Hello members,

The Bulletin informs members of various updates including market, industry, carriers as well as Way’s training and events, so to help you stay up-to-date with ways to grow your business.

Office Updates

Platform

A new online folder has been created for Way Members to access materials such as training presentation files, text templates and others. Click ![]() here to get access.

here to get access.

Carriers’ Updates

Canada Life

Insurance

Faster death claims with online submission

From July 13 onwards, you or client can conveniently file online claims for individual life insurance and wealth policies 24/7 here. Client-initiated online claims will trigger notifications for you to decide your involvement. The option to initiate claims by phone or submit claim forms via mail, fax, or email remains unchanged.

Canada Life Workspace

Do you know how Canada Life Workspace works? Please join the two exclusive session in Mandarin on Aug 8th & 15th training here. You will learn how the tool works, how to access client information to make changes, review product/policies and give you an overview on where to find additional resources. To have the best experience during the session, please make sure to Register for Workspace.

Virtual Learning Academy’s session

Don’t miss out the opportunity to get the tips and tricks you need to efficiently run your business. Register here for the following virtual learning.

Aug 2: How to increase efficiencies in your business with Workspace, center of Canada Life’s digitally enabled future.

Aug 9: How to create insurance illustrations more quickly with new web-based tool, Canada Life illustrations.

2023 Mid-year Market Outlook event highlghts

From the looming clouds of recession to the silver linings that investors may have on the horizon, Canada Life Investment Management’s mid-year outlook webinar covered a lot of ground. Here is the recap of the event for highlights.

For questions on insurance, contact Amber Wang at 604-648-3087 or amberhanyi.wang@canadalife.com or Wenjia Li at 604-612-5105 or wenjia.li@canadalife.com, if you have any question.

For questions on investment, contact Richard Chen at 604-338-6416 or richard.chen@canadalife.com or Jessica Leung at 604-331-2420 or jessica.leung@canadalife.com or Louis Asare at 604-335-4513 or louis.asare@canadalife.com.

RBC

Investment

Economic Update & Latest Housing Report

RBC release their Flobal Investment Outlook for the Summer of 2023, along with the Executive Summary, an Asset Class Commentary as well as a One Minute Market Update. Nathan Janzen and Claire Fan released some economic commentaries looking at both the Canadian and US employment numbers, along with their weekly guidance, where they speak to the fact that the Bank of Canada is likely to raise interest rates yet again. In addition, Robert Hogue has released his latest update on Canadian Housing where he takes a look at the major markets across the country and what the reactions have been to the latest interest rate increases. Please see the attached.

RBC GIF Risk Rating Change

The risk rating for certain underlying funds available in the RBC® GIF Fund. Changes are based on the methodology mandated by the Canadian Securities Administrators to determine the risk. Check out this Risk Rating Changes for RBC GIF link for more details.

Contact Mike Jackson at 604-363-7583 or mike.jackson@rbc.com or Jeffery Ng at 236-333-1621 or Jeffery.ng@rbc.com if you have any question.

Manulife

Insurance

Manulife Par’s 2023-2024 Dividend Interest Rate

The Dividend Interest Rate (DIR) for Manulife Par and Manulife Par with Vitality Plus™ policies is increasing from 6.10% to 6.35% starting from September 1, 2023, until August 31, 2024. Illustrations using the new rate can be done before it officially takes effect, starting later this month. The Manulife Illustration tool will be available for use on June 23rd.

Contact Jason Ma at 604-404-5432 or jason_ma@manulife.ca, or Samantha Xiao at 604-678-2161 or samantha_xiao@manulife.ca if you have any question.

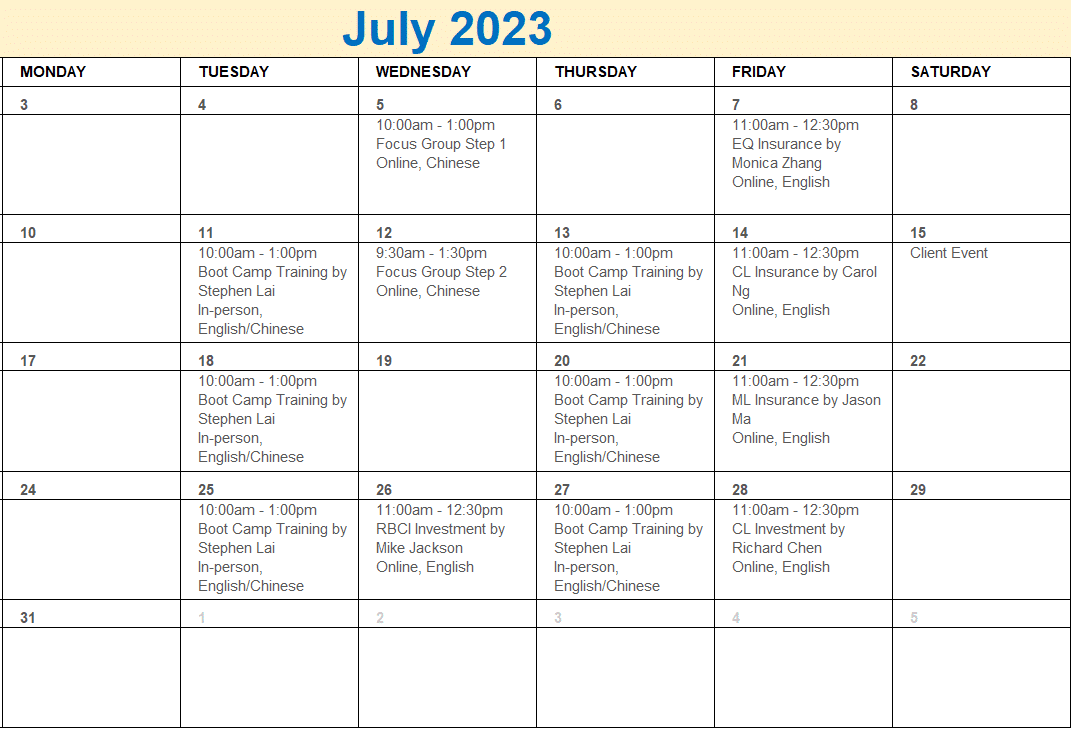

Trainings From Way Platform and Carriers

Holiday Notice

Please note that our office will be closed on:

Monday, August 7 (in lieu of B.C. Day)

Regular operations will resume on:

Tuesday, August 8, 2023