Hello member,

Bless you with great business in March & April by encouragement from Barack Obama.

“If you’re walking down the right path and you’re willing to keep walking, eventually you’ll make progress.”

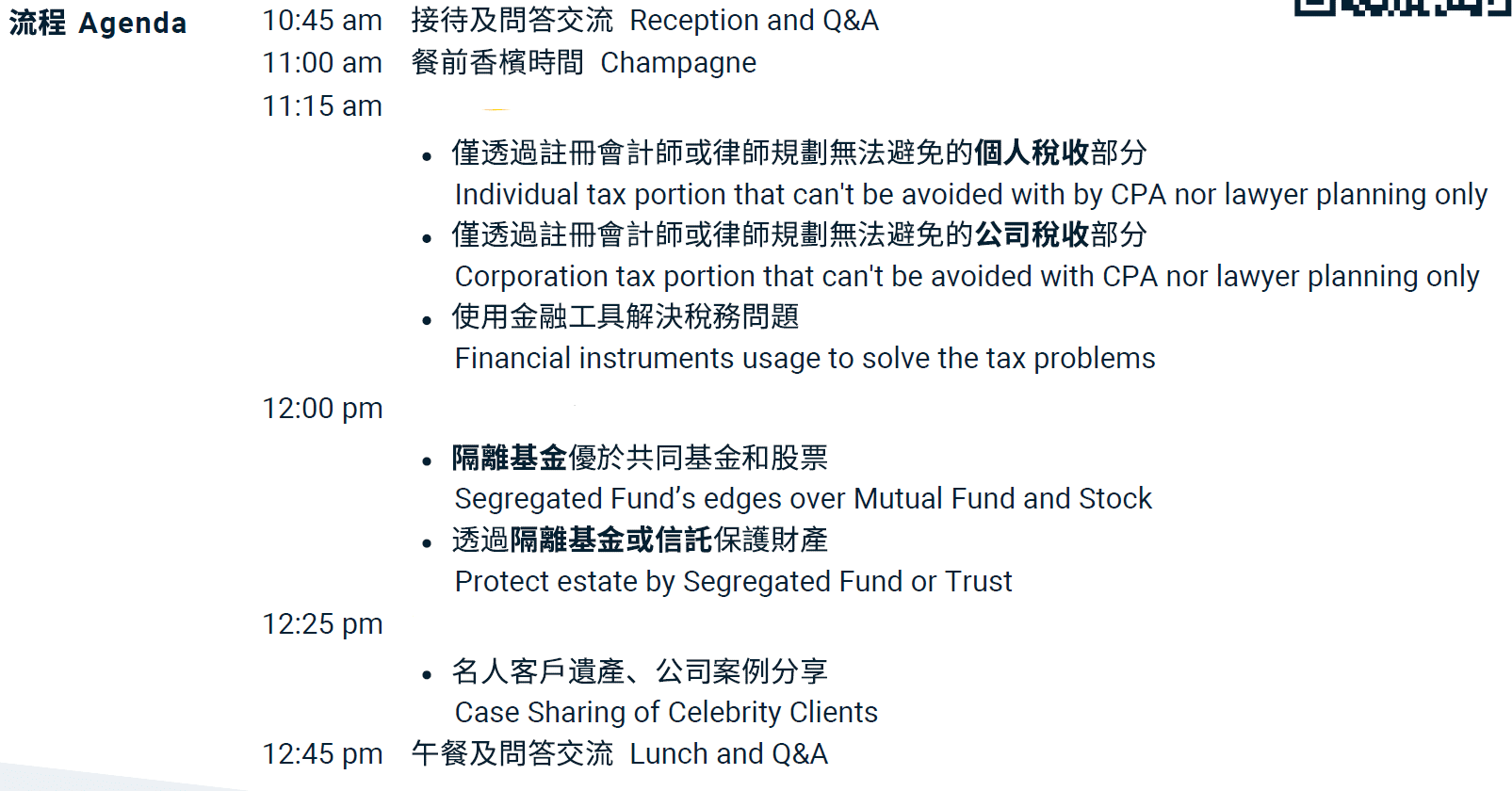

1. April 25th, 2024 Luncheon Client Event Registration – 40 tickets left

At Way, we are excited to announce our upcoming 2nd quarterly 120 people luncheon conference on April 25, 2024, dedicated to helping you boost your new and repeat business, as well as referrals. This unique event will provide you with an opportunity to promote your services while enlightening your network on high-level strategies in “High Net Worth Client Estate Planning & Corporate Tax Savings.”

Our luncheon conferences are renowned for creating a conductive environment for meaningful networking, ensuring that you can make valuable connections with peers and clients alike. In addition to the enriching discussion, we have curated a delightful experience for you and your guests, featuring champagne and a delicious lunch buffet.

Since there was million of premium and investment generated from previous Jan 18th luncheon client event, 80 tickets are already reserved by other members for this April 25th event, which only 40 tickets are left for you to reserve from the link http://financialplatform.sv.mikecrm.com/Ubi4NYZ by Wednesday, April 3rd and contact office manager Susana Yu to arrangement the payment to secure your tickets.

This luncheon conference is an excellent opportunity for you to not only enhance your professional network but also to showcase your expertise. Don’t miss out on this chance to elevate your business and make lasting connections.

p.s. Cash prize is to encourage guest to fill lucky draw form to make appointment with member, so should member’s guest win the cash prize, the member is responsible for the cost.

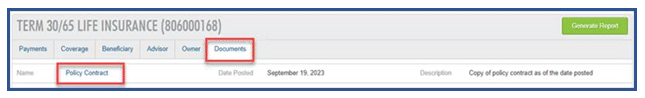

Platform Updates

2. Share folder

A new online folder has been created for Way Members to access materials such as training presentation files, text templates and others. Click ![]() here to get access.

here to get access.

3. Sea & Sky Meeting Room Ready for Booking

Some Members have been using the Sea & Sky meeting rooms already. While priority is given to office users, all Members can make their bookings here: Sea,& Sky

Industry Updates

4. Insurance Council of British Columbia

Update on CE and E&O Requirement for Annual License Renewal

The annual license renewal for all Insurance Council licensees will open on April 3, 2024. The annual deadline for licensees to complete their continuing education (CE) requirement is May 31, 2024, for the licensing period of June 1, 2024 – May 31, 2025. Licensees who renew their licence past deadline and do not meet their CE requirements by May 31 may be investigated further and my result in discipline.

CE guidelines by licence class and CE credit criteria can be found here.

Additional 2024 Annual License Renewal Requirements Webinar

Due to high demand, we are offering a third session of the 2024 Annual Licence Renewal Requirements Webinar on April 11 (9:30-10:30 am PT). This webinar is free, but registration is required. Register Here

Carriers’ Update

5. Canada Life

Insurance

New features coming to Canada Life Illustrations

Coming Mar. 25 to Canada Life illustrations, you’ll find easier access to non-integrated sales strategies, a new option to add advisor profiles and an auto-save feature to recover illustrations in progress.

Learn more about these upcoming enhancements.

Update your Concourse software (version 5.1)

UL will no longer be available on the desktop Concourse illustration software with this update.

After the update, past saved cases will no longer be available.

Find out how we’ve enhanced UL with illustrations information, marketing materials and additional learning resources. LEARN MORE

Embrace the era of web-based Canada Life Illustrations

Get a head start as we gear up for the removal of the desktop insurance illustration software. Access Canada Life illustration through Workspace today to get familiar with the enhanced experience and features. LEARN MORE

Canada Life Elevate is supporting your large case needs

We have two new resources to hep you navigate the world of underwriting large cases. This includes a new guide detailing the large case underwriting process from start to finish, and a new article by Sylvie Schmaus, AVP Advanced Underwriting, and Brigitte Loos, Vice-President, Chief Underwriter, to demystify the word of reinsurance.

Check out these resources now.

Insurance Operations Updates

– Form update – Surrender request form (322 CAN) Read more

We’re improving security for DocuSign

Starting Feb 14, 2024, the way you receive DocuSign certificates of completion will change. Instead of an attached PDF, DocuSign will now send you a secure link to log in and download the certificate. Read more on this change and have you can save certificates.

Investment

Start conversations with your clients with our award-winning funds

Over 30 of our investment funds were recognized at the 2023 Fundata FundGrade A+® awards which happened on Feb 1. The FundGrade A+® award is a highly prized achievement in the Canadian investment funds industry. It’s given annually to investment funds that show consistent, outstanding, risk-adjusted performance throughout the year.

Check out the full list of winners and consider how they can fit into your clients investment plans.

Wealth operations update

– Form updates Read more

6. RBC

Investment

In November, we communicated on Income Allocations and how RBC GIF taxation works.

The RBC GIF T3s are scheduled to be mailed mid -March.

To prepare for client inquiries, review the RBC GIF 2024 Final Income Allocations available on the Sales Resource Centre under Wealth Manager > Sales Tools.

Contact Mike Jaskson at 604-363-7583 or mike.jackson@rbc.com or Jeffery Ng at 236-333-1621 or Jeffery.ng@rbc.com if you have any question.

7. Tugo

Travel

Updates to Student Medical Insurance – Effective April 11

On April 11, 2024, we’re making updates to our Student plans. Benefits and product features will remain the same. Here’s a quick breakdown of the changes:

Introduction

– myTuGo – highlights new self-serve features to modify and extend policies.

– TuGo Wallet app – includes new link to download app from either App Store or Google Play.

Contact Information

– Clarifies instructions on how to contact TuGo, along with updates to international access codes.

Eligibility

– As a new eligibility requirement, the student or family member of the student must not be receiving or been recommended to receive palliative care. This aligns with an existing exclusion in the policy.

General Exclusions

– Includes new rodeo/equestrian sports exclusion.

Definitions

– Sports & Activities – updates made to definitions for motorized sports, rock climbing, and mountaineering.

For a more detailed summary of these changes, refer to the News & Articles section of the Partner Platform. The updated policy wording for Canadian and international students is also available for you in TuGo’s Download Centre.

Contact Helene Desjardins at 905-267-1724 or hdes@tugo.com if you have any question.

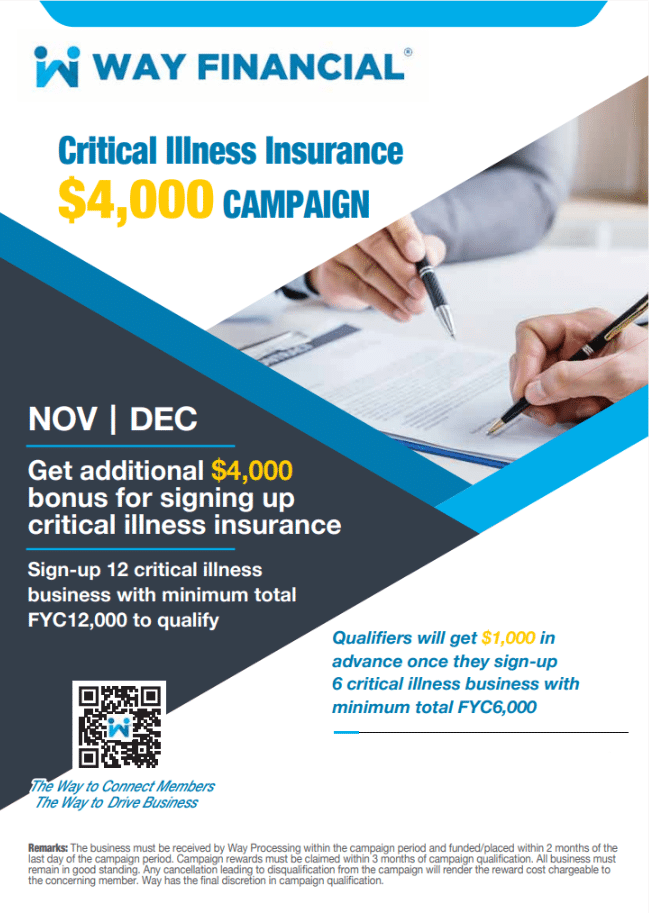

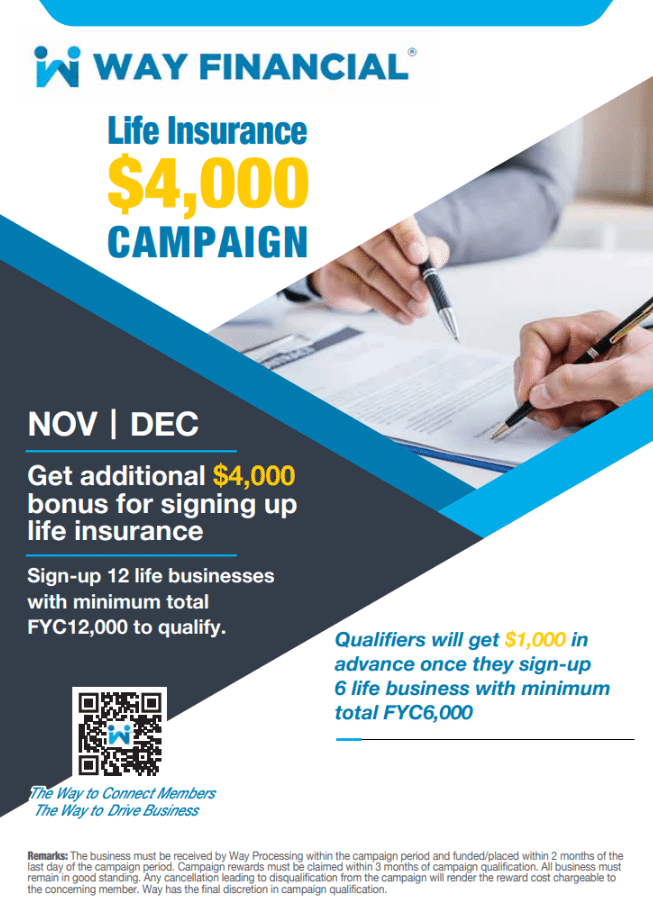

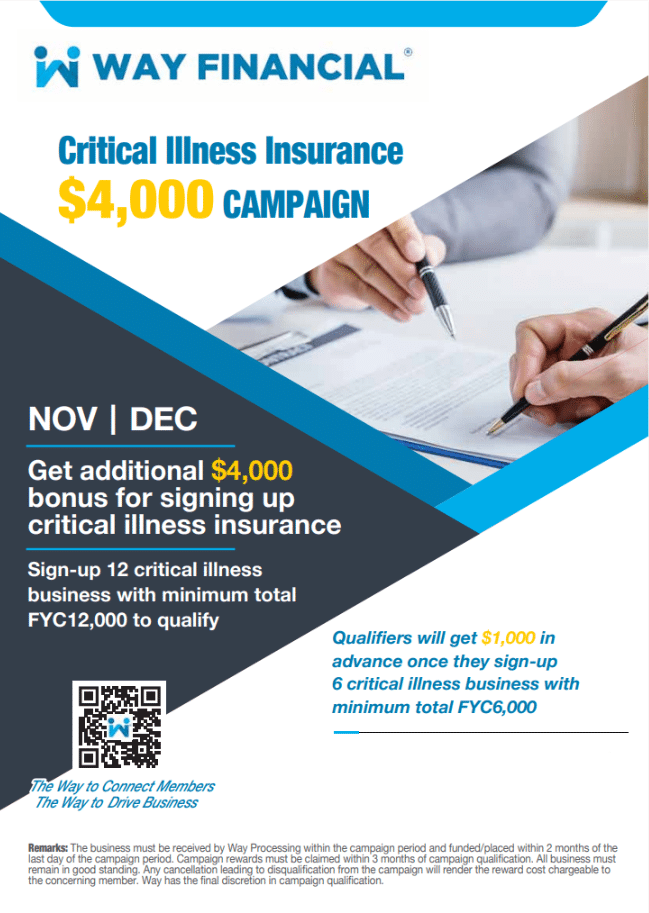

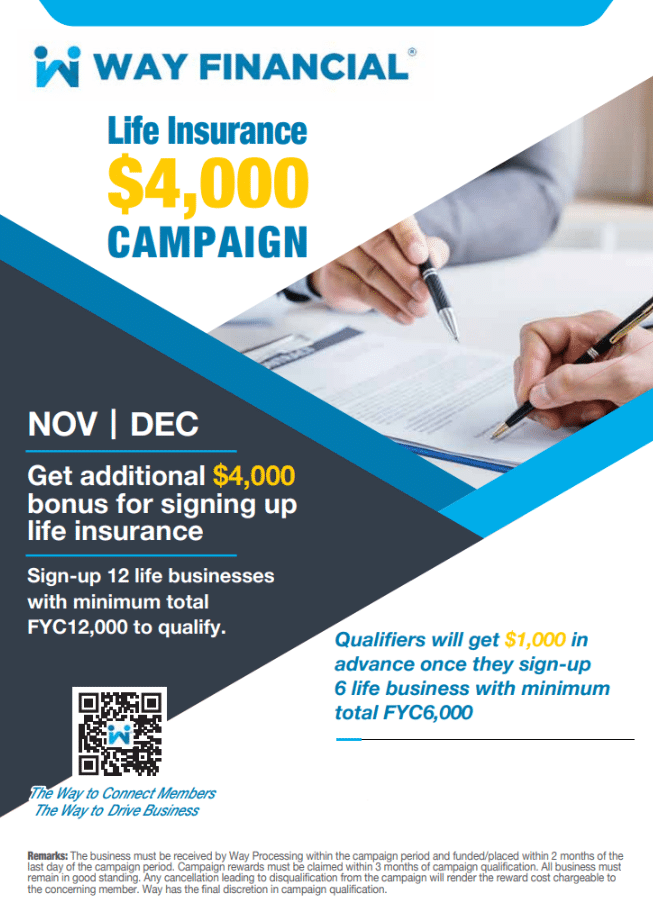

Way & Carriers’ Campaigns

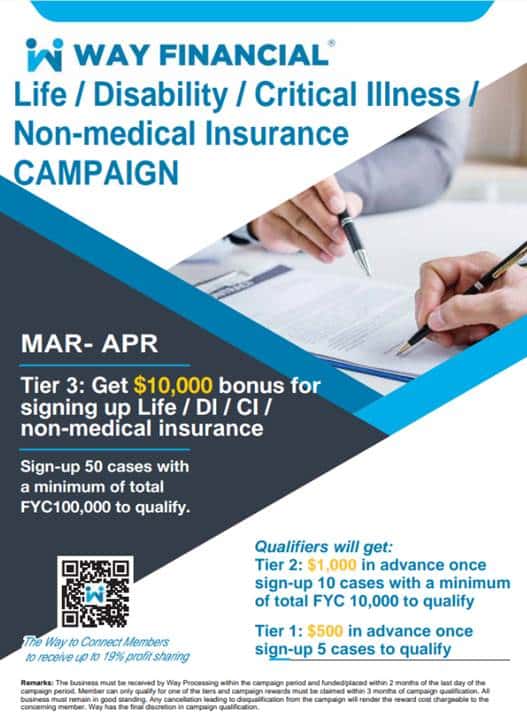

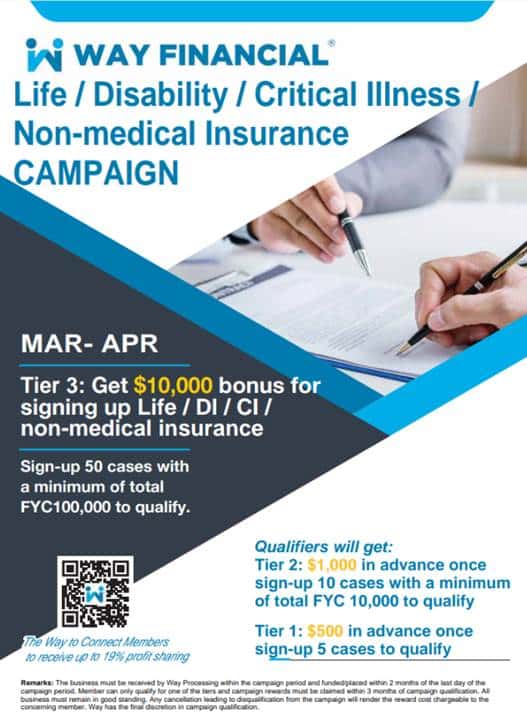

8.

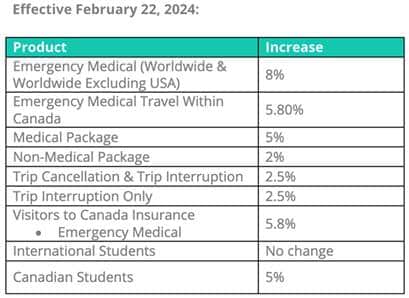

9. Tugo

Travel

Cheers to 60 contest!

From January 1 to March 31, 2024, for each policy sold or renewed, you’ll have a chance to win…

- Top TuGo Sales: $1,000 gift card

- 2nd for TuGo Sales: $500 gift card

- 3rd for TuGo Sales: $500 gift card

- 1 of 15 $60 gift cards by random draw

For more information please click HERE for more information

Contact Helene Desjardins at 905-267-1724 or hdes@tugo.com if you have any question.

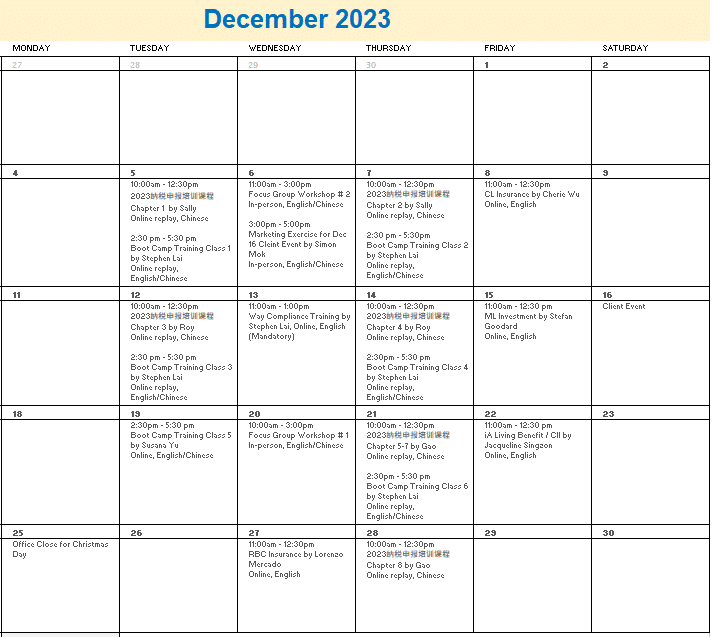

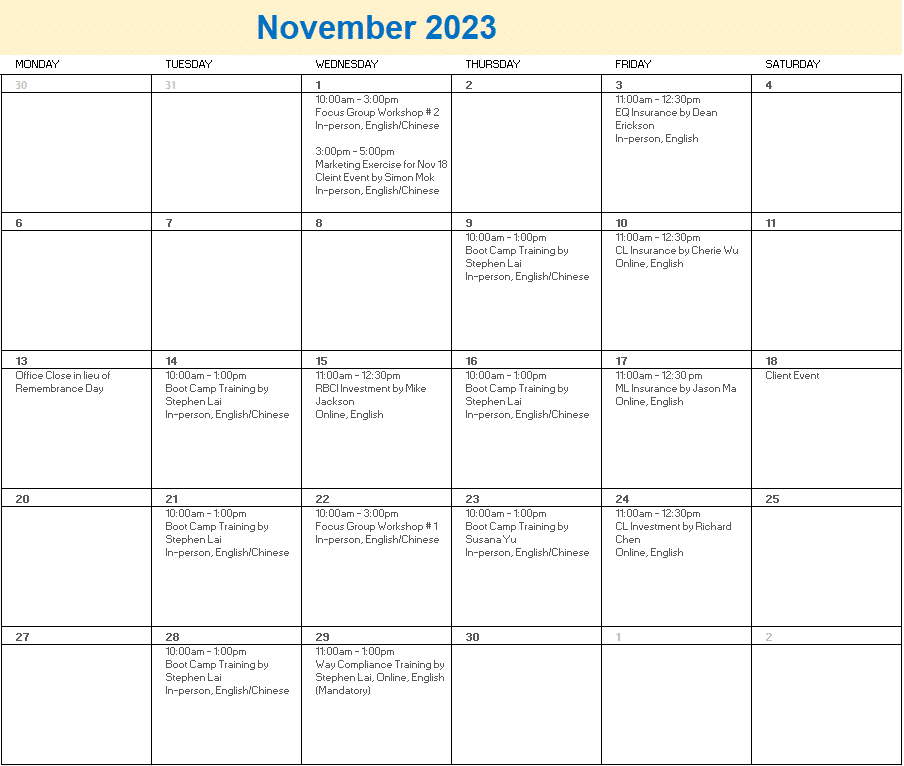

Trainings From Way Platform and Carriers

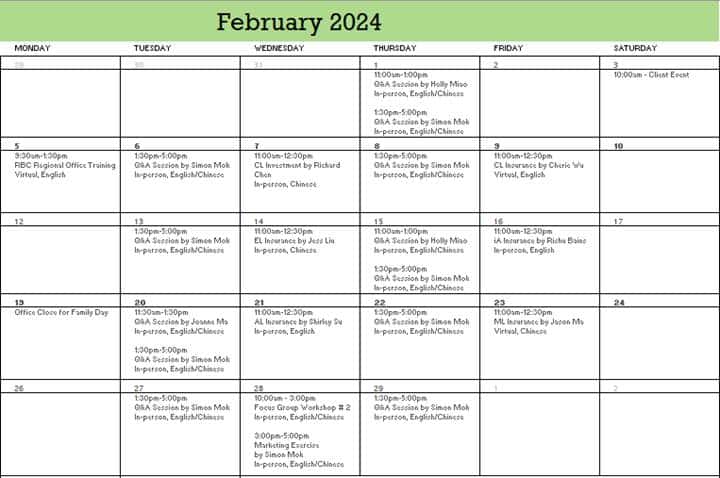

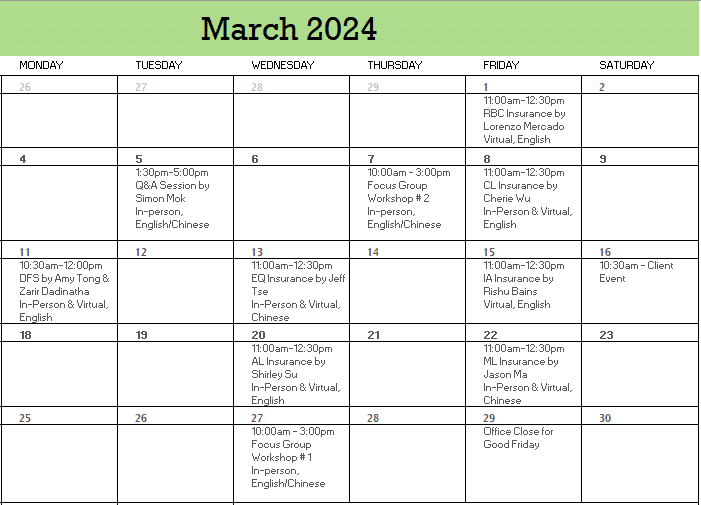

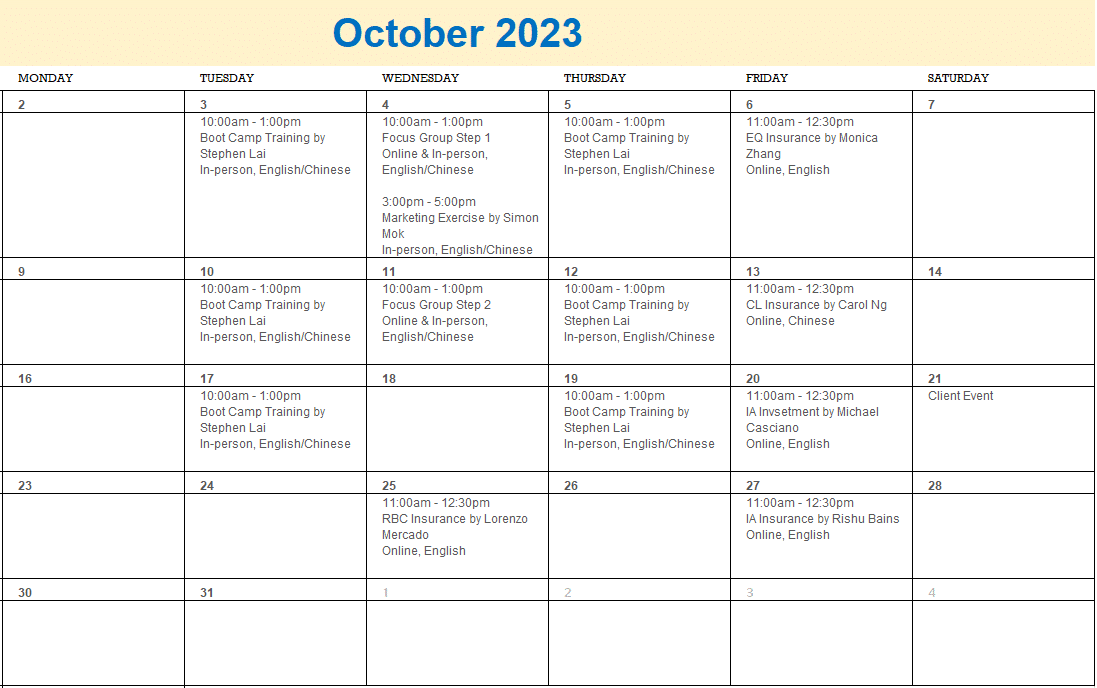

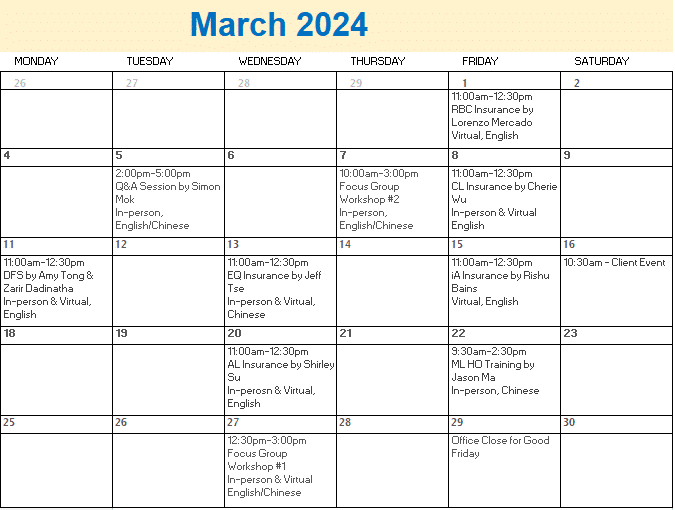

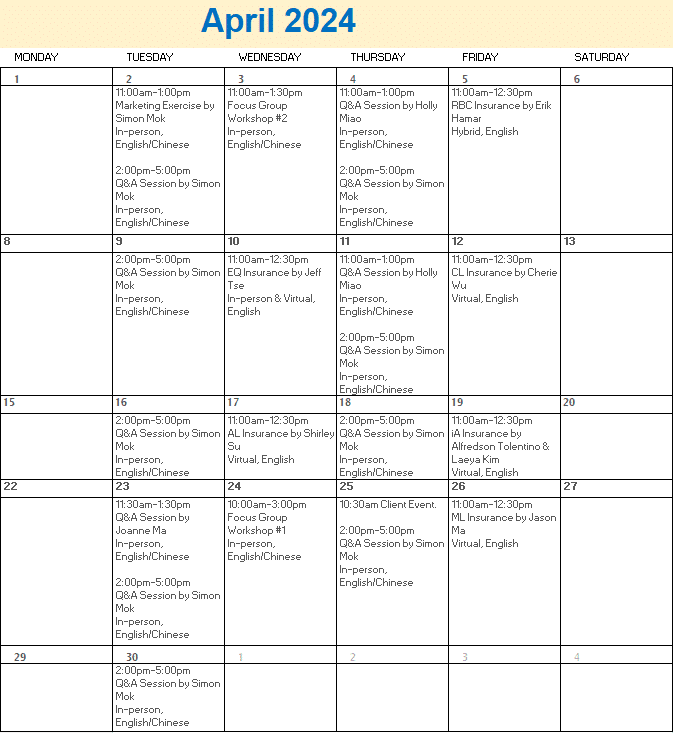

10.

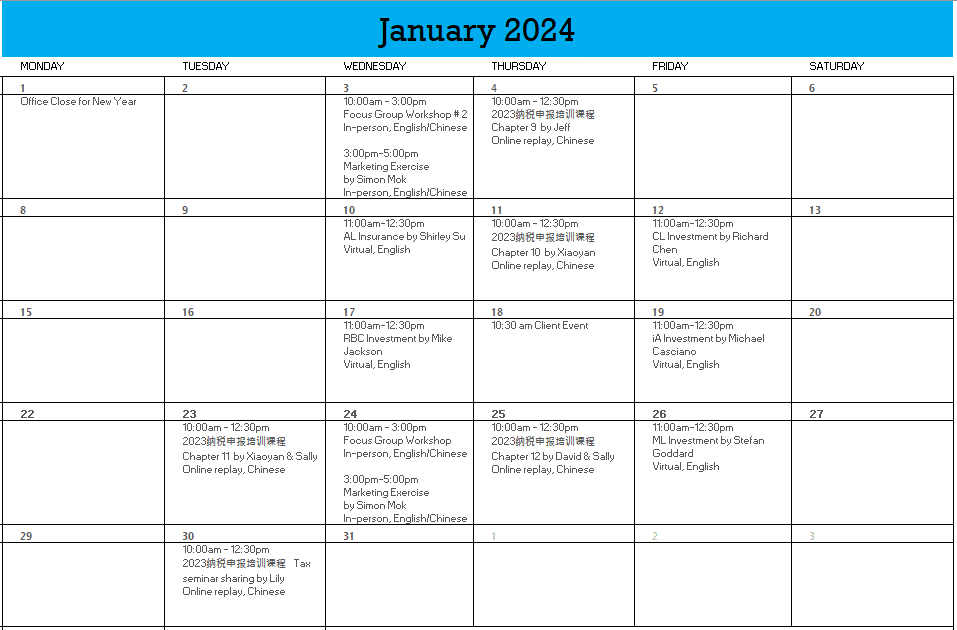

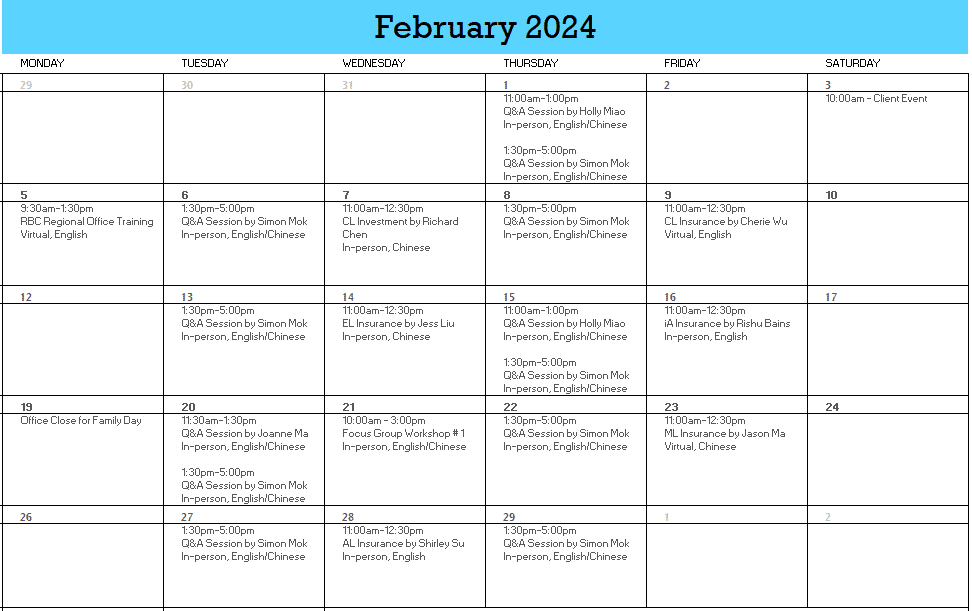

11. Q&A Session

Book your Q&A session directly with Simon Mok Every Tuesday & Thursday from 2:00pm – 5:00pm – Insurance Product, Illustration, Case Application, Selling Technique and Connection

You are welcome to an in-person Q&A session to discuss any General inquiry you have on Carriers’ products, Illustration, Case Application, Selling Techniques and Connection by Mr. Simon Mok.

Simon’s Contact Information:

Email: simon.mok@seedpacific.ca

Phone: 604-338-2928

Book your Q&A session directly with Holly Miao 1st & 3rd Thursday of every month from 11:00am – 1:00pm – Shared Ownership Dividend (SOD)

You are welcome to an in-person Q&A session to discuss Share Ownership Dividend SOD, a strategy to help corporate owner with Critical Illness Insurance protection plus the potential tax efficient dividend withdrawal benefits by Ms. Holly Miao.

Holly’s Contact Information:

Email: sunnylife1618financial@gmail.com

Phone: 778-869-5008

Book your Q&A session directly with Joanne Ma 4th Tuesday of every month from 11:30am – 1:30pm – Tax Filing, Review Tax Statement and CPA POV on Corporate Insurance

You are welcome to an in-person Q&A session to discuss Personal & Corporate Tax Filing, Review Tax Statement and CPA POV on doing Corporate insurance by Ms. Joanne Ma.

Joanne’s Contact Information:

Email: joanne622@gmail.com

Phone: 778-8952236

12. Manulife

Don’t miss your chance to learn through our Critical Illness School!

Join Vanessa Scott, National Living Benefits Consultant for a 5-part series for Critical Illness. Select the below hyperlink (time) to register.

Part #1: Setting the Stage – Back to the Basics

- April 2nd: 9am EST, 1030am EST, 12pm EST, 2pm EST

Part #2: Creating Solutions & Addressing Objections

- April 9th: 9am EST, 1030am EST, 12pm EST, 2pm EST

Part #3: Business Solutions & Taxation

- April 16th: 9am EST, 1030am EST, 12pm EST, 2pm EST

Part #4: Underwriting & Claims

- April 23rd: 9am EST, 1030am EST, 12pm EST, 2pm EST

Part #5: Handling Objections

- April 30th: 9am EST, 1030am EST, 12pm EST, 2pm EST

13. RBCI

RBCI Spring Disability Insurance School

The RBCI Spring Disability Insurance School is a comprehensive seven session course that covers Disability Insurance from A to Z. Sign up for all sessions to take advantage of learning DI step by step, building on your knowledge weekly. If your time is limited and you are already adept at one of our offerings, we recommend singing up for our other sessions. Register Here

Holiday Notice

Please note that our office will be closed on:

Friday, March 29 (Family Day)

Regular operations will resume on:

Monday, April 1, 2024

Best Regards,

Greater Vancouver Area (GVA) 400 – 6388 No. 3 Road, Richmond BC V6Y 0L4

Greater Toronto Area (GTA) Suite N500, 675 Cochrane Drive, North Tower, Markham, ON L3R 0B8

|

Susana Yu

Operations Manager

|

|

| 604 279 0866 (Ext. 122) | ||

|

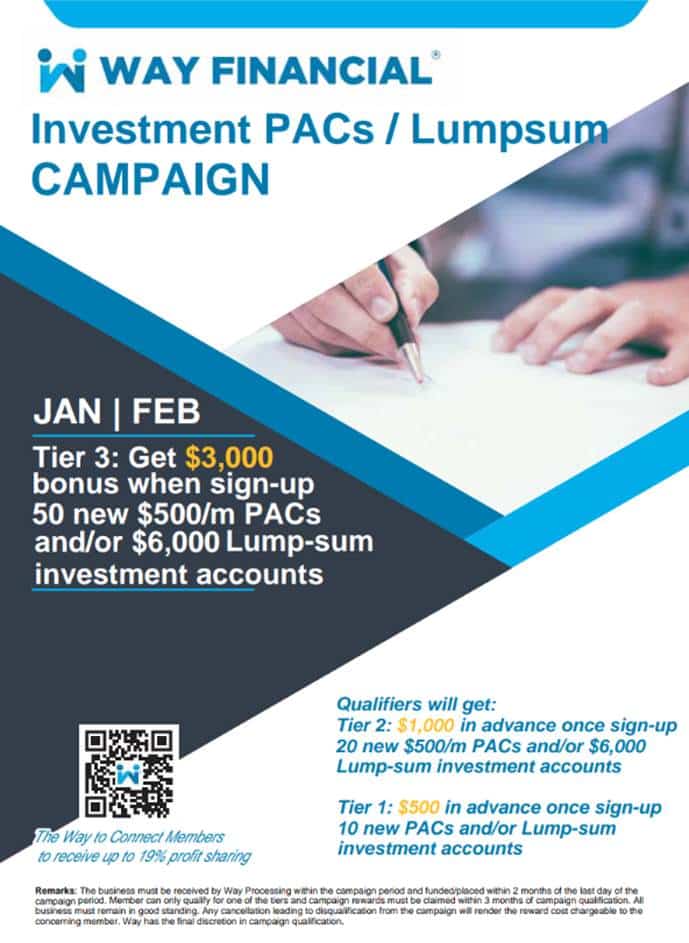

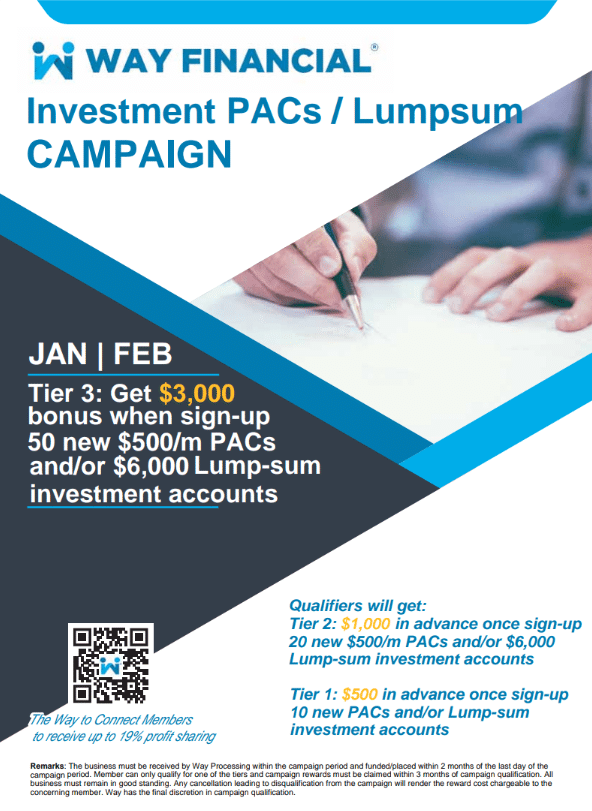

Get an additional $3,000 for Investment PACs / Lumpsum Campaign for Jan & Feb

“The WAY to connect members. The WAY to drive business.” |

||

| This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure. If you are not the intended recipient, please notify the sender immediately by return e-mail, and delete the e-mail from your system. Any disclosure, dissemination, distribution, or copying of this e-mail is strictly prohibited. | ||