The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

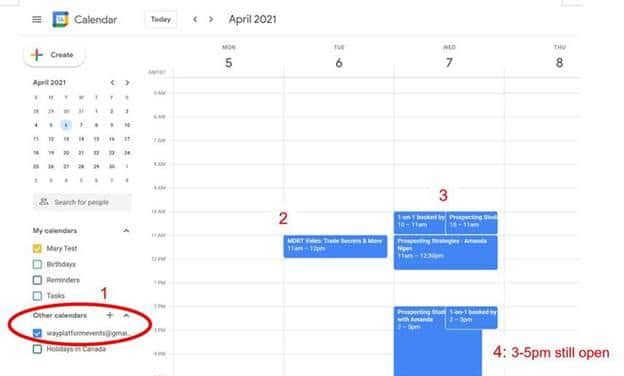

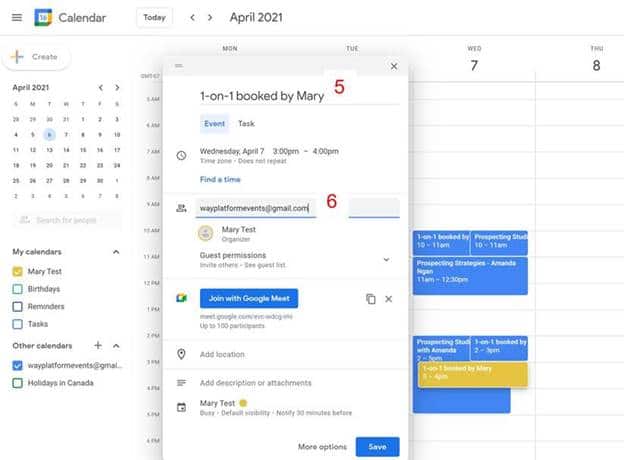

Upcoming Virtual Client Events for Way Members

Members who have made use of the client events have all received positive feedback from their clients. Now, there is an easier for you to promote this service to your network so as to generate new business and referrals and build your reputation.

For each client event, there will be a registration link along with the related poster for you to send out, broadcast, or simply upload onto your own social media platform. Your clients register by themselves, indicating who invited them, and Administration Department will collect the data for you to follow-up. Before the event, you will be sent the link of the live event and you can either send it to those clients who have registered, or host it as your own client virtual gathering.

Here is the information for the first event in December:

20 Taxman Secret: #1 Principal Home Deduction #18 Intergeneration Tax Saving

Time & Date: 10:55 am, Saturday, December 5th

Language: Mandarin

Time & Date: 1:55 pm, Saturday, December 5th

Language: Cantonese

Registration link: https://forms.gle/GrHd8QEjUZfXHyS67.

NEW Investment Transfer-in $2,000 Campaign (Dec to Jan)

Get an additional $2000 bonus for transferring-in registered investments from third parties (e.g. banks, mutual funds companies, etc.)!

Transfer-in 5 clients and qualifiers will already get $500 in advance.

Attendance for Amanda’s training at 11am, December 2nd, Wednesday, is mandatory for participation in this campaign.

Feel free to ask Stephen for more details at stephen.lai@www.wayfinancial.ca or 604-279-0866 ext. 114 or Trainer Amanda Ngan (amandangan@aristowealth.ca) for her tips and joint-field-work support in closing these transfer-in business to qualify for the $2,000!

Marketing Poster for Canada Life 3-Months Free Premium Promotion (December)

As previously mentioned, the Platform has designed a new poster for your use in promoting the extended Canada Life 3-Months Free Premium campaign. The poster is designed for members’ unique use so you would not see any logos, including Way’s, on it – feel free to add your own company logo to it. The wording is also intended to push for immediate action from clients. There will be a poster for each of the subsequent months of the campaign.

Check out and utilize the attached and below posters for December:

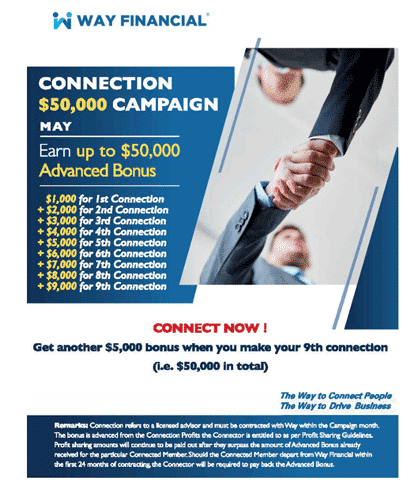

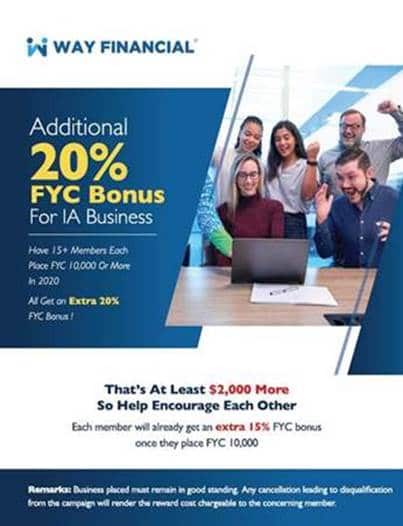

Connection Campaign – Advanced Bonus (October to November)

For those who have already qualified, reach out to Accounting Department at account@www.wayfinancial.ca to get your rewards.

You can continue getting Connection Profits for all of your connections. Simply input your connection’s name on Way’s website as below to get started: https://www.wayfinancial.ca/.

Feel free to ask Stephen for more details at stephen.lai@www.wayfinancial.ca or 604-279-0866 ext. 114.

Carriers’ Updates

Canada Life

Insurance

Canada Life Weekly Call

Time & Date: 10am PST, Wednesday, December 9th

Speaker: Mike Cunneen, Senior Vice-President, Insurance and Independent Distribution; Tim Prescott, President, Quadrus Investment Services Limited and Vice-President, Wealth Distribution; Brad Fedorchuk, Executive Vice-President, Group Customer; Steve Fiorelli, Senior Vice-President, Wealth Solutions and Andrea Frossard, Senior Vice-President, Par Insurance

With 2021 just around the corner, Canada Life will be providing a 2020 year in review.

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203 or Aldous Lam at Aldous.Lam@canadalife.com or (604)443-8215 if you have any questions.

Investment

Further to members’ request on last Friday’s training presentation, attached are the files on recommended funds for your reference. Wholesaler Richard Chen can be reached at richard.chen@canadalife.com or (604)338-6416 if you have any questions.

iA

Investment

iAIM Weekly Fall Series

Webinar #8: Asset allocation : An update on IA’s managed solutions and outlook on 2021

Time & Date: 8am to 8:30am, Wednesday, December 2nd

Guest: Sébastien Mc Mahon, MSc., Econ, PRM, CFA, Senior Portfolio Manager, Diversified Funds and Economist

For those who missed the iA investment roadshow last week, watch all the recording of the presentations here.

iA Connected – The preapproved RRSP loan offer is back!

The 0.50% RRSP loan interest rate discount is in effect from November 9th, 2020, to February 12th, 2021.

Click here for more details.

Contact Hilda Ng at hilda.ng@ia.ca or (778)873-1254 or Barbra Vuan at barbra.vuan@ia.ca or (604)737-9245 if you have any questions.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

All You Need to Know about PAC — RBC Mike Jackson

10am, Wednesday, December 2nd

Don’t miss this this wrap up training on announcing winners, plans going forward, eg. RRSP contribution and more referrals etc.

Click here to join the meeting

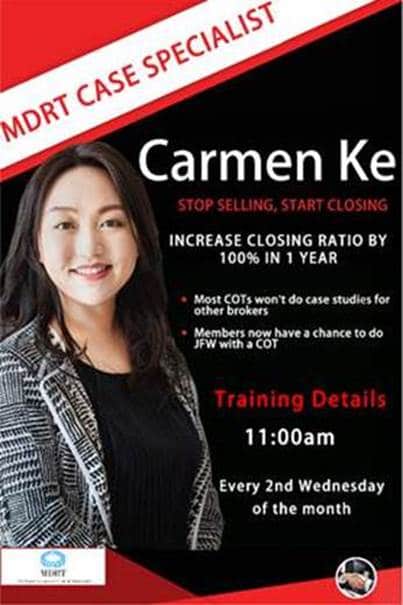

Effective Ways to Transfer-in Investment — Amanda Ngan

11am, Wednesday, December 2nd

Learn from MDRT prospecting expert, Amanda, will tell you how to generate steady client streams. Please note attendance for this training is mandatory for participation in the new Transfer-In $2000 Campaign.

Click here to join the meeting

TuGo’s New Visitors to Canada Travel Insurance – Exclusive Product and its Details — TuGo Hélène Desjardins

11am, Friday, December 4th

Learn about this new travel insurance for visitors to Canada, currently only available exclusively to a few selected firms including Way Financial. You will also hear from Hélène the new COVID-19 insurance and more.

Don’t miss out to providing the extra service to your clients and their families.

Click on link below to register:

https://attendee.gotowebinar.com/register/3978742665335396623

News from the Insurance Council of British Columbia

Online LLQP Exam Registration Now Available

Registration for the LLQP Exam can now be completed online through the Insurance Council website. Examinees can register themselves for exam modules, pay exam fees, and schedule exam dates through the online portal on https://www.insurancecouncilofbc.com/. They can also view their exam results online.

To learn more, see information about the new exam registration process.

Kamna Suri was disciplined for breaching the Insurance Council Rules and Code of Conduct for failing to conduct a written financial needs analysis for a client, providing inaccurate information and omitting information in the client’s policy application, providing one client’s sales illustration to another, and failing to properly document conversations with the client.

Employment Opportunity

An employment opportunity has arisen at a Way Member’s office. Grandtag Financial is looking for a Distribution Support as per the attached job posting. An incentive is provided to our members with successful referrals for the position. Please contact Michelle Yeung for more information at michelle.yeung@grandtag.ca.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.