Hi members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Manulife Vitality $500 Gas Card Campaign – 4 Term Cases to Win!

Some members are already close to winning the $500 gas card because all you need is to submit 4 Term cases with Vitality by the end of June and settle them within 2 months. Leverage the Better Quotation strategy and generate repeated insurance business systematically. Those in the Better Quotation focus group will be generating 100+ cases, and others should also be able to get 20+ cases each year. Check out the Vitality program below, which offers clients a brand new Apple Watch, free annual body check, premiums reduction and more.

Vitality proof points – infographic

Vitality active rewards with apple watch-client flyer

Your first year with Manulife vitality

Feel free to ask Chris Chang at 604-355-4879 or Chris_Chang@Manulife.ca or Cherry Xiang at 604-678-1558 or Cherry_Xiang@manulife.ca for questions on Vitality.

For questions on this unique Way campaign, ask Stephen at 604-279-0866 ext. 114 or stephen.lai@www.wayfinancial.ca.

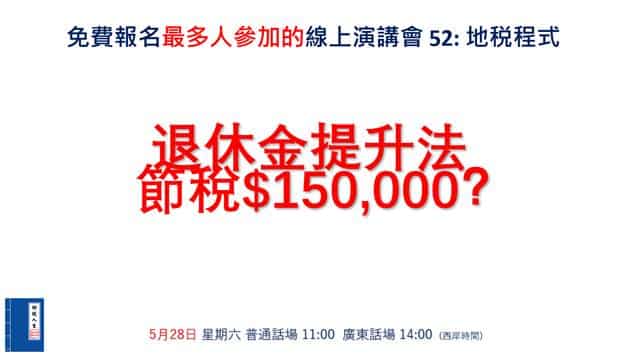

Client Events

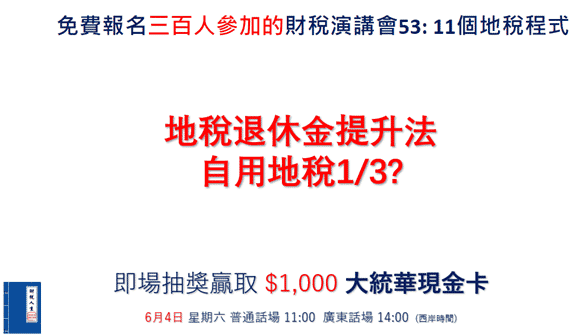

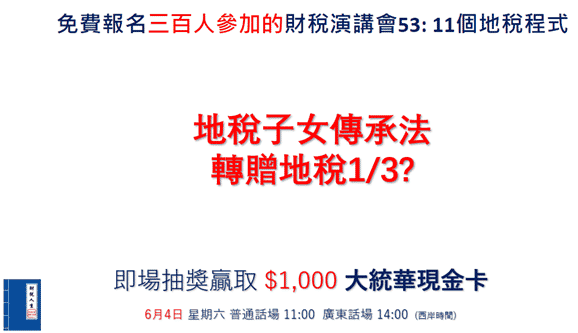

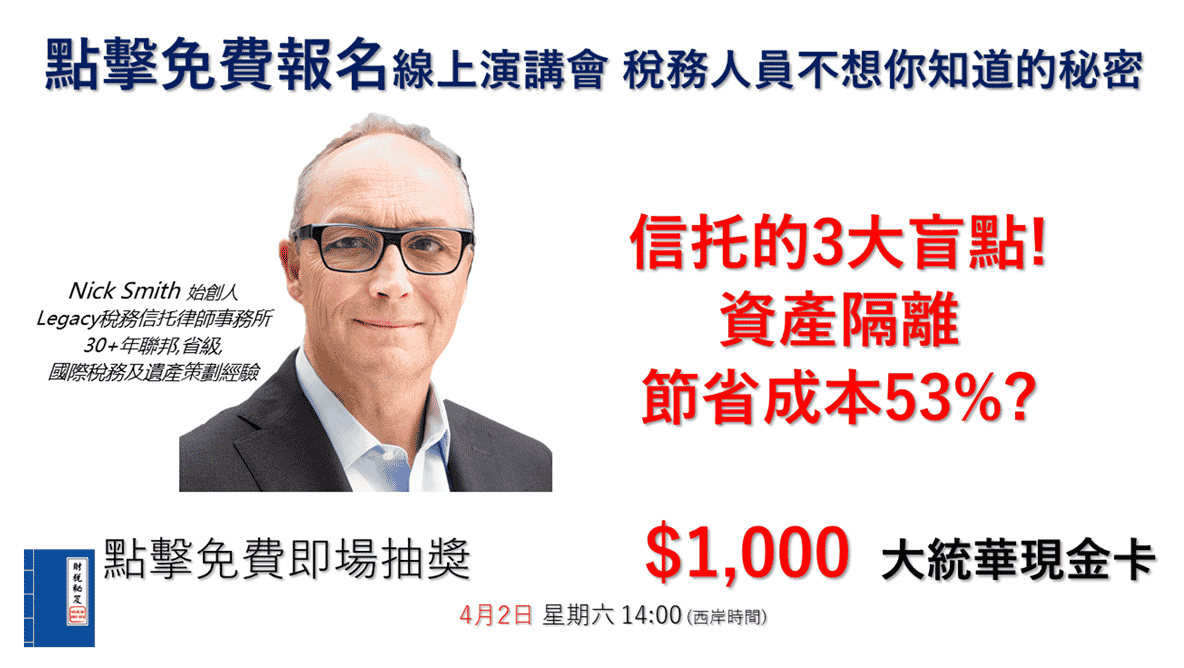

11 Ways of Real Estate & Property Tax Coding : Lock in the Property Tax 3 + Legacy Building

Time & Date : 11:00 am – 12:30 pm PST , Saturday, June 4, 2022

Language: Mandarin

YouTube link: https://youtu.be/a2ZEkkuH-OQ

Time & Date :2:00 pm – 3:30 pm PST , Saturday, June 4, 2022

Language: Cantonese

YouTube link: https://youtu.be/Y82nzNCTFmw

The posters below for broadcasting to your clients.

And here is the registration link: http://financialplatform.sv.mikecrm.com/kT4ByUx

Ask admin@www.wayfinancial.ca if you have any question.

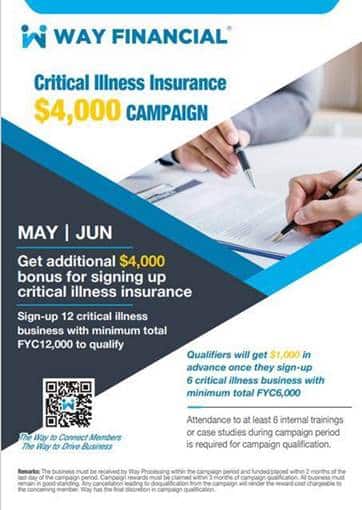

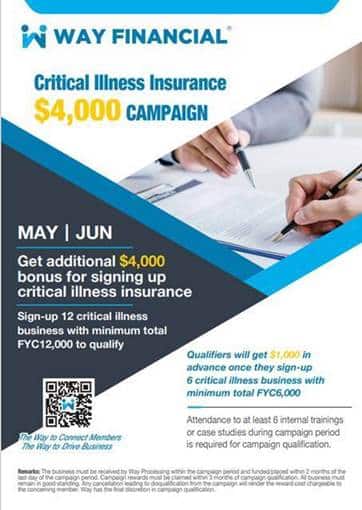

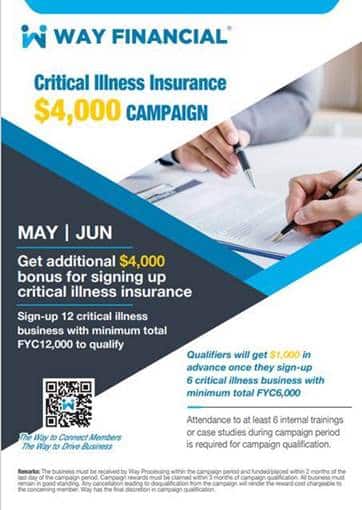

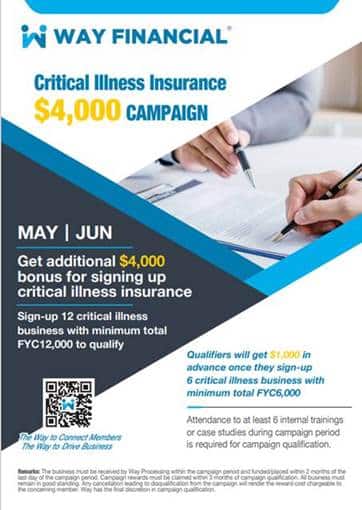

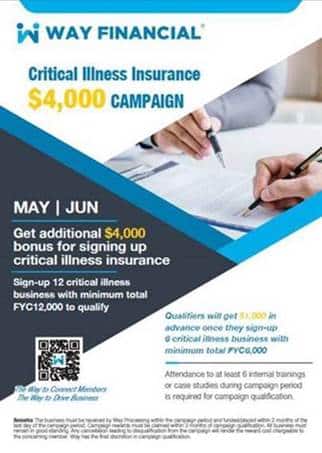

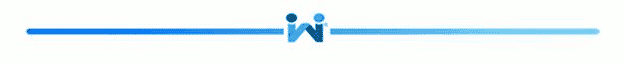

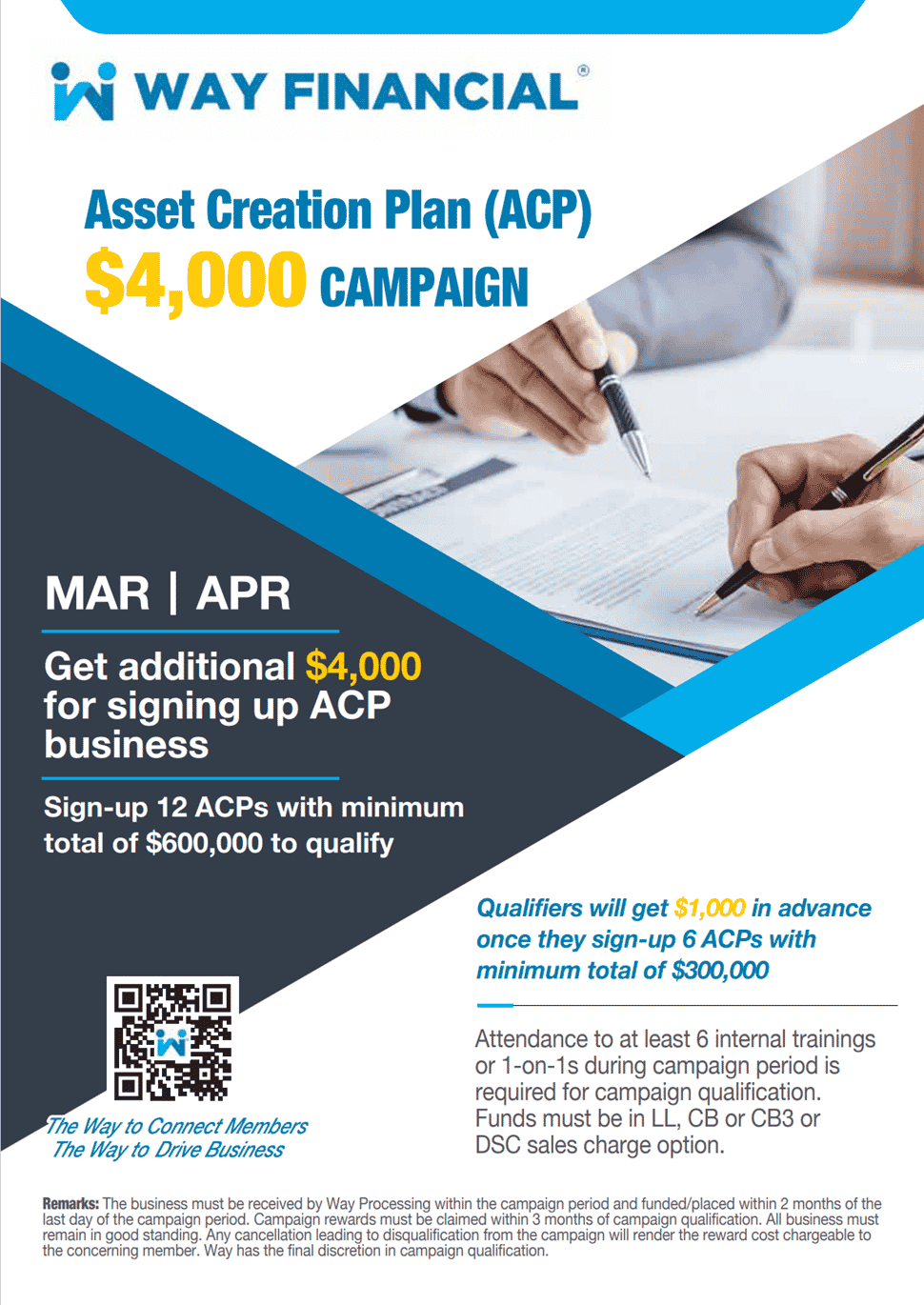

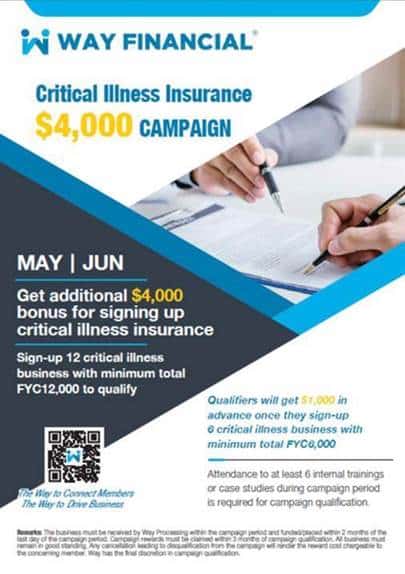

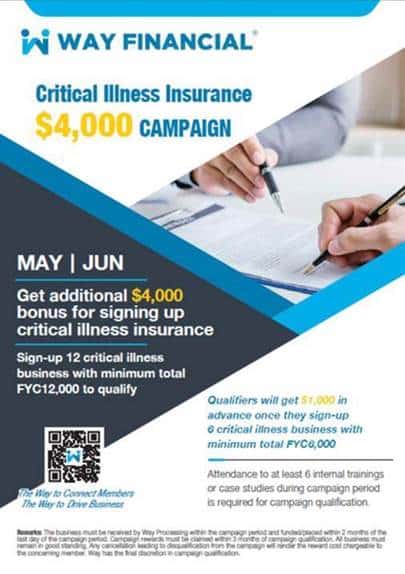

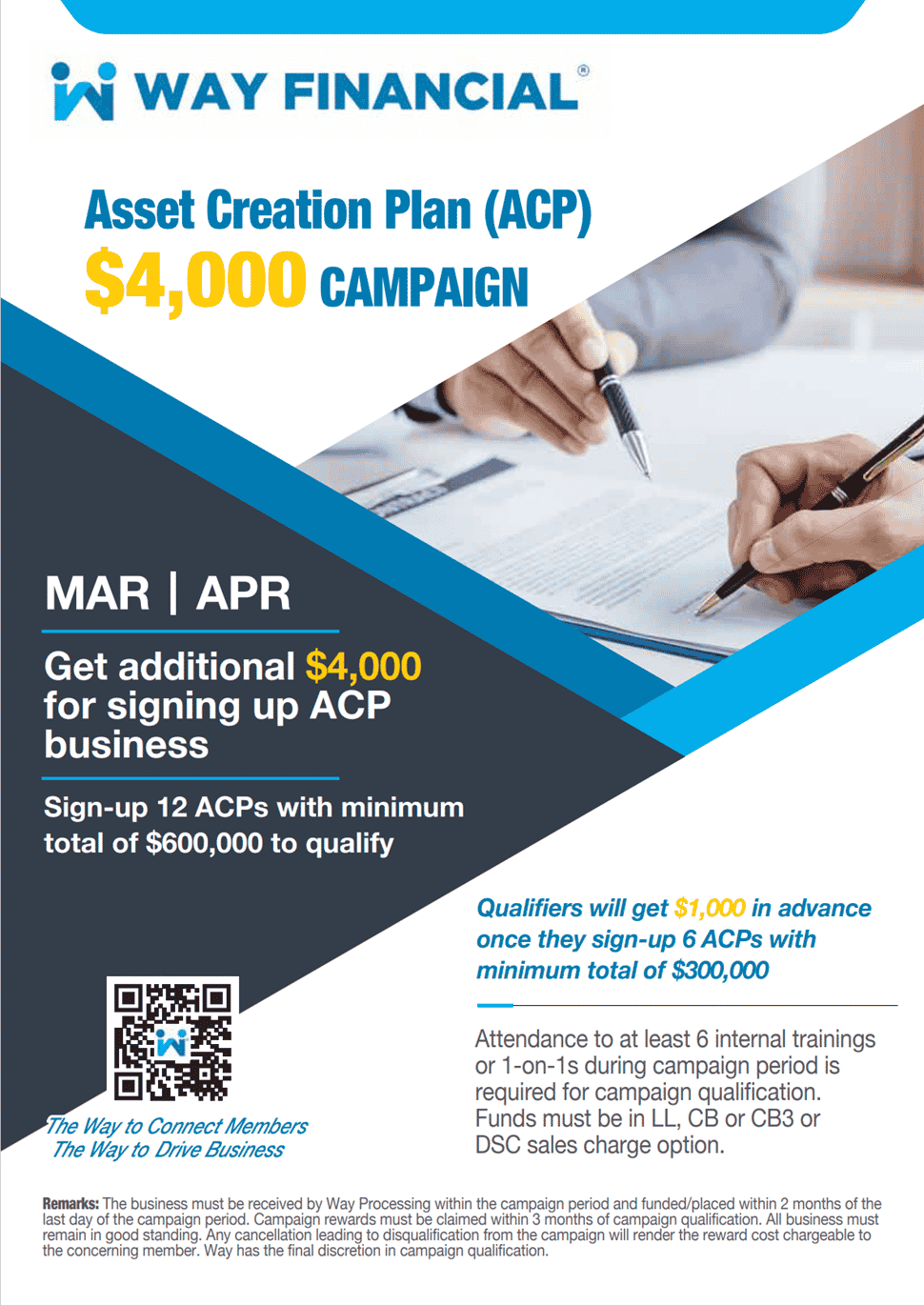

May & June Campaigns – Additional $8,000 bonus on life + CII

You can double dip and win both the $500 Gas Card and the additional $4,000 bonus at the same time!

Upcoming Training

Please remember to sign in using your full name to have your Way Membership confirmed and your training session uninterrupted. Unconfirmed names may be removed from the session.

Times & Date: 11:00am PST, Friday, June 3

Preferred Insurance Solutions For Corporate Clients – EQ Monica Zhang

Equitable Life trainings now require advanced registration to attend and log CE credits. The carrier will send the CE certificate to you directly after the session.

Click here to register for this Friday’s training.

Upcoming Case Studies (30 – 60 mins sessions) – Answer practical questions and generate real business

Bring any questions or cases to get your desired results. Book your session online via the Way Platform Events Calendar or contact admin@www.wayfinancial.ca or 604-279-0866 for assistance.

|

Time & Date: 1:00-3:00pm PST, Friday, June 3 Case studies with EQ Monica Zhang Schedule of Case Studies in June 2022

|

Carriers’ Updates

Canada Life

Insurance

New illustration (version 4.8) now available for update

| Get details on how to update and what’s in the new version or see the attached PDF (CL Illustration software information page). Also attached is the updated underwriting guidelines which include details on enhanced accelerated underwriting features and preferred rates (CL 99-10253 Age and Amount Table 2205). |

Contact Carol Ng at 604-377-7203 or carol.ng@canadalife.com or Wenjia Li at 604-612-5105 or wenjia.li@canadalife.com if you have any question.

Investment

Market Update / Wealth Product Refresher

Last Friday, wholesaler Richard Chen illustrated the market updates and introduced advisors how to leverage Canada Life products to build better business. Please refer to the attachment (CL Why Canada Life – MGA 2022) for more details.

Contact Richard Chen at (604) 338-6416 or Richard.Chen@canadalife.com or Jessica Leung at 604-646-2118 or Jessica.Leung@canadalife.com if you have any questions.

Equitable Life

Weekly Business Builder Series

Topic: Building Your Large Insurance Case Files for Underwriting – Presented by Large Case Underwriter, Denise Lasiuk

Time & Date: 9am PST, May 31, 2022

Register here: https://equitable-ca.zoom.us/webinar/register/WN_q_ST837oSXKL5VYeSk1Bog

Contact Monica Zhang at 604-366-4314 or mzhang@equitable.ca if you have any question.

iA

Insurance

Check out the easing of medical requirements for iA’s critical illness insurance products here such as saying goodbye to fluids for clients aged 40 or under, up to $250,000 of coverage.

Contact Rishu Bains at 604-354-2711 or Rishu.Bains@ia.ca or Vanora McLay at 604-737-9170 or vanora.mclay@ia.ca if you have any question.

Industry Updates

Insurance Council of British Columbia

License renewal

Annual licence renewal deadline is June 1, 2022. More info about non-renewal and changes to licence status can be found here.

Disciplinary decisions

William Charles Brash was disciplined in April 2022 for breaching the Insurance Council Rules by failing to complete continuing education requirements for four consecutive licensing years.

Holiday Notice

Please note that our office will be closed on:

Friday, July 1, 2022 (Canada Day)

Regular operations will resume on:

Monday, July 4, 2022

Best regards,

Administration Department

“The WAY to connect members. The WAY to drive business.”

Way Financial

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

Feel free to ask Stephen Lai if you have any question on the business submissions at

Feel free to ask Stephen Lai if you have any question on the business submissions at

Meeting ID:870 1281 3204

Meeting ID:870 1281 3204