Entrepreneur & Connector – June 2022

Grandtag Financial TH

J.Ke Financial Canada Ltd.

Canadvantage Financial Inc.

Persimmon Financial

Home » Archives for kingtechadmin » Page 4

Entrepreneur & Connector – June 2022

Grandtag Financial TH

J.Ke Financial Canada Ltd.

Canadvantage Financial Inc.

Persimmon Financial

Entrepreneur & Connector – May 2022

Grandtag Financial TH

Wealthpedia Financial Corp.

Grandtag Metrotown

Wealth First Financial Planning

Entrepreneur & Connector – April 2022

Grandtag Financial TH

Grandtag Metrotown

J. Ke Financial Canada Ltd.

Pivanta Financial Inc.

Entrepreneur & Connector – February 2022

Grandtag Financial TH

J. Ke Financial Canada Ltd.

Grandtag Metrotown

Canadvantage Financial Inc

Entrepreneur & Connector – February 2022

Grandtag Financial TH

Wealthpedia Financial Corp.

Aristo Wealth Management Ltd.

Jian Miao Financial

Entrepreneur & Connector – January 2022

Grandtag Financial TH

Sam Jie Zhang

J. Ke Financial Canada Ltd.

Grandtag Metrotown

Hi members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Manulife Vitality $500 Gas Card Campaign – 4 Term Cases to Win!

Congratulations to the members who have already qualified for the extra $500 campaign reward. Use the attached Incentive Application to make your claim.

For the others, there are still three days left to get your 4 term cases in to win.

And don’t let it stop. Continue the Better Quotation strategy to get set-up your stream of residual income as it helps you get new business systematically.

Feel free to review the Vitality product features by rewatching the training video on Way’s Intranet. Login from https://www.wayfinancial.ca/ and look for it under Resources ->Training Videos -> Resource Videos.

More useful information is available via these links below:

Vitality proof points – infographic

Vitality active rewards with apple watch-client flyer

Your first year with Manulife vitality

Feel free to ask Chris Chang at 604-355-4879 or Chris_Chang@Manulife.ca or Cherry Xiang at 604-678-1558 or Cherry_Xiang@manulife.ca for questions on Vitality.

Client Events

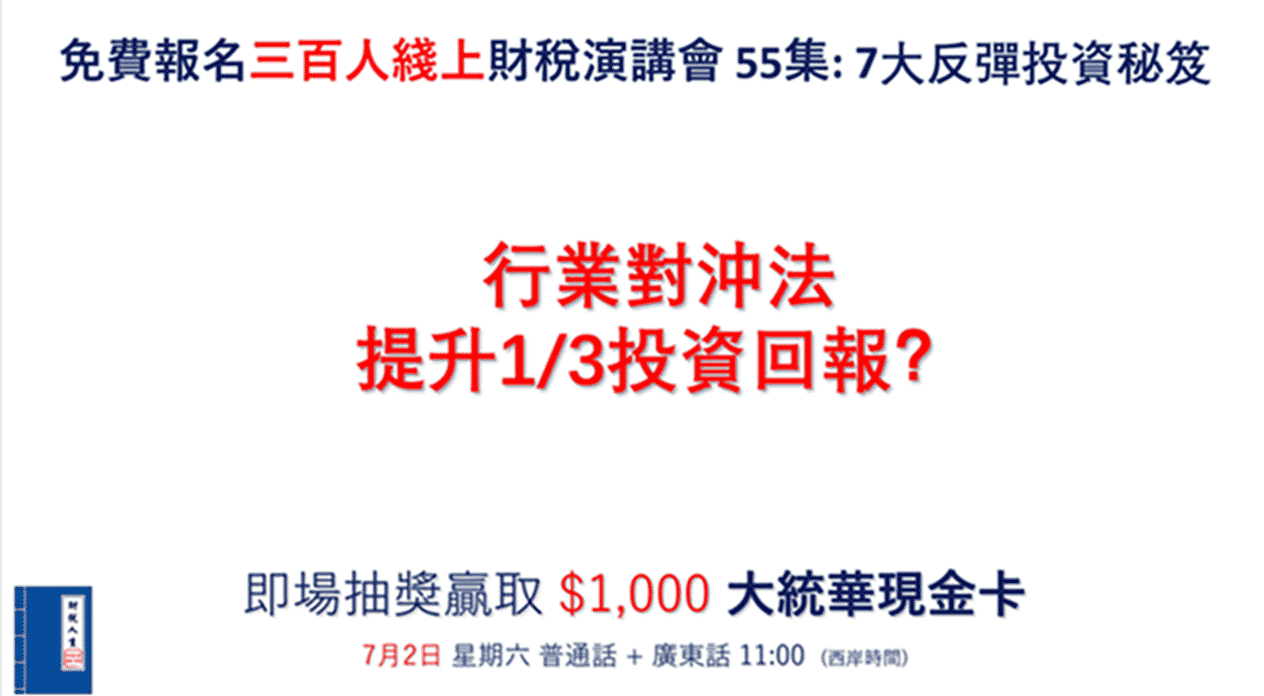

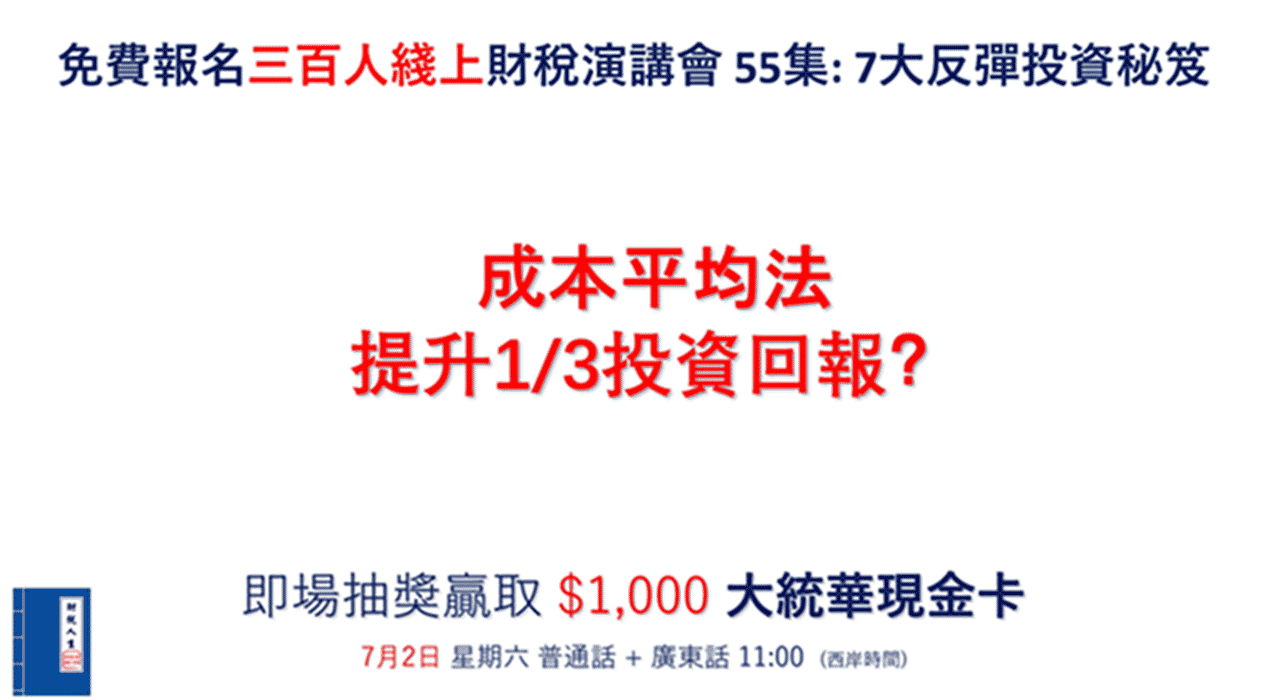

7 Rebound Investment Tactics: Dollar Cost Averaging and Sectors Hedging

Time & Date : 11:00 am – 12:30 pm PST , Saturday, July 2, 2022

Language: Mandarin

YouTube link: https://www.youtube.com/watch?v=H_KQG2RKgjY

Time & Date : 2:00 pm – 3:30 pm PST , Saturday, July 2, 2022

Language: Cantonese

YouTube link: https://www.youtube.com/watch?v=H_KQG2RKgjY

The posters below are for broadcasting to your clients.

And here is the registration link: http://financialplatform.sv.mikecrm.com/N687us7

Ask admin@www.wayfinancial.ca if you have any question.

In-Person Boot Camp – 6-Class Curriculum Updated

In response to members’ requests to have deeper and more detailed training on leveraging Way’s Client Events and Connection Program, an individual training for each of these two topics has been created separate from the Boot Camp whose curriculum is now updated. The next Camp starts next Monday on July 4 with only 8 spots available. Reply to this e-mail indicating “Yes to Boot Camp” to save you a spot for the whole series or if you wish to register for specific classes, indicate “Yes to Class X”. First come first served.

The sessions are hosted in English, Mandarin and Cantonese.

| Date | Time | Topic | Level |

| July 4 | 10am – 1pm | Class 1: Basic insurance product suitability for various types of clients: Term, Whole Life, UL, CII, DI | Green members |

| July 5 | 10am – 1pm | Class 2: Various financial carriers’ strengths by software/illustrations comparison: Practice & present | Green members |

| July 7 | 10am – 1pm | Class 3: Investment: Untapped market especially amongst Asian clientele & all you have to know about seg funds | Green members |

| July 11 | 10am – 1pm | Class 4: Business cycle – marketing, prospecting, advising, servicing, referring, repeating | Green & Experienced members |

| July 12 | 10am – 1pm | Class 5: Way Resources – leverage unique tools including technology & compliance templates to help your ship sail smoothly and safely in the ocean | Green & Experienced members |

| July 18 | 10am – 1pm | Class 6: Unique financial concepts and calculation tools

(with Special Guest Trainer) |

Experienced members |

July & August Campaigns – Additional 8,000 bonus!

Get ready for the next big-ticket business campaigns to promote PAC and Transfer-In investment in July & August. Starting in July, training attendance is no longer required as part of the prerequisites to winning.

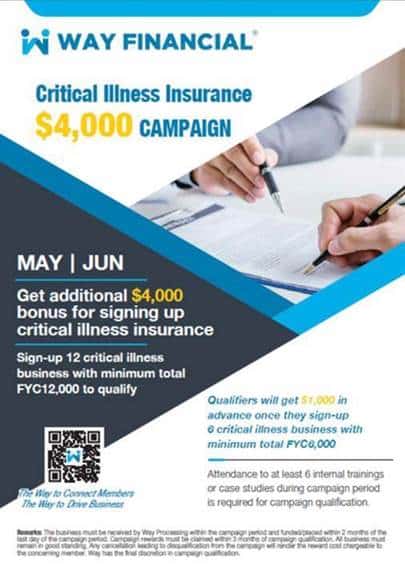

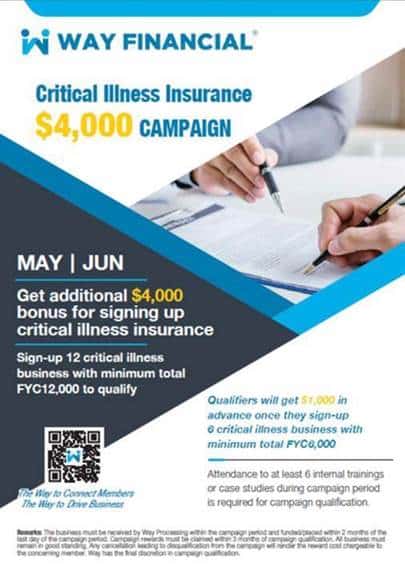

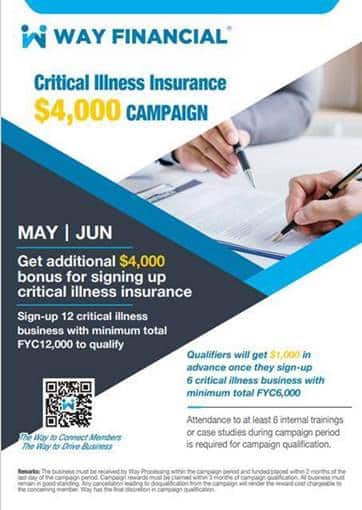

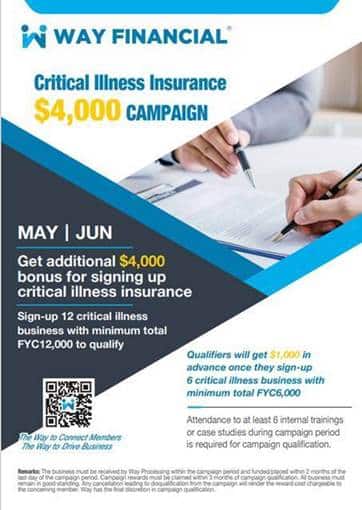

May & June Campaigns – Additional $8,000 bonus!

This is the last week for the Life and Critical Illness insurance campaigns!

Return to In-Person Carriers’ Training

Further to restarting internal trainings in person, the office is working with carrier partners to resume some of their product training in person starting next month. Stay tuned on the relevant invitations and registration procedures.

Please note that there is no carrier training this Friday, July 1, due to Canada Day celebration.

Upcoming Case Studies (30 – 60 mins sessions) – Answer practical questions and generate real business

Bring any questions or cases to get your desired results. Book your session online via the Way Platform Events Calendar or contact admin@www.wayfinancial.ca or 604-279-0866 for assistance.

Schedule of Case Studies in July 2022

|

Carriers’ Updates

Equitable Life

Weekly Business Builder Series

Topic: Upsizing Without Downsizing – Spending your death benefit while still alive using Participating Whole Life (0.50 Credit)

Time & Date: 9:00am PST, Tuesday, June 28

Register here: https://equitable-ca.zoom.us/webinar/register/WN_C9GqiqvVTJyJE0yc46HqfQ

Equitable Life EDO Changes

As of June 21, 2022, planned EDO payment amount is no longer part of financial underwriting. Click here for more information.

Contact Monica Zhang at 604-366-4314 or mzhang@equitable.ca if you have any question.

iA

Insurance

Mechanics of an Immediate Financing Agreement using iA PAR wholelife

See attached presentation from Rishu Bains’ training last Friday.

Contact Rishu Bains at 604-354-2711 or rishu.bains@ia.ca, or Laeya Kim at 778-686-8945 or laeya.kim@ia.ca if you have any question on life insurance products.

Contact Vanora McLay at 604-737-9170 or vanora.mclay@ia.ca, or Alfredson Tolentino at 844-744-4282 ext. 403206 or alfredson.tolentino@ia.ca if you have any question on living benefits products.

Sun Life

Spring 2022 Industry Insights

Click here for articles that focus on key market trends, industry analysis and practice management to help you grow your business and stay current.

Contact Renee Ho at 604-657-9251 or renee.ho@sunlife.com, or June Wang at 604-895-5413 or june.wang@sunlife.com if you have any questions.

Holiday Notice

Please note that our office will be closed on:

Friday, July 1, 2022 (Canada Day)

Regular operations will resume on:

Monday, July 4, 2022

Monday, August 1, 2022 (British Columbia Day)

Regular operations will resume on:

Tuesday, August 2, 2022

Best regards,

Administration Department

“The WAY to connect members. The WAY to drive business.”

Way Financial

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

Hi members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Manulife Vitality $500 Gas Card Campaign – 4 Term Cases to Win!

Less than 2 weeks left of the campaign! Some members are already close to winning the $500 gas card because all you need is to submit 4 Term cases with Vitality by the end of June and settle them within 2 months. Use the attached Incentive Application to claim your rewards.

You can also brush up on the Vitality product features by rewatching the training video on Way’s Intranet. Login from https://www.wayfinancial.ca/ and look for it under Resources ->Training Videos -> Resource Videos.

More useful information is available via these links below:

Vitality proof points – infographic

Vitality active rewards with apple watch-client flyer

Your first year with Manulife vitality

Feel free to ask Chris Chang at 604-355-4879 or Chris_Chang@Manulife.ca or Cherry Xiang at 604-678-1558 or Cherry_Xiang@manulife.ca for questions on Vitality.

July Unique Strategy Training & Focus Group – Asset Creation Plan

If an advisor is capable to not only earn more investment returns for clients, but also help them save taxes immediately, clients will line up for her or his services. Maximize Way’s unique resources to master the knowledge and skills to help clients make 20% annualized investment returns for 5 to 10 consecutive years via the Asset Creation Plan strategy. Stay tuned for details on the learning agenda and registration procedures.

July & August Campaigns – Additional 8,000 bonus!

Get ready for the next big-ticket business campaigns to promote PAC and Transfer-In investment in July & August. Starting in July, training attendance is no longer required as part of the prerequisites to winning.

May & June Campaigns – Additional $8,000 bonus!

Last 2 weeks to go for the Life and Critical Illness insurance campaigns! Attend at least 6 internal trainings or case studies during campaign period as part of the prerequisites to winning.

Feel free to ask Stephen Lai if you have any question on the business submissions at stephen.lai@www.wayfinancial.ca or 604-279-0866 ext. 114. Members’ Relations Manager, Samuel Xu, is also available to help you with your connections. Reach out to him at relations@www.wayfinancial.ca or 604-279-0866 ext. 120.

Upcoming Training

Please remember to sign in using your full name to have your Way Membership confirmed and your training session uninterrupted. Unconfirmed names may be removed from the session.

Times & Date: 11:00am PST, Friday, June 24

Mechanics of an Immediate Financing Agreement using iA PAR wholelife – iA Rishu

Microsoft Teams meeting

Join on your computer or mobile app

Click here to join the meeting

Upcoming Case Studies (30 – 60 mins sessions) – Answer practical questions and generate real business

Bring any questions or cases to get your desired results. Book your session online via the Way Platform Events Calendar or contact admin@www.wayfinancial.ca or 604-279-0866 for assistance.

| Time & Date: 1:00-3:00pm PST, Friday, June 24

Case studies with iA Insurance Rishu Bains Schedule of Case Studies in June 2022

|

Carriers’ Updates

Canada Life

| Trusts and life insurance webinar

Time & Date: 10:00am PST, Tuesday, June 21 |

| Join the Tax & Estate Planning Group webinar hosted by Steven McLeod where you’ll learn the basics about trusts and common situations where trusts and life insurance intersect, including when a trust owns a life insurance policy or receives a death benefit.

The English session applies to outside of Quebec, while the French session applies to Quebec. |

| Register here: https://www.upstreamproductions.ca/en210622reg |

Contact Carol Ng at 604-377-7203 or Carol.Ng@CanadaLife.com or Amber Wang at 226-272-1297 or AmberHanYi.Wang@canadalife.com or Wenjia Li at 6046125105 or wenjia.li@canadalife.com if you have any question.

Manulife

Market update with recommended funds, seg fund contract set up and review of load types

See attached presentation from Stefan Goddard’s training last Friday.

Contact Stefan Goddard at 778-954-9685 or stefan_goddard@manulife.ca if you have any question.

Best regards,

Administration Department

“The WAY to connect members. The WAY to drive business.”

Way Financial

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

Hi members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Manulife Vitality $500 Gas Card Campaign – 4 Term Cases to Win!

Less than 3 weeks left of the campaign! Some members are already close to winning the $500 gas card because all you need is to submit 4 Term cases with Vitality by the end of June and settle them within 2 months. Use the attached Incentive Application to claim your rewards.

You can also brush up on the Vitality product features by rewatching the training video on Way’s Intranet. Login from https://www.wayfinancial.ca/ and look for it under Resources ->Training Videos -> Resource Videos.

More useful information is available via these links below:

Vitality proof points – infographic

Vitality active rewards with apple watch-client flyer

Your first year with Manulife vitality

Feel free to ask Chris Chang at 604-355-4879 or Chris_Chang@Manulife.ca or Cherry Xiang at 604-678-1558 or Cherry_Xiang@manulife.ca for questions on Vitality.

For questions on this unique Way campaign, ask Stephen at 604-279-0866 ext. 114 or stephen.lai@www.wayfinancial.ca.

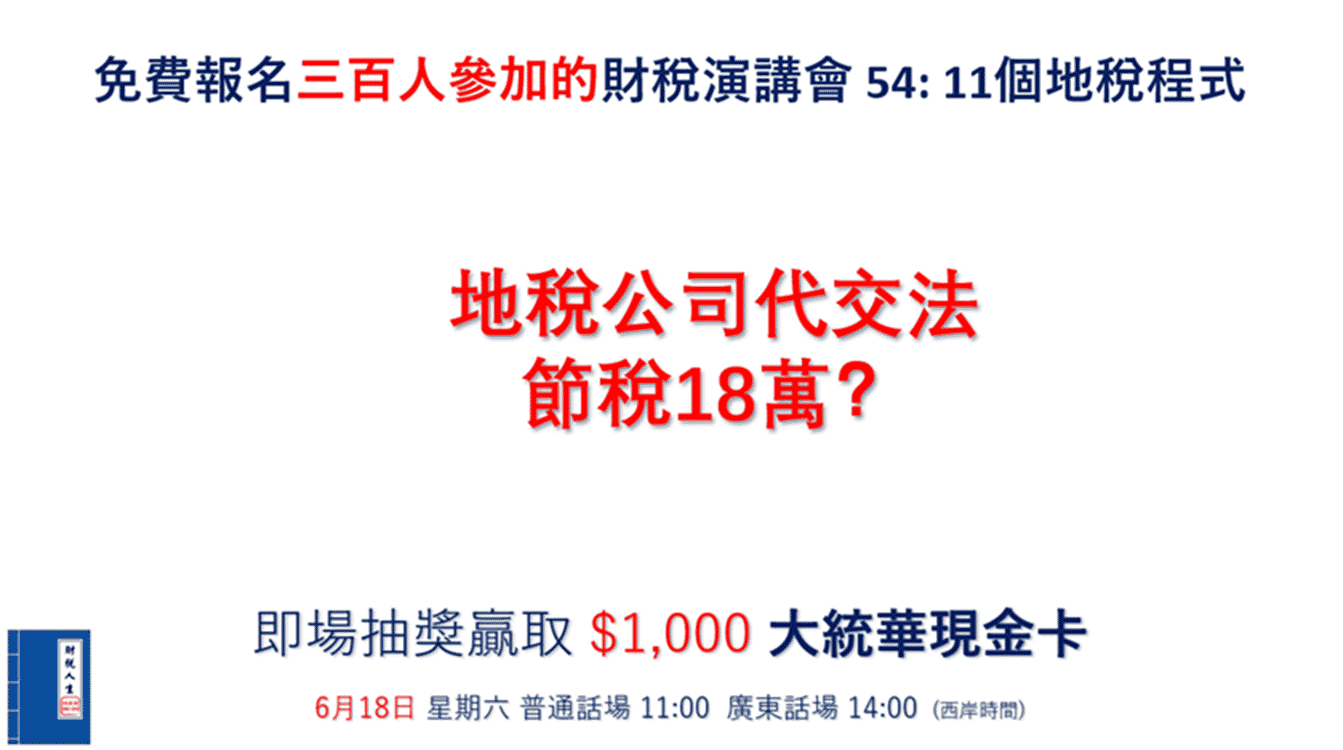

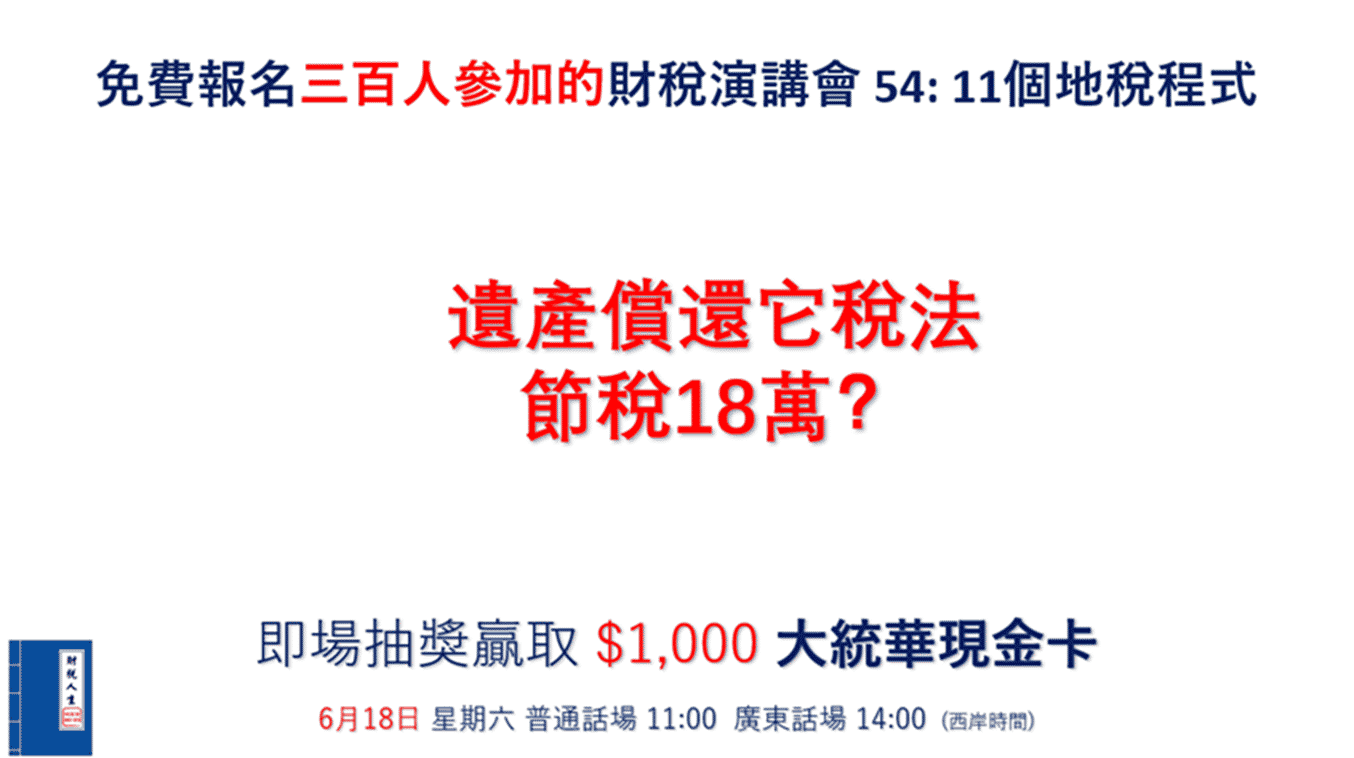

Upcoming Client Events

Payment by Corporate and Final Tax Repayment

Time & Date: 11:00 am-12:30 pm PST, Saturday, Jun 18, 2022

Language: Mandarin

YouTube link: https://youtu.be/4e_28PkugGo

Time & Date: 2:00-3:30 pm PST, Saturday, Jun 18, 2022

Language: Cantonese

YouTube link: https://youtu.be/fkdK7CV_g0I

Here is the registration link for the online live broadcast: http://financialplatform.sv.mikecrm.com/osEv63e

Ask admin@www.wayfinancial.ca if you have any question.

May & June Campaigns – Additional $8,000 bonus on life + CII

You can double dip and win both the $500 Gas Card and the additional $4,000 bonus at the same time!

Upcoming Training

Please remember to sign in using your full name to have your Way Membership confirmed and your training session uninterrupted. Unconfirmed names may be removed from the session.

Times & Date: 11:00am PST, Friday, June 17

Market update with recommended funds, seg fund contract set up/review of load types – ML Stefan Goddard

Microsoft Teams meeting

Join on your computer or mobile app

Click here to join the meeting

Upcoming Case Studies (30 – 60 mins sessions) – Answer practical questions and generate real business

Bring any questions or cases to get your desired results. Book your session online via the Way Platform Events Calendar or contact admin@www.wayfinancial.ca or 604-279-0866 for assistance.

| Time & Date: 1:00-3:00pm PST, Wednesday, June 15

Case studies with iA Investment Hilda Ng Time & Date: 1:30-5:00pm PST, Wednesday, June 15 Case studies with TOT Tim Lau Time & Date: 1:00-3:00pm PST, Friday, June 17 Case studies with iA Insurance Rishu Bains Schedule of Case Studies in June 2022

|

Carriers’ Updates

Assumption life

Platinum Protection

The maximum coverage of Platinum Protection, a simplified issue product, has increased to $500,000! See the attached product guide and the data collection form for simplified issue products, which include client’s qualifying questions.

Contact Mohammed A. Saiepour at 800-343-5622 or mohammed.saiepour@assomption.ca if you have any question.

Canada Life

Par in 2022 / Dividend Scale and Performance

See attached presentation from Carol Ng’s training last Friday.

Contact Carol Ng at 604-377-7203 or Carol.Ng@CanadaLife.com or Amber Wang at 226-272-1297 or AmberHanYi.Wang@canadalife.com or Wenjia Li at 6046125105 or wenjia.li@canadalife.com if you have any question.

Equitable Life

Weekly Business Builder Series

Topic: Customized Reports for Crucial Conversations Presented by Chris Thompson, Advanced Case Consultant

When: 9:00am PST, Tuesday, June 14

Register here: https://equitable-ca.zoom.us/webinar/register/WN__PCtxnjFRLukf9gyAwxMDA

Contact Monica Zhang at 604-366-4314 or mzhang@equitable.ca if you have any question.

RBCI

Market Update Info for Clients

Check out the latest RBCI newsletter attached for market update information that you can share with your clients.

Contact Mike Jackson at 604-699-2345 or mike.jackson@rbc.com or Jeffrey Ng at 604-699-2348 or Jeffery.ng@rbc.com if you have any question .

Best regards,

Administration Department

“The WAY to connect members. The WAY to drive business.”

Way Financial

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

Hi members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Manulife Vitality $500 Gas Card Campaign – 4 Term Cases to Win!

Some members are already close to winning the $500 gas card because all you need is to submit 4 Term cases with Vitality by the end of June and settle them within 2 months. Leverage the Better Quotation strategy and generate repeated insurance business systematically. Those in the Better Quotation focus group will be generating 100+ cases, and others should also be able to get 20+ cases each year. Check out the Vitality program below, which offers clients a brand new Apple Watch, free annual body check, premiums reduction and more.

Vitality proof points – infographic

Vitality active rewards with apple watch-client flyer

Your first year with Manulife vitality

Feel free to ask Chris Chang at 604-355-4879 or Chris_Chang@Manulife.ca or Cherry Xiang at 604-678-1558 or Cherry_Xiang@manulife.ca for questions on Vitality.

For questions on this unique Way campaign, ask Stephen at 604-279-0866 ext. 114 or stephen.lai@www.wayfinancial.ca.

May & June Campaigns – Additional $8,000 bonus on life + CII

You can double dip and win both the $500 Gas Card and the additional $4,000 bonus at the same time!

Upcoming Training

Please remember to sign in using your full name to have your Way Membership confirmed and your training session uninterrupted. Unconfirmed names may be removed from the session.

Times & Date: 11:00am PST, Friday, June 10

Microsoft Teams meeting

Join on your computer or mobile app

Click here to join the meeting

Upcoming Case Studies (30 – 60 mins sessions) – Answer practical questions and generate real business

Bring any questions or cases to get your desired results. Book your session online via the Way Platform Events Calendar or contact admin@www.wayfinancial.ca or 604-279-0866 for assistance.

|

Time & Date: 1:00-3:00pm PST, Friday, June 10 Case studies with CL Carol Ng Schedule of Case Studies in June 2022

|

Carriers’ Updates

Canada Life

Investment

Canada Life Win with Wealth in 2022 – Get an Extra 1 Bps of your AUM

By generating net sales of 5% of your January 1, 2022 assets under management (AUM), minimum $500,000, you could receive an extra 1 bps of your December 31, 2022 AUM. Check out the attached PDF (CL Win with Wealth in 2022) and the Q&A for more information on qualifications & rules.

Reduced Investment Management Fees of Four Segregated Funds

| Investment management fees are being lowered on certain series and guarantee levels of four segregated funds (Global Resources, Canadian Core Plus Bond, Canadian Tactical Bond and Pathways Core Plus Bond). No other changes are being made to the funds and no action is required by you or your clients. Your clients will receive a message about the reductions on their June statements. For more information, click here.

Contact Richard Chen at (604)338-6416 or richard.chen@canadalife.com or Jessica Leung at (604)331-2420 or jessica.leung@canadalife.com if you have any question. |

Equitable Life

Insurance

$10,000 Step Up Campaign

Win an extra $10,000 with your Equitable business this year!

Place at least FYC20,000 more than your business amount in 2021 and four insurance cases to start winning.

Read attached PDF file (EQ Step Up Your Sales 2022) for more details.

Weekly Business Builder Series

Topic: Come with Us to Head Office!

When: 9:00am PST, Tuesday, June 7

Register here: https://equitable-ca.zoom.us/webinar/register/WN_ldqxzrG3QrWpTew8j6CanA

Preferred Insurance Solutions For Corporate Clients

See attached presentation from Monica Zhang’s training last Friday.

Contact Monica Zhang at 604-366-4314 or mzhang@equitable.ca if you have any question.

Manulife

Insurance

Grow For It Campaign by Manulife – Win up to two iPad Airs this year

You will get an iPad Air when you:

• Settle 10 or more life or living benefits policies in 2022 or

• Sell 5 or more health and dental policies with an effective date in 2022

If you achieve both policy count requirements, you will receive two iPads! Read attached PDF file (ML Grow For It 2022 Poster) for more details.

Contact Chris Chang at (604)355-4879 or chris_chang@manulife.com or Cherry Xiang at (604)678-1558 or Cherry_Xiang@manulife.ca if you have any question.

iA

Market Update – Latest Bank Rate Hike

Check out iA specialist Sébastien McMahon’s insight on impact of the latest bank rate hike here.

Insurance

iA Strategy Session

Topic: Wealth Transfer Using Life Insurance

When: 9:30am PST, Thursday, June 23

Register here: Webinar Registration – Zoom

Register for June 23rd Webinar HERE

Contact Rishu Bains at 604-354-2711 or Rishu.Bains@ia.ca or Vanora McLay at 604-737-9170 or vanora.mclay@ia.ca if you have any question.

Best regards,

Administration Department

“The WAY to connect members. The WAY to drive business.”

Way Financial

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.