The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

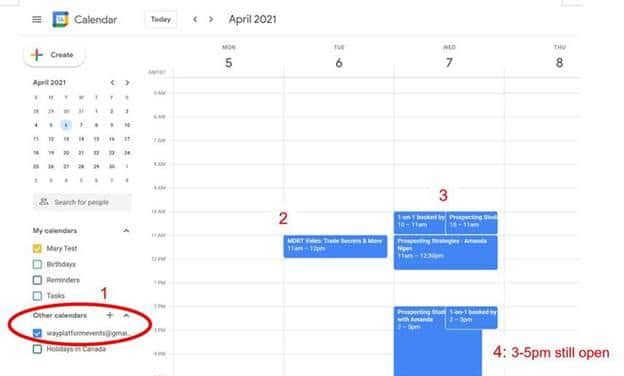

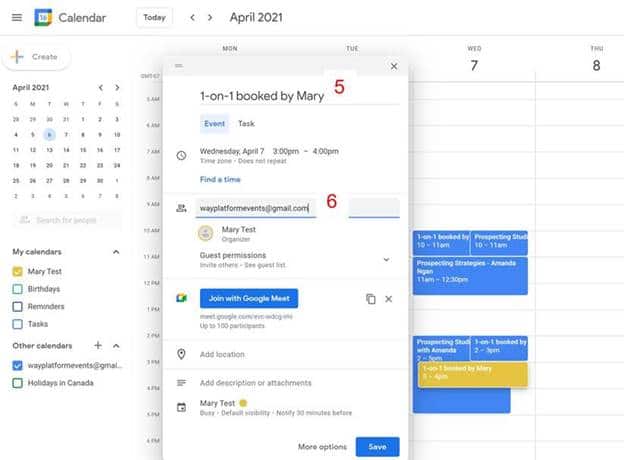

Client Events for Way Members – How to Use it in the Most Efficient and Effective Way

Members who have made use of the client events have all received positive feedback from their clients. Now, there is an easier for you to promote this service to your network so as to generate new business and referrals and build your reputation.

For each client event, there will be a registration link along with the related poster for you to send out, broadcast, or simply upload onto your own social media platform. Your clients register by themselves, indicating who invited them, and Administration Department will collect the data for you to follow-up. Before the event, you will be sent the link of the live event and you can either send it to those clients who have registered, or host it as your own client virtual gathering.

Here is the information for the first event in January:

11 Ways of Property Tax Coding: #1 Debt Repayment #8 Property Tax Locking #11 Payment by Corporate

Time & Date: 10:55 am, Saturday, January 2nd

Language: Mandarin

YouTube link: https://youtu.be/A_AXBaQNhUk

Time & Date: 1:55 pm, Saturday, January 2nd

Language: Cantonese

YouTube link:https://youtu.be/7NPQAVR0EOc

And here is the registration link: http://sv.mikecrm.com/23tIiU5

Ask admin@www.wayfinancial.ca if you have any question.

Marketing Poster for Canada Life 3-Months Free Premium Promotion (January)

As previously mentioned, Canada Life is extending their special introductory offer of free three months premium on qualifying, new term 20, term 30 and term-to-age-65 policies, in BC. Business from other provinces will enjoy four months premium free. The last eligible date for application submission is March 1st, 2021. The poster is designed for members’ unique use so you would not see any logos, including Way’s, on it – feel free to add your own company logo to it. The wording is also intended to push for immediate action from clients. There will be a poster for each of the subsequent months of the campaign. This is an unprecedented offer and there are also updates on SimpleProtect to make your application process smoother. A client can get $2 million in coverage in just 10 minutes! Watch this video if you do not know how to use SimpleProtect.

Check out and utilize the attached and below posters for January:

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203 or Aldous Lam at Aldous.Lam@canadalife.com or (604)443-8215 if you have any questions.

Investment Transfer-in $2,000 Campaign (Dec to Jan)

Only 5 more weeks to go to get an additional $2000 bonus for transferring-in registered investments from third parties (e.g. banks, mutual funds companies, etc.)!

All transfer-in businesses must be funded into a segregated fund account. Any amount qualifies!

Transfer-in 5 clients and qualifiers will already get $500 in advance. 5 different accounts (e.g. 1 RRSP, 1 Spousal RRSP, 1 RRIF, 1 TFSA, 1 RESP) transferred by the same client will also qualify for 5 counts.

Two or more of the same account transferred by the same client will qualify for one count. For example: A mother transfers in 2 RESPs for her different children will be treated as one count.

Feel free to ask Stephen for more details at stephen.lai@www.wayfinancial.ca or 604-279-0866 ext. 114 or Trainer Amanda Ngan (amandangan@aristowealth.ca) for her tips and joint-field-work support in closing these transfer-in business to qualify for the $2,000!

Sponsorship for The 20 Secrets that the Taxman Doesn’t Want You to Know

The “Taxman Book” is selling fast and copies are limited.

You can order a copy on Amazon directly or place your order via Coordinator@yourqna.com. Simply indicate the following in your e-mail:

Name:

Phone number:

Mailing address (for receipt purpose):

Number of copies:

Remarks: I, a Way member, am making payment for my order via Way to have shipping and handling fees waived. Please deliver my order to the Way office.

Cheque payments are made to QNA Technology Inc and can be dropped off at the Front Desk.

For Members only, Way will provide a sponsorship for your orders via the office. If you order 20 copies, you can bring your receipt to Accounting Department to claim a $200 sponsorship. That means you can get a copy for only $15.

This is to encourage you to do more business and build a closer relation with your clients as the book will help you close cases after your clients read it.

Seasons’ Greetings

We wish you a very happy holiday season and a prosperous Year 2021 !

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.