Hi members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

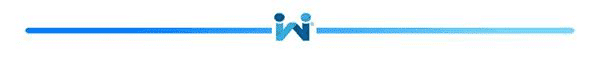

Upcoming High Net Worth In-Person Client Lecture

As we move out of COVID restrictions, our first in-person client event is a highly anticipated one for clients with assets of $10+ million. Many clients believe in the benefits and importance of estate planning, but they do not know where to find resourceful advice. Even if they had money, they may not have the connections to get proper and effective service.

|

|

Date: Saturday, April 2, 2022

Language: English

Time: 2:00 pm PST

Speakers:

Mr. Nick Smith

Founding principal of Legacy Tax + Trust Lawyers

30+ years, focused on federal, provincial and international tax and estate planning.

Mr. Tim Lau

CEA CFP CLU 10+ TOT

The only tax and financial planner who holds all 4 of the above titles in Canada.

Regular consultation fee schedules of Mr. Nick Smith and Mr. Tim Lau are $900/hour.

Admission Requirement: Client to have $10 million plus in assets

Tickets: $300/admission (Member pays $150/admission, Way will sponsor $150/admission)

Capacity: Only 8 clients can be accommodated, on a first come first served basis

Time & Date: 2 to 3:30pm, April 2, 2022

Venue: Boardroom, Legacy Tax + Trust Lawyers, 777 Dunsmuir St #1300, Vancouver

Attached is more information on Legacy Tax + Trust Lawyers as well as on Mr. Nick Smith himself. To register, please reply to this email with the following information to admin@www.wayfinancial.ca by today, March 21, 2022.

Member’s name:

Number of tickets:

Members successful in getting a ticket will be given further details on payment and event arrangements.

Leverage Way’s unique modern values delivered to you to help you stand out to your clients!

Ask admin@www.wayfinancial.ca if you have any question.

Compliance Update

Starting from April 16, all paper forms of Compliance documents, Applications, etc will not be returned to advisors’ mailboxes after processing. They will continue to be uploaded to Virtgate and paper documents will be shredded after processing by the processing team.

Ask process@www.wayfinancial.ca if you have any question.

New Office Capacity Full – Get Your Spot on the Waitlist Now

Send your request to account@www.wayfinancial.ca to get your name on the waitlist. Also feel free to ask Accounting for rates and other details.

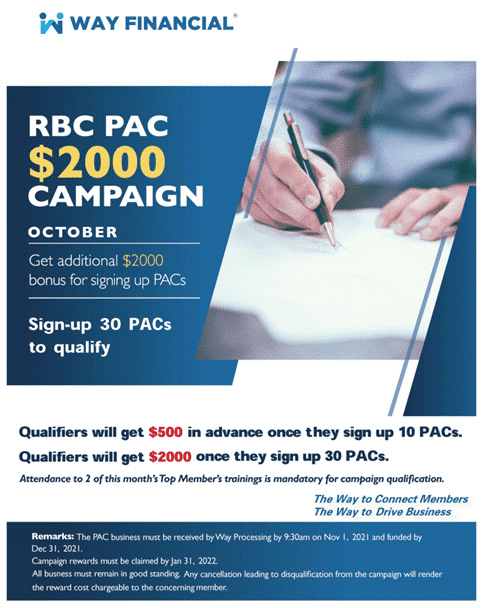

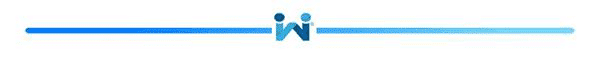

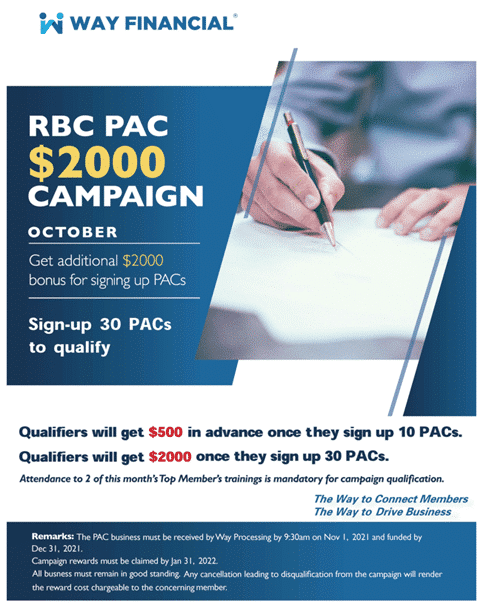

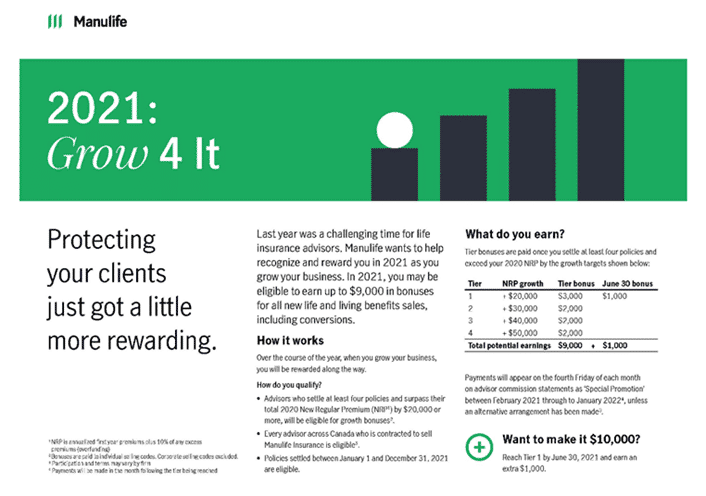

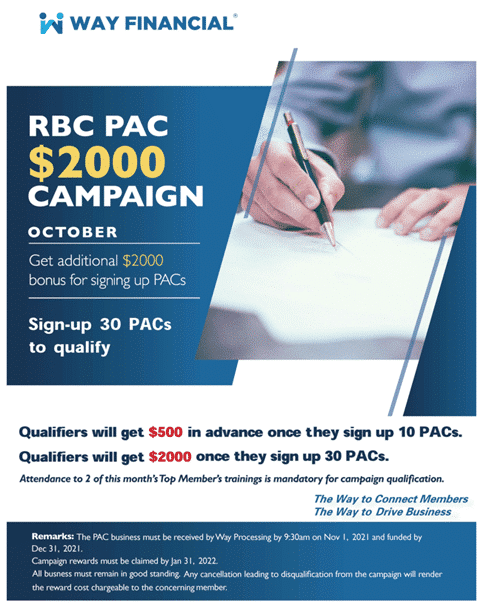

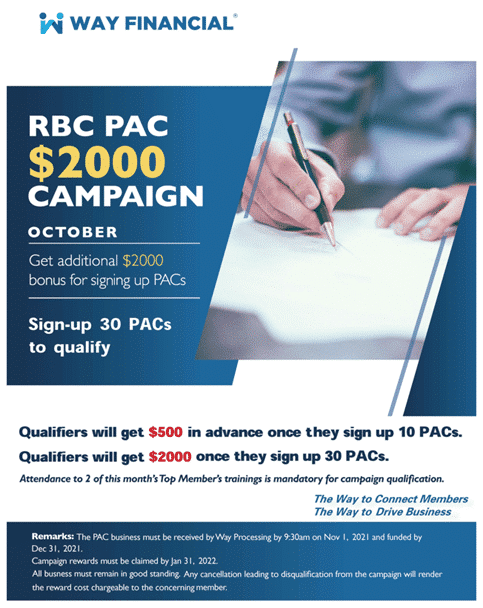

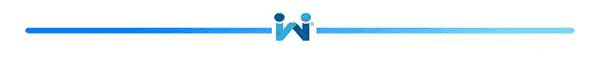

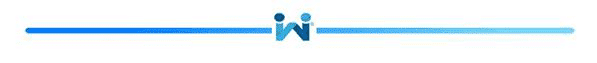

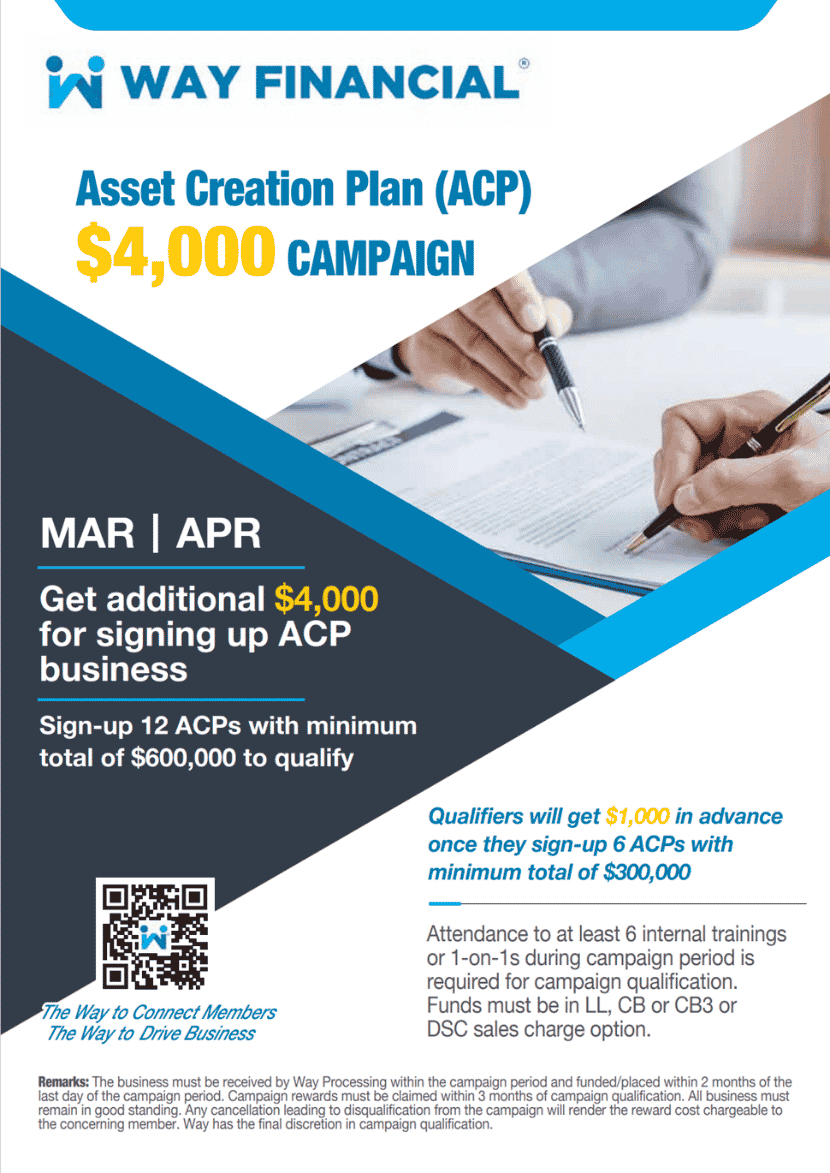

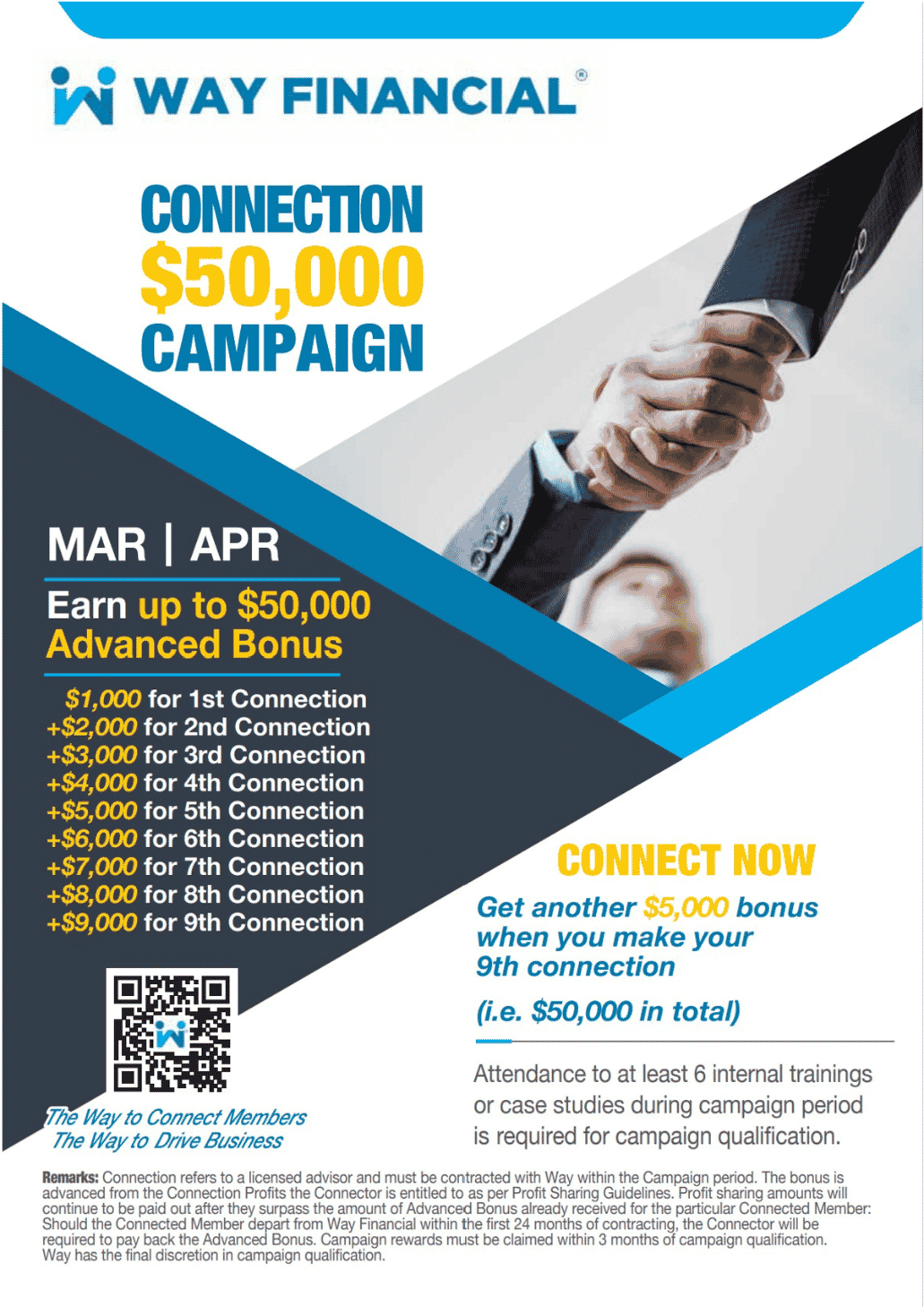

March & April Campaigns – $54,000 up for grabs!

The Asset Creation Plan (ACP) and Connection campaigns with the maximum reward of $54,000 have started for the months of March and April! Attend at least 6 internal trainings or case studies during campaign period as part of the prerequisites to winning.

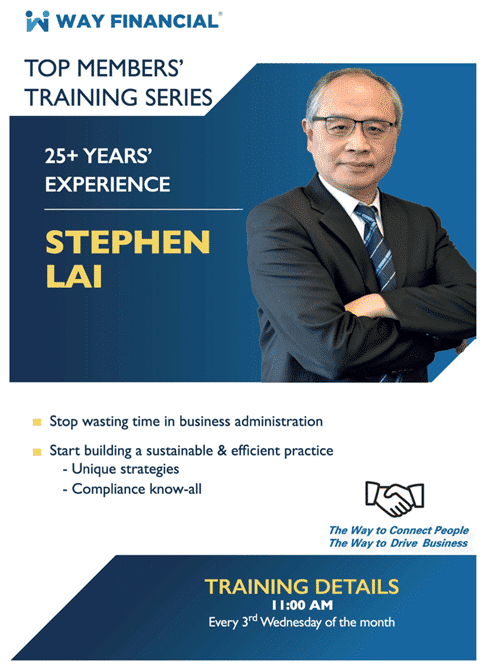

Feel free to ask Stephen Lai if you have any question on the business submissions at stephen.lai@www.wayfinancial.ca or 604-279-0866 ext. 114. Members’ Relations Manager, Samuel Xu, is also available to help you with your connections. Reach out to him at relations@www.wayfinancial.ca or 604-279-0866 ext. 120.

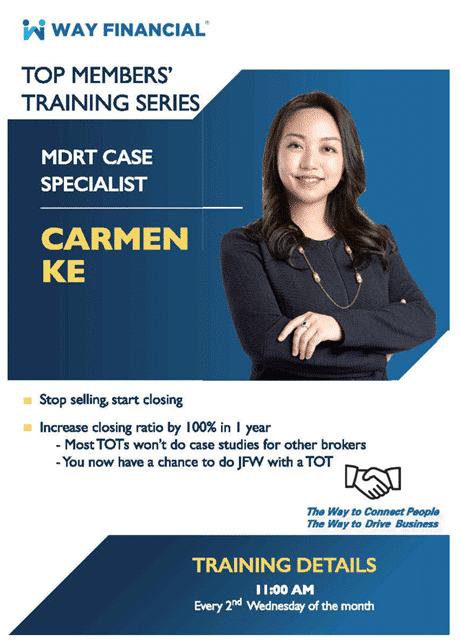

Upcoming Trainings (Internal training sessions qualify for campaign)

Please remember to sign in using your full name to have your Way Membership confirmed and your training session uninterrupted. Unconfirmed names may be removed from the session.

Also note that the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

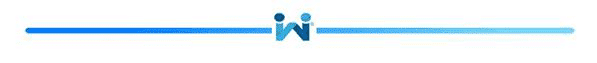

Time & Date: 11:00am PST, Wednesday, March 23

Risk Management: Shared Ownership Dividends (SOD) / FYC33,000 – MDRT Holly Miao

MDRT Holly Miao will share a case on SOD strategy that helps her client to effectively use corporate earnings in corporate wealth planning. Please click the below link for the training.

Click here to join the meeting

Time & Date: 11:00am PST, Friday, March 25

How to prospect wealth opportunities with business owners – CL Richard Chen & CL John Yanchus

Click here to join the meeting

Upcoming Case Studies (30 mins or 1 hour sessions available) – all sessions count towards campaign qualification

Bring a case to get your desired results. All you need to bring is the client’s name and enquiry area. Examples include:

- How to present the case (illustrations & presentations help)

- How to respond to clients’ objections

- How to get repeated or referral business

- How to start the conversation

Check out the case studies schedule in February below and book your session online via the Way Platform Events Calendar or contact admin@www.wayfinancial.ca or 604-279-0866 for assistance.

|

Time & Date: 1:00 – 3:00pm PST, Friday, March 23 Case studies with MDRT Holly Miao (12:30-1:30pm) Case studies with RBC Mike Jackson (1:00-3:00pm)

Time & Date: 1:00 – 3:00pm PST, Friday, March 25 Case studies with CL Insurance Richard Chen (1:00-3:00pm)

Schedule of Case Studies in March 2022 |

| Monday | Tuesday | Wednesday | Thursday | Friday |

| 28 | 01 | 02 | 03 | 04 |

| Case studies with COT Amanda Ngan (2:00-6:00pm) | Case studies with EQ Monica Zhang (1:00-3:00pm) | |||

| 07 | 08 | 09 | 10 | 11 |

| Case studies with SL Renee Ho (1:00-3:00pm) | Case studies with CL Insurance Carol Ng (1:00-3:00pm) | |||

| 14 | 15 | 16 | 17 | 18 |

| Case studies with ML Chris Chang (1:00-3:00pm) | ||||

| 21 | 22 | 23

Case studies with MDRT Holly Miao (12:30-1:30pm) |

24 | 25 |

| Case studies with RBC Mike Jackson (1:00-3:00pm) | Case studies with CL Insurance Richard Chen (1:00-3:00pm) | |||

| 28 | 29 | 30 | 31 | 01 |

Carriers’ Updates

Equitable Life

Insurance

Prestige Advisor Program 2022 – get your own dedicated Underwriter and Case Manager

To qualify, an advisor must settle either:

- A minimum of 15 policies and $75,000> NAFYC; OR

- A minimum of 5 policies and $150,000> NAFYC;

In addition to this production criteria, an advisor must receive approval from Equitable Life’s Compliance/Market Conduct Department.

Webinar Topic: Levelize the Tax on your Fixed Income Investments with Participating Whole Life – EQ Tony Zhang (0.5 Credit)

Time & Date: 9 am PST, Tuesday, Mar 22

Register in advance for this webinar: https://equitable-ca.zoom.us/webinar/register/WN_3HBSdHY3REOJnOaL0bVkyg

Contact Monica Zhang at 604-366-4314 or mzhang@equitable.ca if you have any question.

iA

investment

In line with investment business submissions, iA Diploma can now be submitted using FundServ code, making it more efficient and easy for advisors to track the account on VirtGate as well as have commissions paid out faster.

Contact Hilda Ng at (778)873-1254 or hilda.ng@ia.ca , or Barbra Vuan at (604)737-9245 or barbra.vuan@ia.ca if you have any question.

Best Regards,

Administration Department

“The WAY to connect members. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

Feel free to ask Stephen Lai if you have any question on the business submissions at

Feel free to ask Stephen Lai if you have any question on the business submissions at