Hi Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

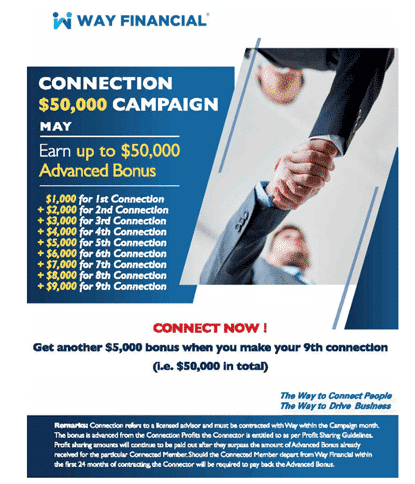

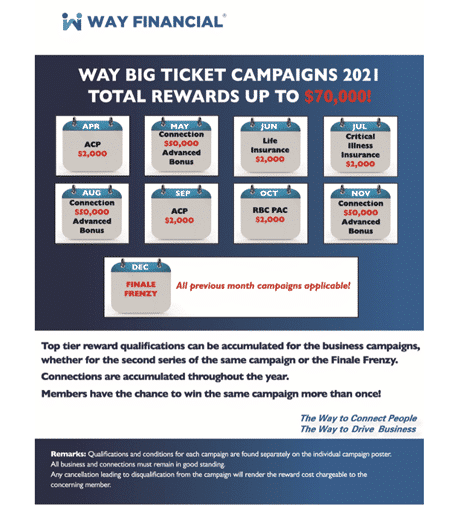

Connection $50,000 Campaign – starting in May!

The BIG Connection $50,000 Campaign is coming up in two weeks so get ready by reaching out to your potential connections now. Join this Wednesday training on $70,000 Extra Commission Campaign & Business Plan to get tools to make your connections efficiently and effectively.

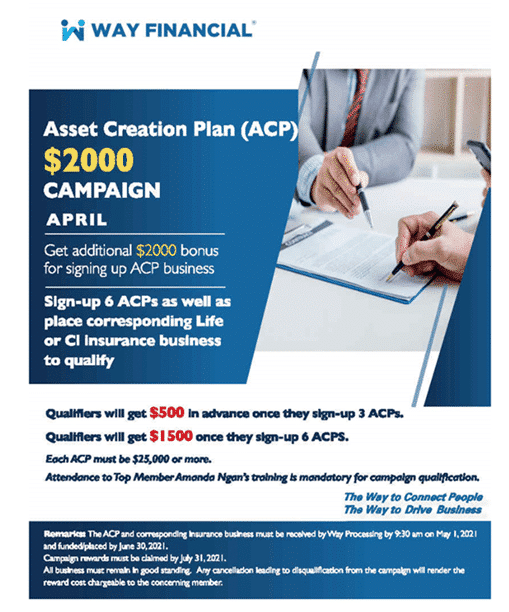

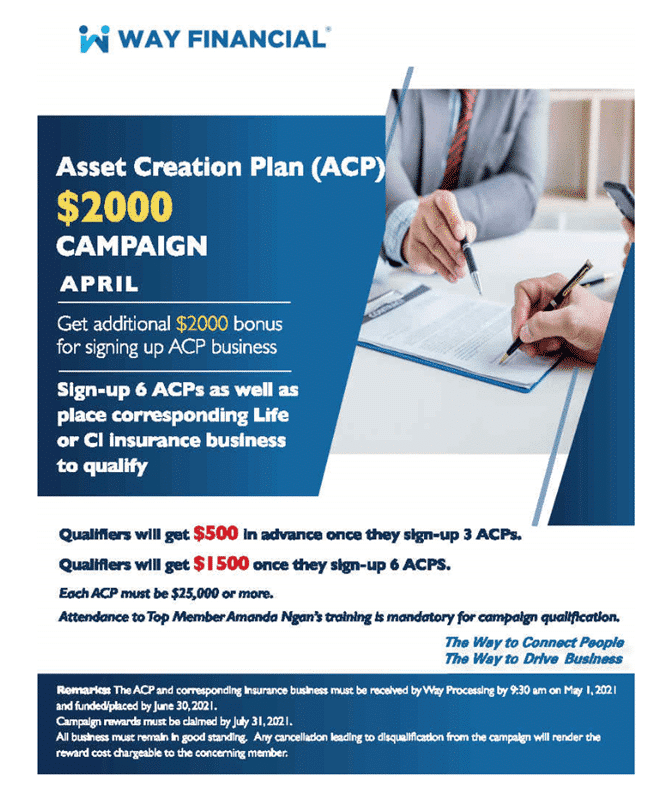

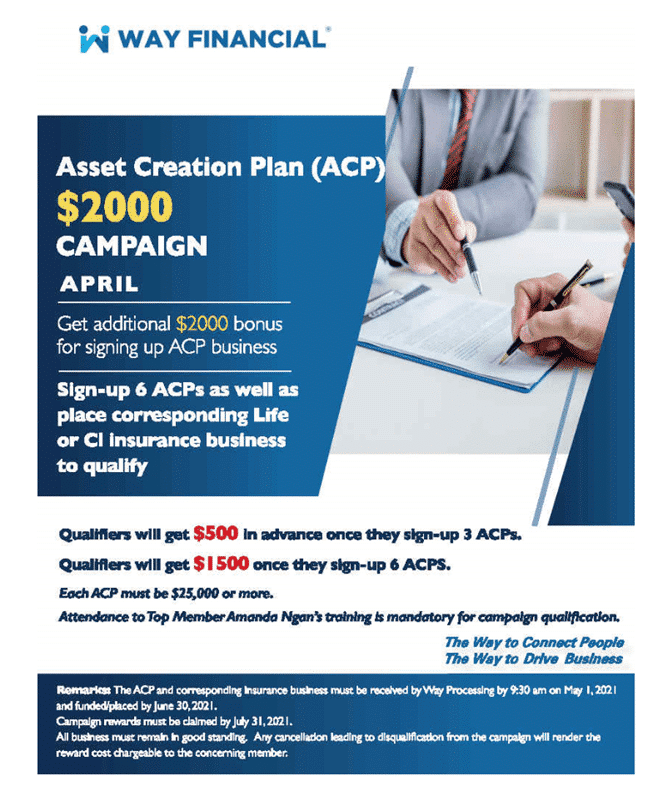

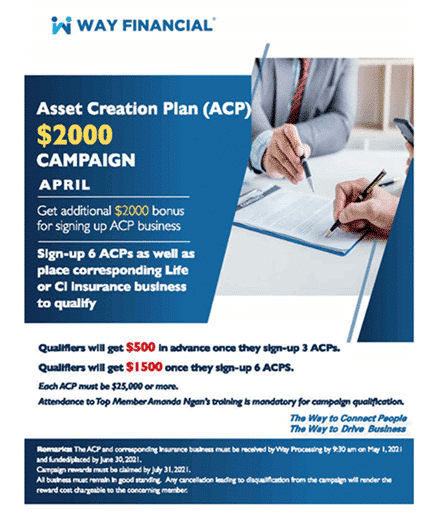

ACP $2000 Campaign – only 2 weeks to go!

Only 2 more weeks to go for submissions for the ACP $2000 campaign. Book a 1-on-1 or Joint-Field Work if you need help with your cases – ask Admin how if uncertain.

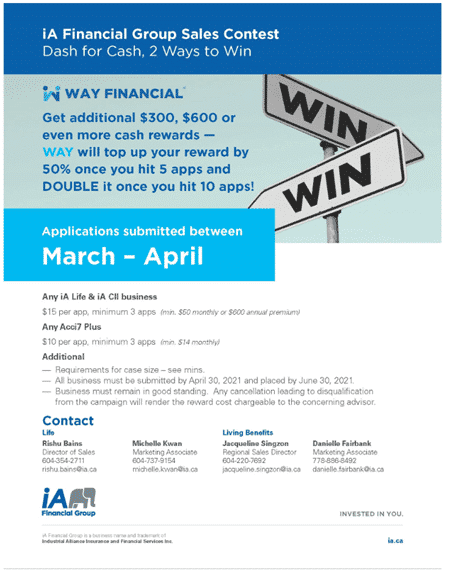

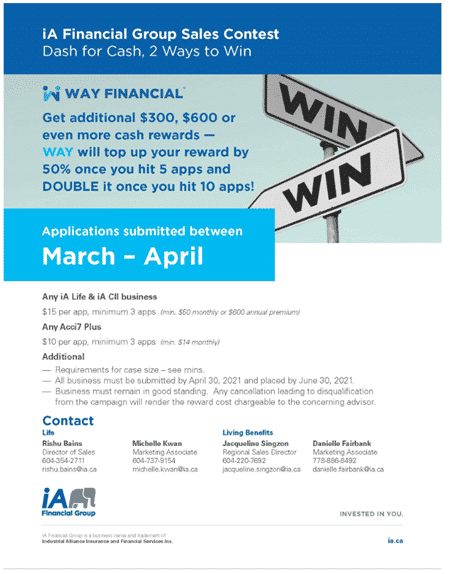

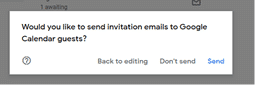

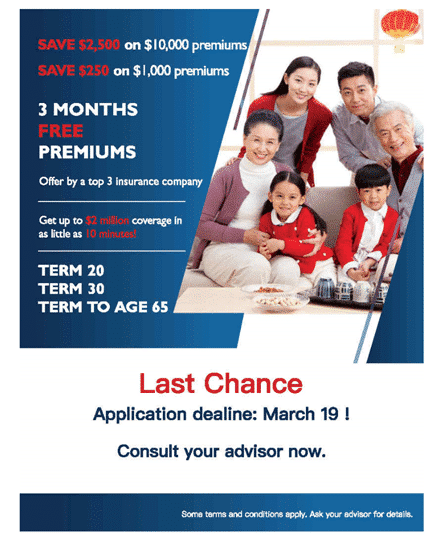

Way & iA Financial Group Sales Contest – last month to win!

Half a month left to get additional $300, $600 or even more cash rewards from your business application submissions! For the Sales Contest held by Way & iA, Way will top up your reward by 50% once you hit 5 apps and DOUBLE it once you hit 10 apps! All business must be submitted by April 30, 2021 and placed by June 30, 2021. See the details below.

For iA Life Insurance enquiries, please contact Rishu Bains at rishu.bains@ia.ca or (604)354-2711, or Michelle Kwan at Michelle.Kwan@ia.ca or (604)737-9154.

For iA Living Benefit enquiries, please contact Jacqueline Singzon at Jacqueline.Singzon@ia.ca or (604) 220-7692 or Danielle Fairbank at danielle.fairbank@ia.ca or 778-886-8492.

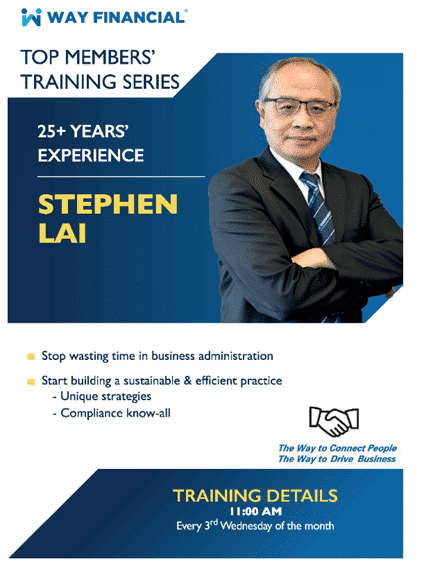

Way’s Weekly Radio Talk Show – Connecting Talents「匯賢天下」

This week’s Connecting Talents 匯賢天下 features Way’s Vice President, Compliance & Advisor Development, Stephen Lai as the interviewee and Director, Operations & Development, Carol Lau as the host. Stephen shares his vast experience as he approaches the Pearl Anniversary in the industry and the beliefs he holds dear to during times of crisis and difficulties.

Tune in to hear this human encyclopedia for the financial services industry.

AM1320 – 10:15am PST every Wednesday

AM1470 – 11:16am PST every Thursday

In helping interviewed members further leverage their promotion on air, as well as to help other members connect external brokers, a featured marketing piece is designed for your use. The attached pdf version (Way Connecting Talents March) has links to the abridged version of each member’s interview and can be accessed by clicking on the member’s name/photo. Showcase this to your networks to share how the Way Platform supports members.

Upcoming Virtual Trainings

Time & Date: 08:30am PST, Tuesday, Apr 20

Advocis Training: Advice Delivery Mentor Input

Way is providing an extra training resource to our members by offering the Advocis Practice Development series, focusing on skills and knowledge for newer advisors to further your development and ensure success in the industry.

Time & Date: 11:00am PST, Wednesday, Apr 21

$70,000 Extra Commission Campaign & Business Plan – Tim Lau

What will you do with an extra $70,000 income? Many people can’t even make $70,000 a year, and now you have this opportunity. Special guest speaker Tim Lau has been invited by Stephen to give you a crash course to success.

Hear from CEA, CLU, CFP & TOT Tim Lau the effective and systematic way to win the extra $70,000. Don’t miss this opportunity to learn and earn!

And there will be an additional $150 reward – only to those who attend and meet the requirements.

Time & Date: 11:00am PST, Friday, Apr 23

The Advantages and Hot Spots of iA’s Transition Critical Illness – iA Danielle Fairbank

This is the last month for Way & iA Financial Group Sales Contest. Please join iA Danielle’s training and learn how to win. She will talk about the Advantages and Hot Spots of iA’s Transition Critical Illness.

WebinarID: 871 9908 2731

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

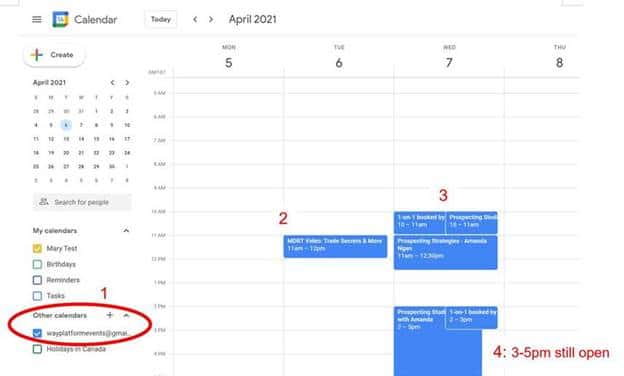

Upcoming 1-on-1 Case Studies (30 mins or 1 hour sessions available)

Time & Date: 1-3pm PST, Wednesday, Apr 21

1-on-1 Case Studies with iA Hilda Ng

Time & Date: 1-3pm PST, Friday, Apr 23

1-on-1 Case Studies with iA Danielle Fairbank

Book your session online via the Way Platform Events calendar. Contact admin@www.wayfinancial.ca or 604-279-0866 if you have any question.

1-on-1 case studies can be 30 minutes or an hour each. Bring a case to get your desired results. All you need to bring is the client’s name and enquiry area. Examples include:

- How to present the case (illustrations & presentations help)

- How to respond to clients’ objections

- How to get repeated or referral business

- How to start the conversation

Carriers’ Updates

Apexa

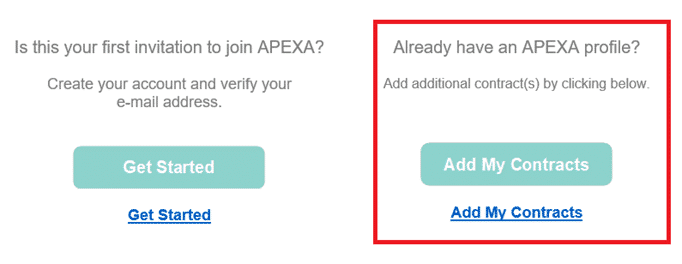

Most members have already set-up their Apexa account from our initial migration last year. Now we are into the second phase and will be on boarding the remaining carriers’ contracts for you. When you receive new invitations from Apexa, simply click the “Add Your Contracts” button and the steps are easy to follow. Remember, the sooner you finish onboarding all your contracts, the faster you will be able to enjoy its effective tools in managing your contracting and licensing requirements, so look out for the Apexa e-mails.

Ask Way’s Contracting Team (contracing@www.wayfinancial.ca) if you need any assistance.

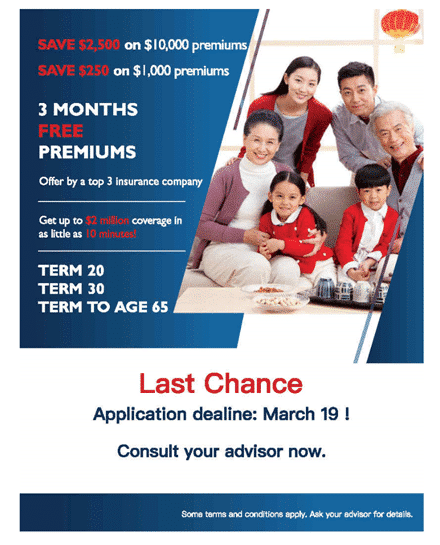

iA

Insurance

A new onboarding letter will be mailed directly to the client’s home after a new insurance contract has been issued. It will be sent automatically to the applicant 30 days after the issuing of any new individual insurance contract on the EVO platform. A copy of the letter will also be available in the Advisor Centre and My Client Space. Read here for more details.

Investment

Mark Dziedzic, Vice President of Sales, will interview iA Chief Investment Officer, Dan Bastasic, about stocks and bonds to look at in 2021 and the factors that will influence the markets for the next couple of years. Participate in this webinar and be among the first to learn about and gain access to the new iA Estate Cost Comparison tool exclusively before its official launch. Please click here for registration.

Time & Date: 1-3pm PST, Friday, Apr 23

Canada Life

Insurance

Sign up for the Insurance Live webinar which goes into depth on how a Par policy works – its mechanic functions and stability, and how it serves the purpose of your client’s financial planning. There will also be an in-depth participating account investment panel with Canada Life investment managers and an exclusive interview with keynote speaker Paul Desmarais III, Chairman and CEO of Sagard Holdings and Senior Vice-President of Power Corporation of Canada. Anyone who does Par business should attend.

Click here for registration; Mandarin session option available too.

Insurance Live!

Time & Date: 12- 2pm PST, Friday, Apr 29

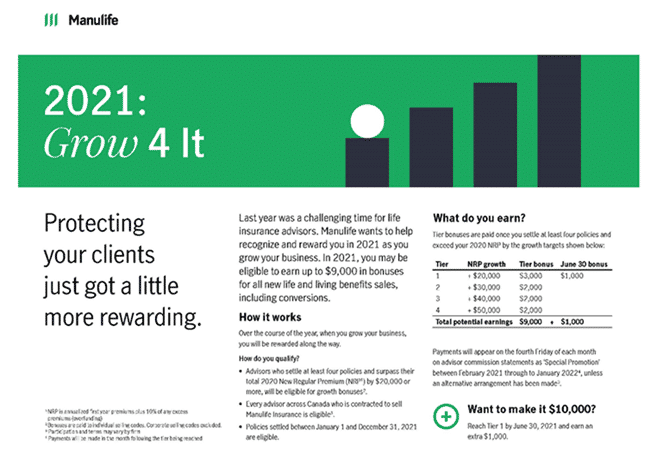

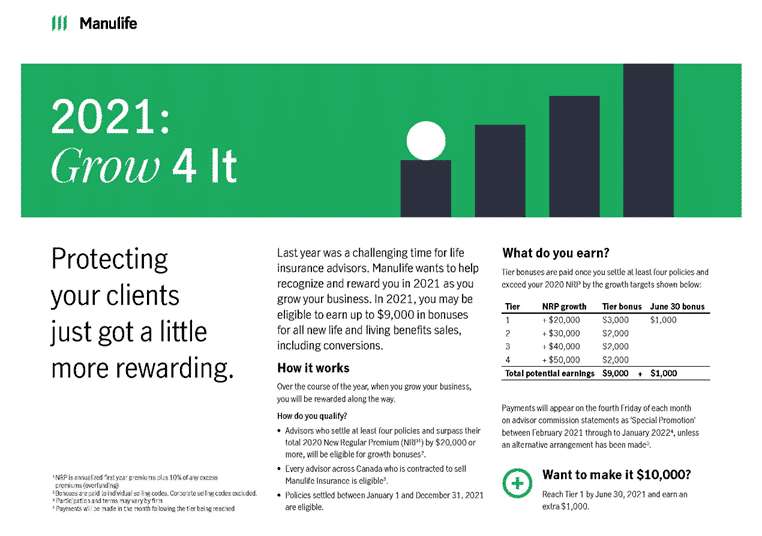

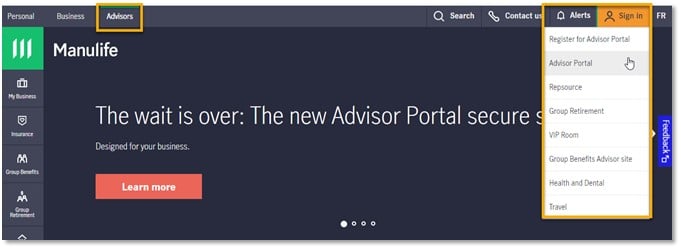

Manulife

Investment

Please see the attached presentation file to review Manulife Investment, Stefan’s training last Friday. (ML+Q1 Chartbook_2021)

Contact Stefan Goddard at stefan_goddard@manulife.ca or (778)954-9685 or Nathan Ma at nathan_ma@manulife.com or (604)664-8041 if you have any questions.

Events Schedule – May

The updated Events Schedule for May is attached for your reference.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.