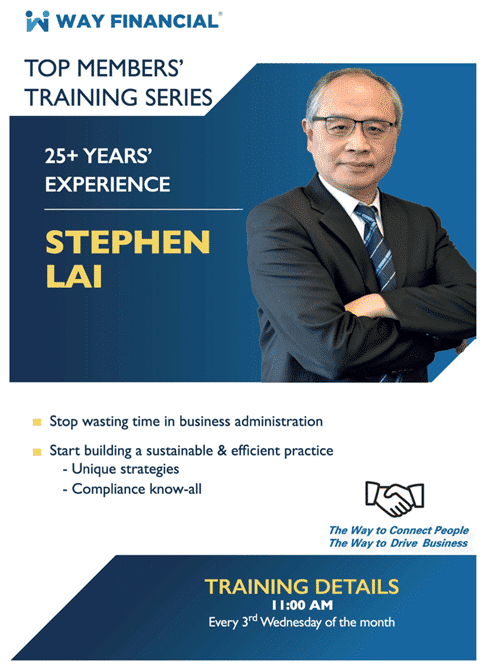

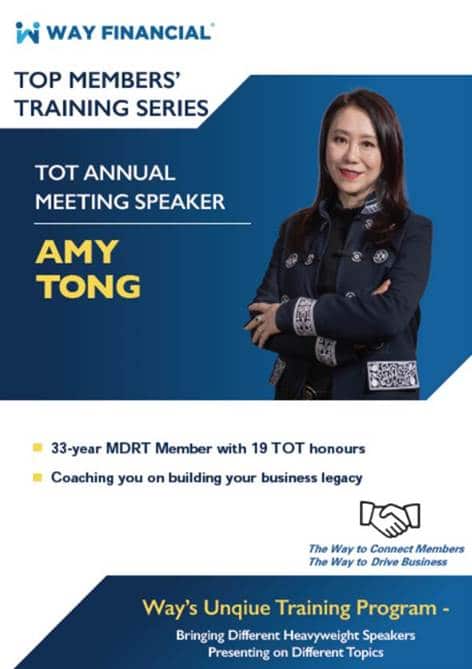

Upcoming Trainings

Please remember to sign in using your full name to have your Way Membership confirmed and your training session uninterrupted. Unconfirmed names may be removed from the session.

Also note that the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Time & Date: 8:30am PST, Tuesday, November 16

Advocis: Practice Development Series: Module 12B – Relationship Management (Mentor Input)

Come join Advocis training to gain skills and knowledge to further your development and ensure success in the industry.

Click here to join the meeting

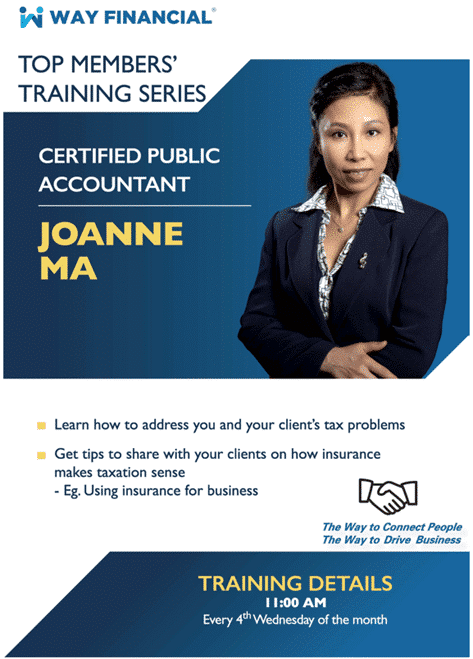

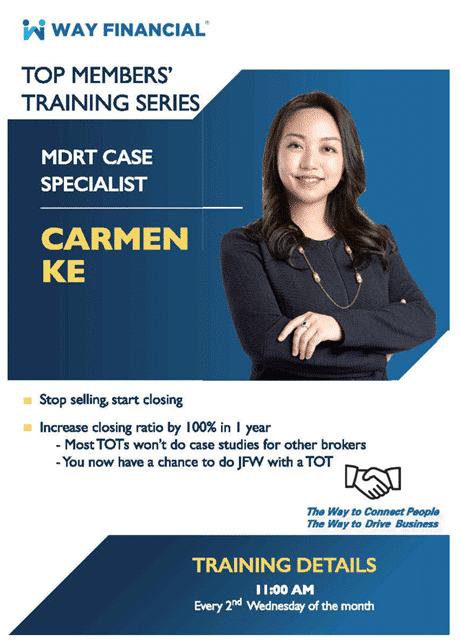

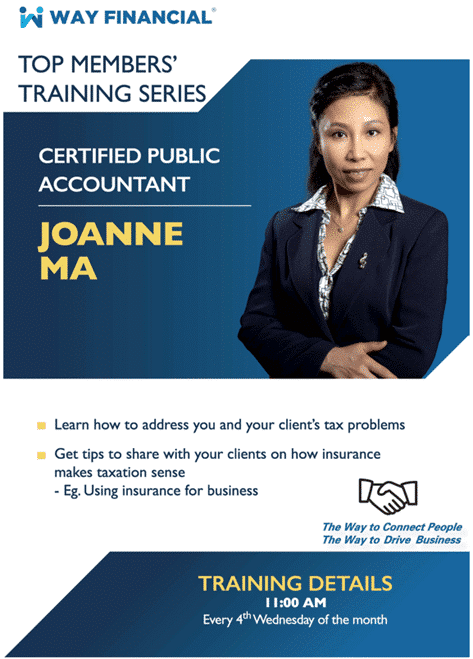

Time & Date: 11:00am PST, Wednesday, November 17

Concept: Risk Management / Strategy: Property Tax Deferment / Case Size: $10,000FYC – CFP CIM COT Sophia Li

Come and learn from CFP CIM COT Sophia Li. Tax defer was applied in June and now use the tax money in a corporate owned whole life policy.

Click here to join the meeting

Live Q&A Prize Contest:

We are giving out gift cards for members who join our Top member trainings on Wednesdays.

3 X $20 gift card for up to 50 attendees

6 X $20 gift card for 51 to 100 attendees

9 X $20 gift card for 100+ attendees

Time & Date: 11:00am PST, Friday, November 19

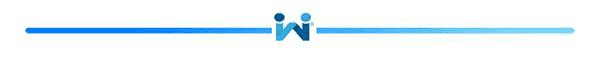

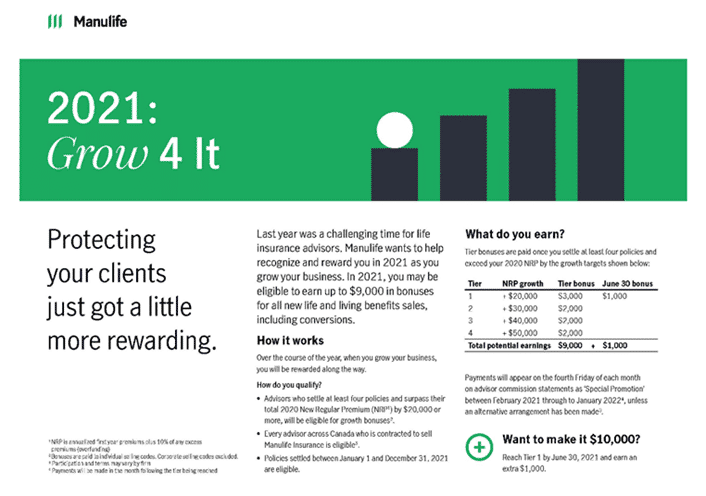

Manulife Q4 Update, where have we seen success in 2021 – Manulife Chris Chang

Join Chris’ training to learn about the update of Manulife in Q4 2021 to help you better meet clients’ expectation.

Click here to join the meeting

Upcoming 1-on-1 Case Studies (30 mins or 1 hour sessions available)

Time & Date: 12:30-1:30pm PST, Wednesday, November 17

1-on-1 Case Studies with CFP CIM COT Sophia Li

Time & Date: 1:00-3:00pm PST, Friday, November 19

1-on-1 Case Studies with Manulife Chris Chang

Book your session online via the Way Platform Events calendar. Contact admin@www.wayfinancial.ca or 604-279-0866 if you have any question.

1-on-1 case studies can be 30 minutes or an hour each. Bring a case to get your desired results. All you need to bring is the client’s name and enquiry area. Examples include:

- How to present the case (illustrations & presentations help)

- How to respond to clients’ objections

- How to get repeated or referral business

- How to start the conversation

Carriers’ Updates

B2B

RSP Loan and Investment Loan pre-qualified offer

B2B Bank is offerring a pre-qualified offer to some of your client for the following variable rate loan terms:

- 5-year RSP Loan

- 10-year RSP Loan

- 20-year Investment Loan (if applicable)

A client can pre-qualify for amounts, products and term lengths as outlined in the list and can choose one loan option. This pre-qualified offer is available until February 1, 2022.

Contact Danya Wang at 236-688-6201 or danya.wang@b2bbank.com if you have any question.

Canada Life

Insurance

Watch Canada Life Day on demand

Canada Life Day was held on October 28, 2021. To support the day’s learning, Canada Life have gathered a variety of resources for advisors. To access resources, click the event’s virtual booths. View wealth and insurance breakout sessions to learn more about how to use segregated funds to power clients’ financial plans and how estate equalization influences succession planning.

Creating Effective CI Plans to Protect Your Client’s Assets

Please refer to attached presentation file shared by wholesaler Carol Ng, who taught you how to make good use of their different promotions and tools to meet your clients’ expectation.

Contact Carol Ng at 604-377-7203 or Carol.Ng@CanadaLife.com or Amber Wang at 226-272-1297 or AmberHanYi.Wang@canadalife.com if you have any question.

Investment

Updated Canada Life fund shelf

- Effective November 19, 2021, changes are made to Canada Life segregated fund names. Click the quick reference chart for more details.

- As a part of this, pricing changes are also being introduced to Canada Life segregated funds (applies to selected funds only).

Contact Richard Chen at (604) 338-6416 or Richard.Chen@canadalife.com or Floria Song at (604) 331-2420 or floria.song@canadalife.com if you have any question.

iA Financial

Investment

iA Financial Group will proceed with four fund mergers on November 19.

| Current fund | Replacement fund |

| Diversified Income | Diversified Opportunity |

| North American Equity Hybrid 75/25 | Dividend Growth Hybrid 75/25 |

| Global Opportunities (Loomis Sayles) Hybrid 75/25 | Global Dividend (Dynamic) Hybrid 75/25 |

| Global True Conviction Hybrid 75/25 | Global Equity Hybrid 75/25 |

If the changes indicated in the table above suit your client, no action on your part or on your client’s part is required.

For registered contracts, these mergers will not result in tax consequences. For non-registered contracts, taxable capital gain or loss to be declared on your clients’ tax slips (federal: T3, Quebec: Relevé 16) issued for the 2021 tax year.

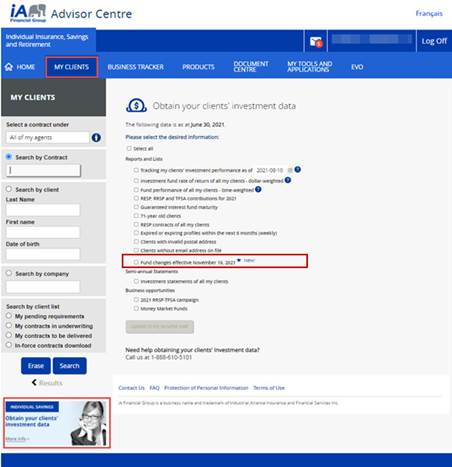

For impacted clients with transactions of $1,000 or more, they will received transaction confirmation by mail or online in their My Client Space account. Advisor can view these transaction confirmations on the Business Tracker tool in the Advisor Centre. To download your impacted client list, please click on “Obtain your clients’ investment data”, then check the “Fund changes effective November 19, 2021” box and upload to your secure mail.

Contact Hilda Ng at 778-873-1254 or hilda.ng@ia.ca or Barbra Vuan at 604-737-9245 or barbra.vuan@ia.ca if you have any questions.

Manulife

Insurance

Apple Watch S7 is now available to Vitality members. Check out the details here to see how you can leverage this resource to close more business: https://advisor.manulife.ca/advisors/insurance/vitality/apple-watch.html

Contact Chris Chang at 604-355-4879 or chris_chang@manulife.com or Cherry Xiang at 604-678-1558 or Cherry_Xiang@manulife.ca for more information.

Thank you!

Best Regards,

Administration Department

“The WAY to connect members. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.