Hi Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

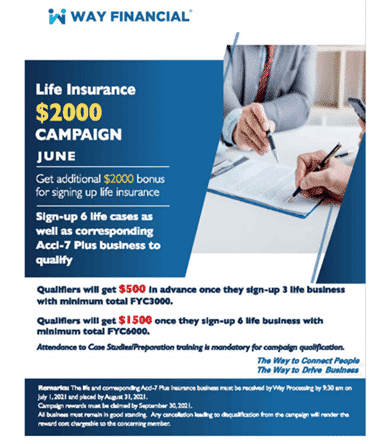

Critical Illness Insurance $2000 – July

Get additional bonus $2000 for signing up Critical Illness Insurance this month.

Training Attendance $50 Reward– July & August

Utilize Way’s unique training resources to close more cases with your clients. And now, you can even earn marketing allowance dollars simply by attending training! Attend a combination of 12 internal training, product training and 1-on-1 case studies to win the $50 Marketing Allowance Reward.

Eligible expenses include advertisement, marketing events, printing of marketing materials & client gifts. Marketing allowance will be paid out for initiatives where the member is responsible for 50% of the expense. Just bring your receipt to Accounting along with the attached Attendance Sheet to get $50!

Upcoming Virtual Trainings – all sessions qualify for the Training Attendance $50 Reward

Time & Date: 11:00am PST, Wednesday, July 7

Corporate Wealth Planning using CI Insurance / Shared Ownership: ROPC/D / Case Size $15,000 FYC – MDRT Amanda Ngan

Learn how client can use corporate CII as a vehicle to transfer wealth out of the corporation with tax efficiency strategy. Amanda will show you a real client presentation to earn ~ FYC $15,000 from the case.

Click here to join the meeting

Live Q&A Prize Contest:

We are giving out gift cards for members who join our Top member trainings on Wednesdays.

3 X $20 gift card for up to 50 attendees

6 X $20 gift card for 51 to 100 attendees

9 X $20 gift card for 100+ attendees

Time & Date: 11:00am PST, Friday, July 9

Power of Cash Value – the foundations, structure and opportunities with reduced paid up – CL Carol Ng

Join Carol’s presentation on the foundation, structure and opportunities with reduced paid-up option and know how to structure a Pick a Par product to tailor the needs for your high-net-worth client.

Click here to join the meeting

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Upcoming 1-on-1 Case Studies (30 mins or 1 hour sessions available) – all sessions qualify for the Training Attendance $50 Reward

Time & Date: 2-6pm PST, Wednesday, July 7

1-on-1 Case Studies with MDRT Amanda Ngan

Time & Date: 1-3pm PST, Wednesday, July 9

1-on-1 Case Studies with CL Carol Ng

Book your session online via the Way Platform Events calendar. Contact admin@www.wayfinancial.ca or 604-279-0866 if you have any question.

1-on-1 case studies can be 30 minutes or an hour each. Bring a case to get your desired results. All you need to bring is the client’s name and enquiry area. Examples include:

- How to present the case (illustrations & presentations help)

- How to respond to clients’ objections

- How to get repeated or referral business

- How to start the conversation

Carriers’ Updates

Assumption Life

AL just launched 5 two NEW simplified issue products, Platinum Protection and Golden Protection Elite. Get up to $250,000 immediate coverage for your hard-to-insure clients without medical. Please find the AL attachments for details. Following this update, you will be required to download version 11 the next time you connect to the LIA application.

Contact Mohammed (Mo) Saiepour at mo.saiepour@assomption.ca or at 1506870915 for any questions.

Canada Life

Create a personalized marketing brief for your network, prospects and clients using Canada Life’s Value of Advice site here. You can pick and choose different taglines and images while adding your own logo. See an abridged example below:

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203, Brenda Chan at Brenda.Chan@canadalife.com or at (604) 646-2114 or Aldous Lam at Aldous.Lam@canadalife.com or (604)443-8215 if you have any questions.

RBC

Investment

Attached is RBC’s July Newsletter. It covers RBC Global Asset Management’s investment outlook for the summer, emerging market outlook, and currency outlook.

Reminder on Office Guidelines in Managing COVID-19

While government COVID guidelines have been updated, we continue to be prudent in managing the pandemic risk and safe-guarding the health and safety of our members. Please be reminded of the safety protocols currently undertaken.

In visiting the office, everyone should continue maintaining high level of personal hygiene and be mindful of the following when you enter the premise:

- Sanitize your hands and put on a face mask; and

- Ask your visitors to do the same above.

Persons who are not feeling well, have travelled outside Canada within the last 14 days, have been in contact with a person confirmed to have COVID-19 or have the following symptoms are asked not to come to the office:

- Fever

- Chills

- Cough

- Shortness of breath

- Loss of sense of smell or taste

- Diarrhea

- Nausea and vomiting

Our Operations staff remain in full-day service. Send us an e-mail for any enquiry or request you may have:

-

- process@www.wayfinancial.ca (for business related matters)

- account@www.wayfinancial.ca (for compensation related matters)

- contracting@www.wayfinancial.ca (for contracting matters)

- admin@www.wayfinancial.ca (for licensing, E&O and other matters)

Let’s focus our attention to growing business while staying caution in keeping COVID-19 at bay.

Holiday Notice

Please note that our office will be closed on:

Monday, August 2, 2021 (BC Day)

Normal operations will resume on:

Tuesday, August 3, 2021

Best regards,

Administration Department

“The WAY to connect members. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.