The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Upcoming Client Events

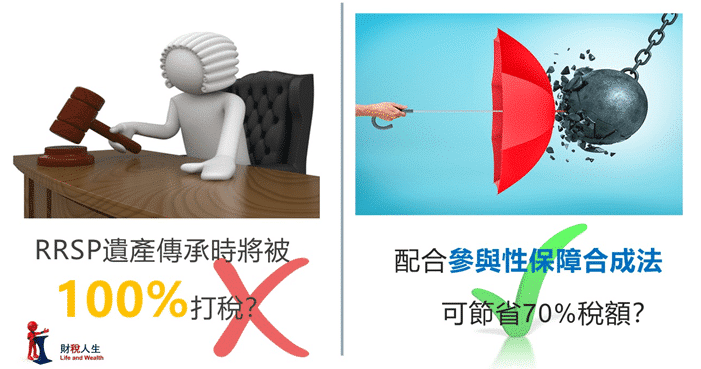

3 RRSP Mistakes 9 Solutions: #4 Withdrawn Timing #8 PAR Synthesis

Time & Date: 10:55 am, Thursday, February 18

Language: Mandarin

YouTube link: https://youtu.be/h-Vv5M6g-DQ

Time & Date: 1:55 pm, Thursday, February 18

Language: Cantonese

YouTube link: https://youtu.be/y7UE_3OCyO8

And here is the registration link: http://sv.mikecrm.com/DJ5UZZk

Ask admin@www.wayfinancial.ca if you have any question.

Carriers’ Updates

Canada Life

Insurance

There is a live demonstration of SimpleProtect with information on the digital business tool – single start and a chance to ask questions. It will guide you the best use of SimpleProtect or the New Business WebApp.

Time & Date: 1pm – 2pm EST, Thursday, Feb 18

Click here to join.

Ask Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203 or Aldous Lam at Aldous.Lam@canadalife.com or (604)443-8215 if you have any question on using SimpleProtect.

Equitable Life

Effective February 2, 2021, Equitable Life is making two changes related to the settlement of Individual Life & Health policies:

- Commission will be paid daily for settled (for Individual Life & Health) policies and renewal commissions instead of weekly. Commission statements will only be available weekly, as usual.

- The delivery confirmation sent with each contract will be a new settlement requirement for policies to be put into effect and for commissions to be paid. As a result, policies will no longer settle upon being issued – meaning commissions would not be paid out until the policy delivery receipt is signed and received.

Click here for details.

Contact Monica Zhang at mzhang@equitable.ca or (604)366-4314 for more details.

Reminder for submitting Equitable Life e-app

Some members have been missing underwriting notices from Equitable Life Underwriting. Please be reminded to indicate the correct contact information when submitting e-Apps to ensure underwriting requirements and updates are sent to our office promptly. Please use the information below:

MGA Information

MGA Name: Way Financial

MGA Code: 6R3A1

MGA Email: process@www.wayfinancial.ca

Feel free to ask your case coordinator should you have any question in this regard.

Manulife

Manulife is having a Chinese New Year Celebration Event online.

Time a& Date: 2 – 2:45pm PST, Tuesday, Feb 16

Please click here to RVSP.

Investment

Please find the attached recording for the presentation, 2021 Market Outlook, last Thursday by Chief Investment Strategist, Philip Petursson.

Sun Life

Insurance

Renee Ho has been appointed as our new dedicated Regional Sales Director and supporting her is Insurance Sales Representative June Wang. Please feel free to contact Reene Ho at renee.ho@sunlife.com or 604-657-9251 and June Wang at june.wang@sunlife.com or 604-895-5413 when you need help or support.

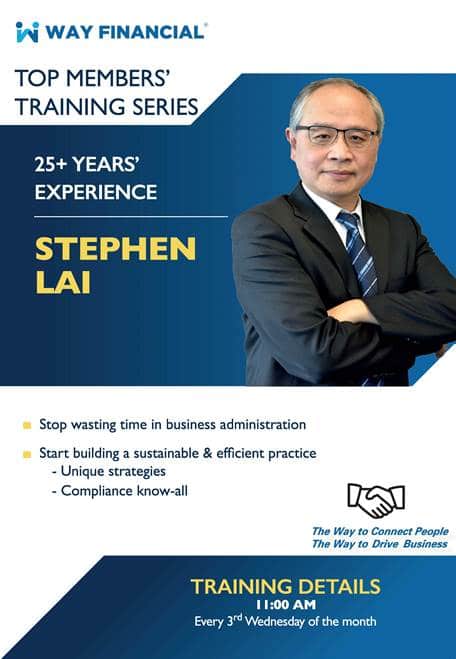

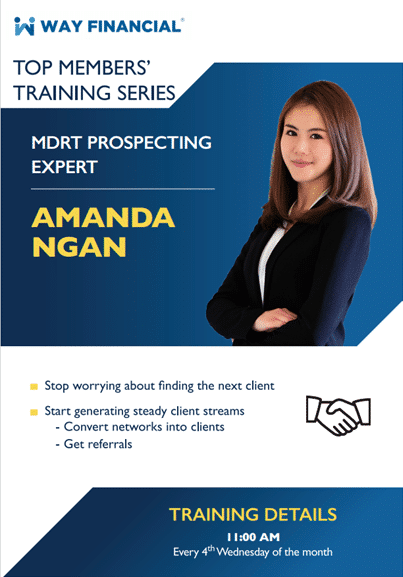

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Advocis Practice Development – Client Engagement

Way is providing an extra training resource to our members by offering the Advocis Practice Development series, focusing on skills and knowledge for newer advisors to further your development and ensure success in the industry.

8:30am PST, Tuesday, Feb 9

Case Study: 3 RRSP Mistakes 9 Solutions – Carmen Ke

Bring a case with you and learn from the best and have COT Member, Carmen Ke. She will help you increase your closing rate and teach you tactics in dealing with different clienteles.

11am PST, Wednesday, Feb 10

RRSP Meltdown Strategy using life insurance – CL Carol Ng

Carol will give you RRSP Meltdown Strategy using Life Insurance. Don’t miss it.

11am PST, Friday, Feb 12

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.